As Hollywood reopens, can movie theaters fully recover from the pandemic?

- Share via

This is the March 16, 2021, edition of The Wide Shot, a weekly newsletter about everything happening in the business of entertainment. Sign up here to get it in your inbox.

At about 12:45 p.m. on Monday, nearly a full year after the pandemic shut down Los Angeles movie houses, patrons finally began to trickle back into the lobby of the Cinemark Playa Vista and XD theater.

One of the first through the door was Ken May, a 58-year-old financial trader who hasn’t been to a movie since seeing “The Invisible Man” right before shutdowns took hold in March 2020. He’d been dying to get out of his home, where he stares at charts all day, so he got a ticket to the 1:10 p.m. showing of Sony’s “Monster Hunter.”

“I’ve been itching like I’ve got hives,” he said. “I miss my movie theaters. It’s just been a part of my life.”

Others slowly trekked into the nine-screen multiplex in what could almost be described as a normal midday trip to the movies. One mother, Pamelyn Rocco, pushed a stroller with one hand while carrying an armful of candy on her way to find the auditorium playing “Tom & Jerry.”

She and her two kids were visiting Playa Vista on a spring-break trip from Nashville, where they moved just months before COVID-19 upended everything. They were all happy to return to their favorite theater.

“When we lived here, we would come once a week,” Rocco said. “We were really big moviegoers.”

For Cinemark Chief Executive Mark Zoradi, who was there to oversee the reopening Monday, the occasion was long-awaited.

Los Angeles — home of the movie business and the nation’s biggest box office market — is one of the last major metropolitan areas in the U.S. to reopen indoor theaters. For America’s theater chains, this could finally be the start of what’s expected to be a long recovery for the moviegoing experience.

“It’s gigantic,” said Zoradi, who splits his time between L.A. and Dallas, near Cinemark’s Plano, Texas, headquarters. “I’ve been back here thinking we were going to reopen in the late summer or early fall. ... It’s a very monumental time.”

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Now the awaited reopening is happening, for real this time, albeit with strict limitations. Theater auditoriums are restricted to 25% capacity in Los Angeles County, and masks are, of course, required. To ensure social distancing, Cinemark’s online ticketing system automatically blocks off at least two seats next to tickets that have already been purchased.

Despite a glut of long-delayed Hollywood movies and the signs of pent-up demand in other markets including China, Japan and even New York, cinema owners recognize it will take time for most moviegoers to get comfortable going back. Analysts say it will be at least 2022 before theatrical attendance in the U.S. comes even close to prepandemic levels — if it ever does.

Wedbush analyst Michael Pachter projects this year’s domestic box office will be a paltry $4.75 billion, compared with 2019’s total of $11.3 billion.

The big screen probably will always be attractive to film fans. But anyone paying attention can see real changes in consumer behavior after — as Disney CEO Bob Chapek described it — a year of consumers getting movies whenever they want in their living rooms. Theaters would do well to try to stay ahead of these changes.

Studios will continue bringing new movies to the home earlier, collapsing theaters’ exclusive window to anywhere from three weekends (in the case of Universal’s PVOD strategy) to 45 days (for a Paramount Pictures release).

Despite fierce opposition in the past, some exhibitors have shown a willingness to compromise with distributors as they test out new models. Cinemark and AMC Theatres have inked deals with Universal Pictures for its early rental strategy, for example.

Zoradi has no illusions about the business returning to the days when audiences had to wait 90 days to see new films in the home. He said Cinemark is in discussions with Warner Bros. about the studio’s eventual return to releasing movies in theaters before sending them to streaming. Warner Bros.’ 2021 slate is going straight to HBO Max and theaters, simultaneously.

“The world has changed,” Zoradi said. “Every studio is going to do it a little bit differently. ... The new world order will probably be somewhere in that no-less-than-30 to 45-day range, and then there will be some exceptions.”

Some theater companies probably will keep certain adaptations that served them and audiences well during the pandemic, including Cinemark’s “private watch parties,” allowing groups to buy out whole auditoriums for as little as $99. Such screenings could help theaters make money at less popular moviegoing times, like Saturday afternoons and weekdays. Cinemark also has transitioned to paperless ticketing, a shift that also is here to stay.

Smaller theater chains, arthouses and mom-and-pops hopped onto “virtual cinema” screenings — basically rentals through their websites — to help keep the lights on, and could benefit from the added revenue stream for years to come. Even independent theaters will have to catch up to the reserve seating trend.

The health of the business depends on the quality of the experience. Before the pandemic, theaters invested in electric recliner seating, craft cocktail bars and seats that shake and spray mist.

What more can they do to get consumers back into the habit of going to theaters? One idea could be shaking up the dining options. A studio veteran I spoke to recently suggested that cinemas could make better use of their real estate by bringing gourmet food vendors into their lobbies, in the vein of Smorgasburg and Grand Central Market.

Dynamic ticket pricing has long been floated but never fully embraced. Implementing the concept could boost attendance for less popular films and improve weekday attendance. AMC, Cinemark, Regal and other chains already have their own version of a subscription model to encourage customer loyalty.

While they’re at it, theaters could cut down the number of annoying preroll commercials.

AMC chief Adam Aron put a fine point on another big issue during the company’s last earnings call.

“This is something that our operations department shudders about,” he said in response to an analyst. “But I’m just going to tell everybody here now: The days of dirty movie theaters are over.”

Going to the movies without your shoes sticking to the floor? Now that’s a concept few tech innovations can match.

Things we wrote

Read our full coverage of the 2021 Academy Award nominations. Netflix dominated the Living Room Oscars with 35 nods, while Amazon scored 12. Also, check out our stories on Sunday’s Grammy Awards.

— Folks, maybe don’t do this? Flooded with Hollywood and media workers, Pasadena cancels a COVID-19 vaccine clinic.

— Stephen Battaglio speaks to Savannah Guthrie and others about the ways COVID-19 changed TV news, probably forever. I guess home studios are not going away.

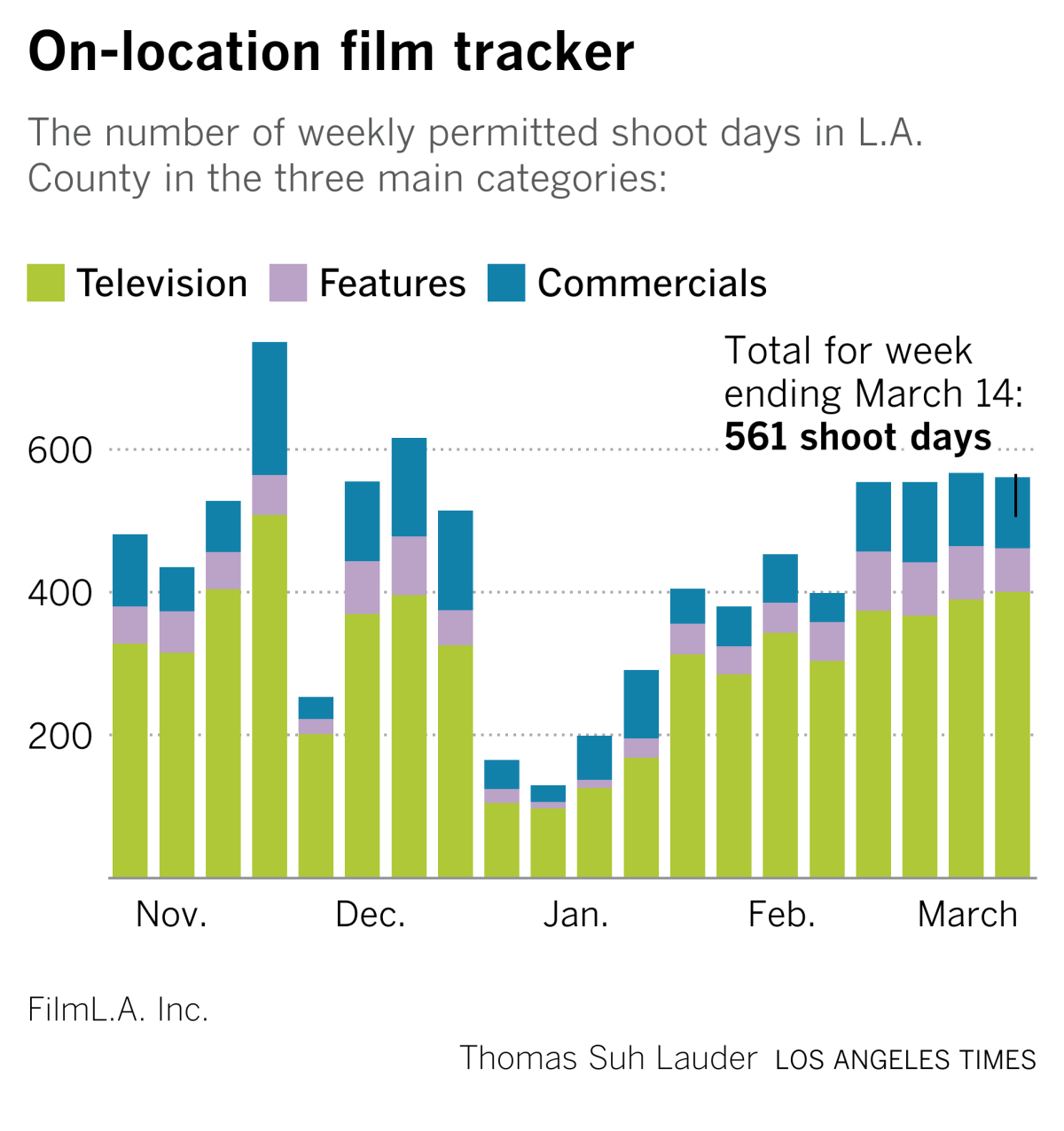

— L.A. filming gets a big boost as the virus threat begins to recede, Anousha Sakoui reports. “February saw 777 film permit applications, up 43% from the previous month, FilmLA said in a report.” We’ve been tracking the weekly updates from FilmLA as productions get people back to work. Here’s the latest, which shows shoot days staying essentially flat during the last several weeks, but much higher than January:

Streaming stuff

March Madness for streaming is here! Thanks to everyone who filled out and sent in a bracket in the last couple weeks. The “streaming wars” isn’t really “who will win” or “who will survive.” It’s which services and companies will reach the level of global scale to become long-term players in the space.

Here are some things that happened in the last week:

- Walt Disney Co. said Disney+ “surpassed” 100 million worldwide subscribers in its first 16 months of existence. That’s an impressive milestone.

- MoffettNathanson released a report on ViacomCBS titled “Climbing a Mountain of Worries” that laid out some reservations about the company’s streaming strategy but ultimately raised its price target $17 to $67 a share. The researchers “believe that ViacomCBS has enough unique content to grow Paramount+ in the U.S.” but “remain cautious on Showtime’s OTT transition.”

- AT&T said HBO Max’s ad-supported tier will debut in June in the U.S. and that the company expects to reach 120 million to 150 million subscribers (including legacy HBO) by the end of 2025. That’s up from prior guidance of 75 million to 90 million. How will WarnerMedia do it? More content, the AVOD service (advertising-based video on demand) and international expansion.

- Netflix is looking to crack down on password sharing. Wendy Lee reports the company is “testing a feature that will force some users to verify their accounts — policing those who share passwords outside of their households.”

Update your brackets accordingly.

Further reading: Meg James dug into the surge in stock prices for media and entertainment companies during the pandemic, thanks to valuations placed on streaming services. Notably, AT&T has been a laggard.

Number of the week

Thursday’s McKinsey & Co. report on representation in Hollywood emphasized a startling conclusion — that the film and entertainment industry is missing out on $10 billion in annual revenue by not closing inclusion gaps for Black talent and creatives.

How’d they come up with that number? McKinsey partner Sheldon Lyn, who co-authored the report, explained the methodology.

First, the firm established a baseline for industry revenue — $148 billion for 2019 — by adding up global box office grosses for U.S.-produced films and U.S. television dollars from broadcast, streaming and cable. Researchers wanted to see what might happen to that tally if funding and distribution for Black-led films and TV shows were proportional to that of non-Black-led content. They came up with a 7% increase, or $10 billion.

UCLA research shows that films with Black leads are shown in considerably fewer international markets than white-led movies. Production and marketing budgets for films with two or more Black professionals in key offscreen creative roles (producer, writer or director) also tend to be lower than those of their white-led counterparts.

The report also imagines what would happen to the size of the market if the industry increased the percentage of films with Black offscreen leaders (4.3%) to match the U.S. population (13.4%). The group made similar extrapolations in TV.

“The logic is, what if we took away those artificial gates?” Lyn said. “For every Jordan Peele, there are two or three we didn’t bring in.”

Lyn said the team adjusted for the assumption that not all revenue generated by additional Black-led films and shows would be incremental — some would clearly take market share from other content. Overall, though, Lyn said, “Great content creates great demand.”

The Pitch: Circle of life edition

Everything really is CGI now.

AdWeek reports MGM has revamped its logo for the first time since 2012: “MGM Studios has stuck to its branding roots by always featuring Leo, its lion mascot. ... This is the first time that Leo the Lion has been reimagined in more than six decades (this time with CGI, rather than a new feline model.)”

The new digi-lion has the same roar and the same look as MGM’s previous real-life big cat and the same film strip banner. If no one had announced the change, I doubt many people would have noticed. We may be on the verge of Simba deepfakes taking over the internet. Anyway, PETA approves.

More stories

— Jason Zinoman, who writes about comedy for the New York Times, explains what he has missed about being part of an in-person audience.

— LAT sports columnist Helene Elliott weighs in on the new NHL-ESPN rights deal. Also, from Awful Announcing: the winners and losers of the big pact.

— Vanity Fair: The fall of Armie Hammer: a family saga of sex, money, drugs and betrayal.

— Catching up to this: The New Yorker interviews offbeat British documentarian Adam Curtis.

Finally ... a hybrid theory

I’m a little late to this, but the musical duo 100 gecs created a reanimation of Linkin Park’s “One Step Closer” from the album “Hybrid Theory” in their manic electronic blend of styles, and you just have to hear it rather than listen to me explain.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.