Disney earnings top Wall Street expectations amid proxy battle with Nelson Peltz

- Share via

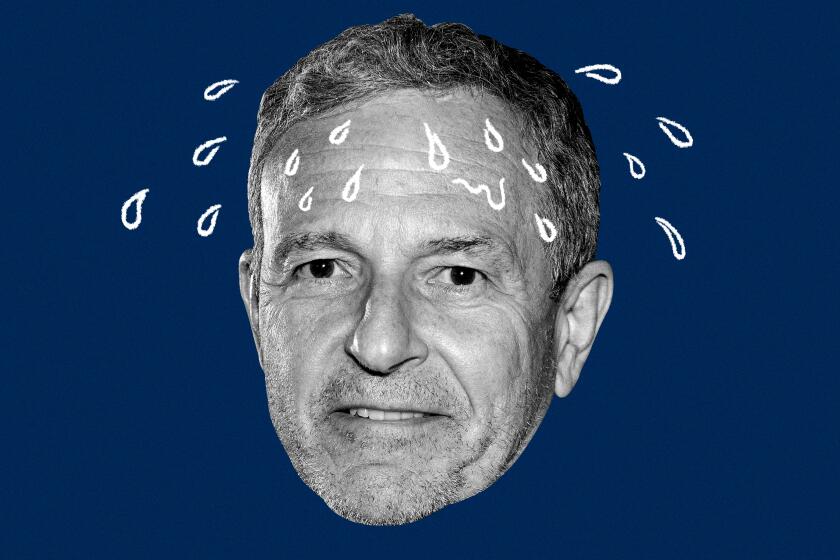

Disney beat earnings expectations for its most recent fiscal quarter as pressure mounts on Chief Executive Bob Iger to impress shareholders while trying to beat back a challenge to his strategy from activist investor Nelson Peltz.

The Burbank entertainment giant delivered net income of $2.15 billion during the first fiscal quarter of 2024, which is about 58% higher than what it made a year earlier, according to an earnings report released Wednesday. The first-quarter results landed as Iger strives to convince investors that he is steering the business in the right direction after unexpectedly returning to the helm in November 2022.

Total revenue was $23.5 billion, roughly flat compared with the year-ago quarter. Analysts polled by FactSet had anticipated Disney would generate $23.7 billion in sales. Earnings per share of $1.22 beat analysts’ expectations of 99 cents a share, excluding certain items.

The latest earnings results come as the company prepares for its annual shareholder meeting this spring, during which Peltz and his allies vying for seats on Disney’s board of directors are expected to challenge the chief executive’s authority.

The report also comes just a day after Disney announced a joint venture with Warner Bros. Discovery and Fox Corp. to launch a streaming service with sports content, including from ESPN. All three companies are attempting to evolve their sports businesses in a media environment rocked by cord-cutting. Disney will separately launch an ESPN direct-to-consumer service in fall 2025.

“Just one year ago, we outlined an ambitious plan to return The Walt Disney Company to a period of sustained growth and shareholder value creation,” Iger said in a statement. “Our strong performance this past quarter demonstrates we have turned the corner and entered a new era for our Company, focused on fortifying ESPN for the future, building streaming into a profitable growth business, reinvigorating our film studios, and turbocharging growth in our parks and experiences.”

Disney has gained support from ValueAct Capital Management and Blackwells Capital. The investment firms are expected to support Disney’s recommended nominations for its board of directors at an upcoming shareholder meeting.

Disney’s stock increased by 8% after the close of trading on Wall Street.

Disney’s direct-to-consumer division, which encompasses Disney+, Hulu and ESPN+, reported an operating loss of $216 million — compared with its loss of $1 billion during the same quarter last year, thanks in part to substantial cost-cutting.

Disney+ — which recently welcomed fresh TV content such as “Percy Jackson and the Olympians” and the second season of Marvel’s “Loki” — lost 1.3 million subscribers in its first quarter for a worldwide cumulative of 111.3 million subscribers after a major price increase.

Average monthly revenue per user for Disney+ has risen 2% to $6.84 globally (excluding India’s Disney+ Hotstar) compared with the quarter that ended in September.

In a headline-making deal, Disney said the concert film “Taylor Swift: The Eras Tour” will land on Disney+ on March 15. The extended “Taylor’s Version” of the Eras Tour movie will include songs not featured in the theatrical release, including the “Folklore” single “Cardigan” and unspecified acoustic performances.

Disney blasted the activist investor’s agitation, calling it an agenda driven by former Marvel CEO Ike Perlmutter, who was ousted from the company earlier this year.

Beyond streaming, Disney’s network TV revenue decreased by 12% to $2.8 billion, while operating income dipped 7% to $1.2 billion. Content sales, including box office revenue from theatrical releases, plummeted 38% to $1.6 billion, with an operating loss of $224 million. The studio’s latest animated flop, “Wish,” opened in theaters during the quarter.

The next major Disney title set for wide release is 20th Century Studios’ “The First Omen” (April 5) followed by “Kingdom of the Planet of the Apes” (May 10), and the third season of Quinta Brunson’s hit sitcom “Abbott Elementary” premieres Wednesday on ABC. The company on Wednesday announced that an animated sequel to the hit film “Moana” will hit theaters in November. A live-action remake of the original “Moana” is planned for next year.

Meanwhile, Disney’s parks, experiences and consumer products division — which continues to buoy the company thanks to income from the popular Disneyland and Walt Disney World — jumped 7% to $9.1 billion in sales during the first quarter of the new year. Operating income also increased, up 8% to $3.1 billion.

In addition, Disney said it will invest $1.5 billion in Epic Games, best known as the creator of “Fortnite.”

The hedge fund manager, of Trian Partners, abandoned a previous effort to join the Disney board after CEO Bob Iger promised a vast cost-cutting plan for the company.

All of this comes as Disney endeavors to stave off a proxy fight from Peltz, who has long voiced disappointment with Iger’s corporate strategy and whose company, Trian Fund Management, has launched a campaign to elect Peltz to Disney’s board. Trian and Peltz have the support of former Marvel Entertainment CEO Ike Perlmutter and former Disney Chief Financial Officer Jay Rasulo, whom Trian is putting forth for a board position.

On team Iger is investment firm ValueAct Capital Management, a Disney shareholder that recently said it will back the entertainment company’s nominees for its board at the shareholder meeting.

Blackwells Capital, another Disney shareholder, has been critical of Peltz and nominated a trio of executives for the board.

Peltz’s fight for a place on Disney’s board predates Iger’s current stint as chief executive.

The Burbank company has a hangover from its big streaming push. The stock has struggled, investors are restive and its key studios have been stretched.

The investor began lobbying for board representation in 2022, when Trian acquired about $800 million in Disney shares and Bob Chapek was chief executive of the company. Iger appointed Chapek to succeed him as chief executive in February 2020 before reclaiming the role in November 2022.

After a temporary retreat by Peltz in February 2023 after Iger implemented significant cost cuts — including the elimination of thousands of jobs — Peltz recently revived his campaign with aid from Perlmutter, and Trian upped its stake in Disney to about $2.5 billion.

Disney’s annual shareholder meeting is scheduled for April 3.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.