Sony/ATV sale expected to attract rivals, private equity

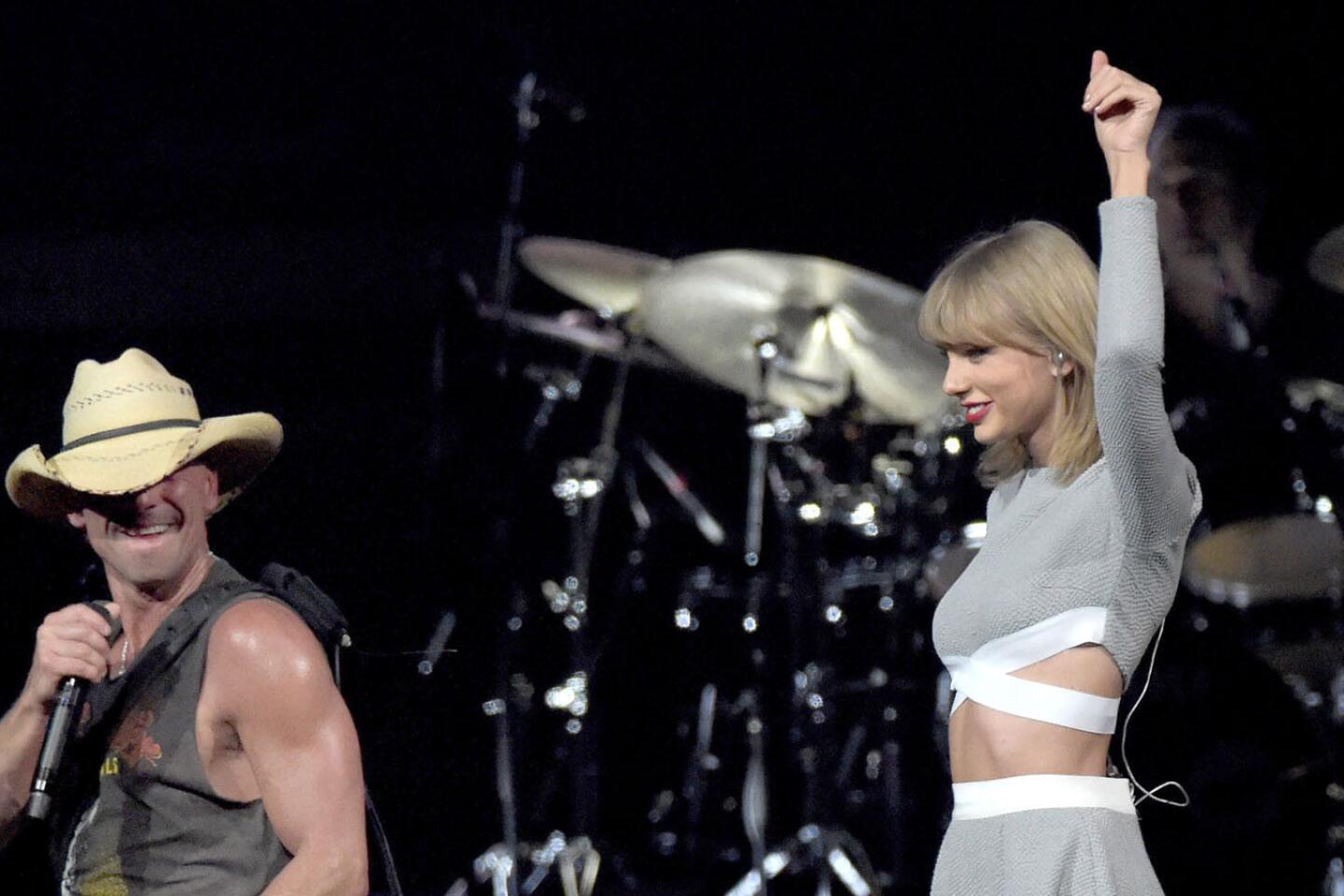

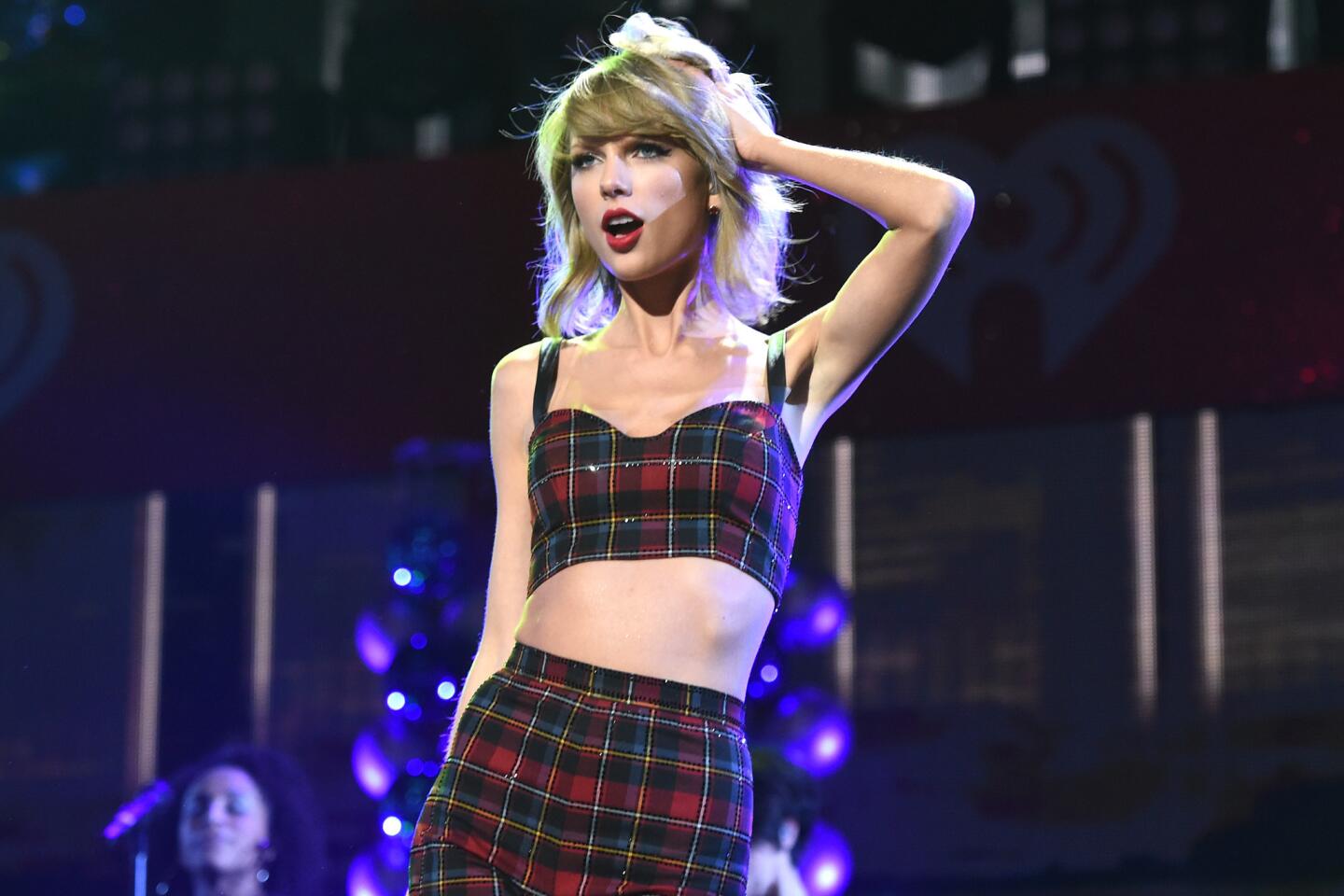

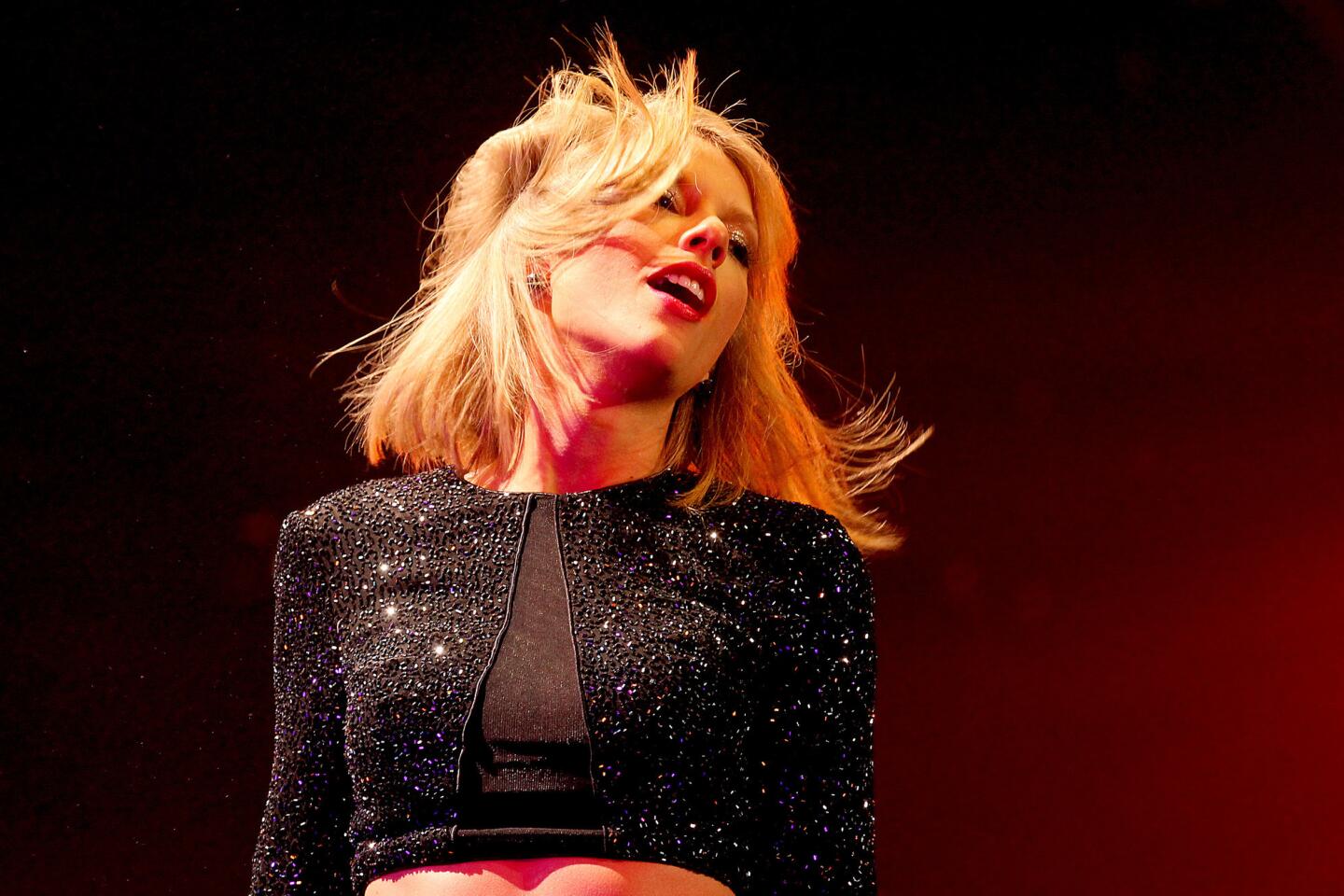

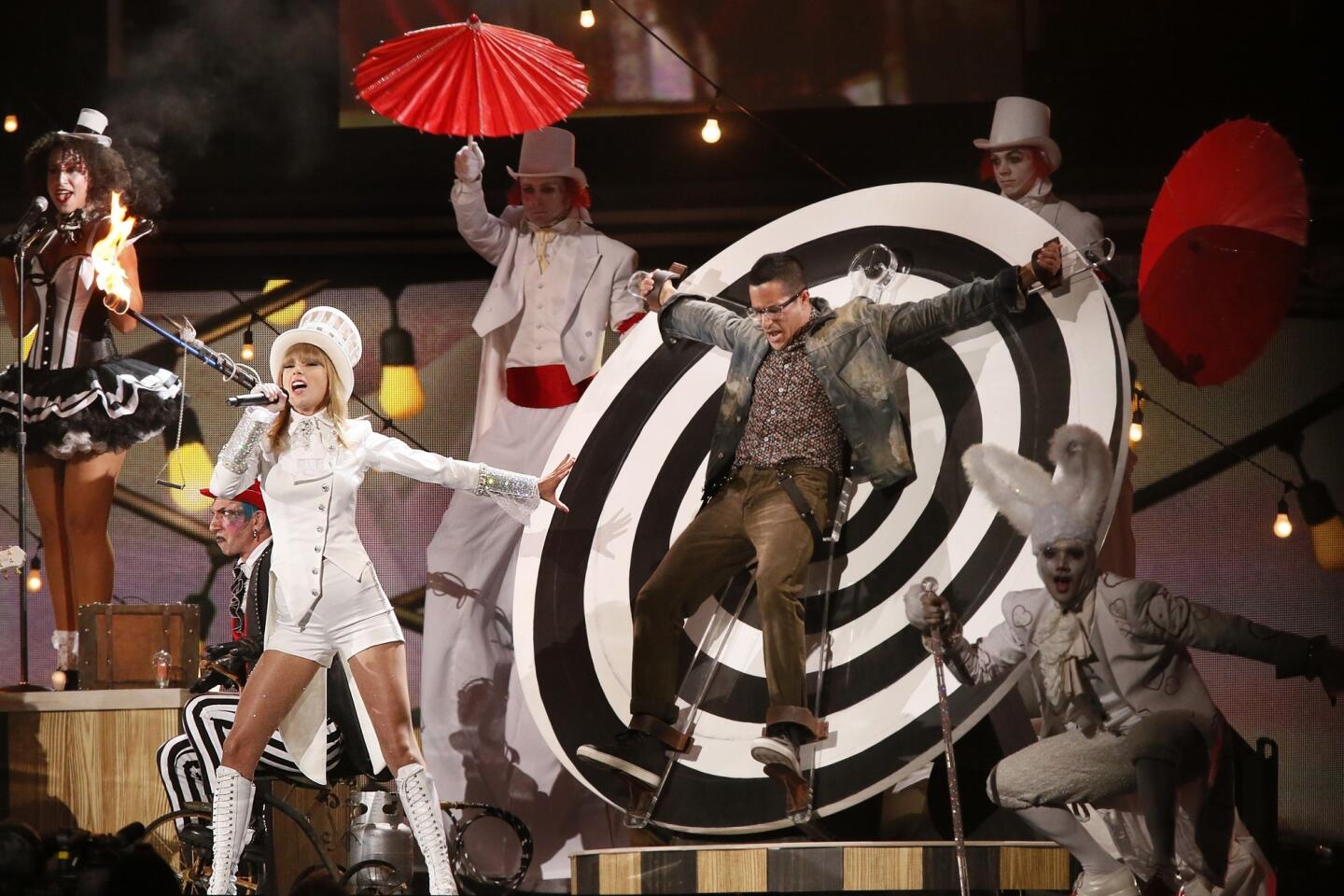

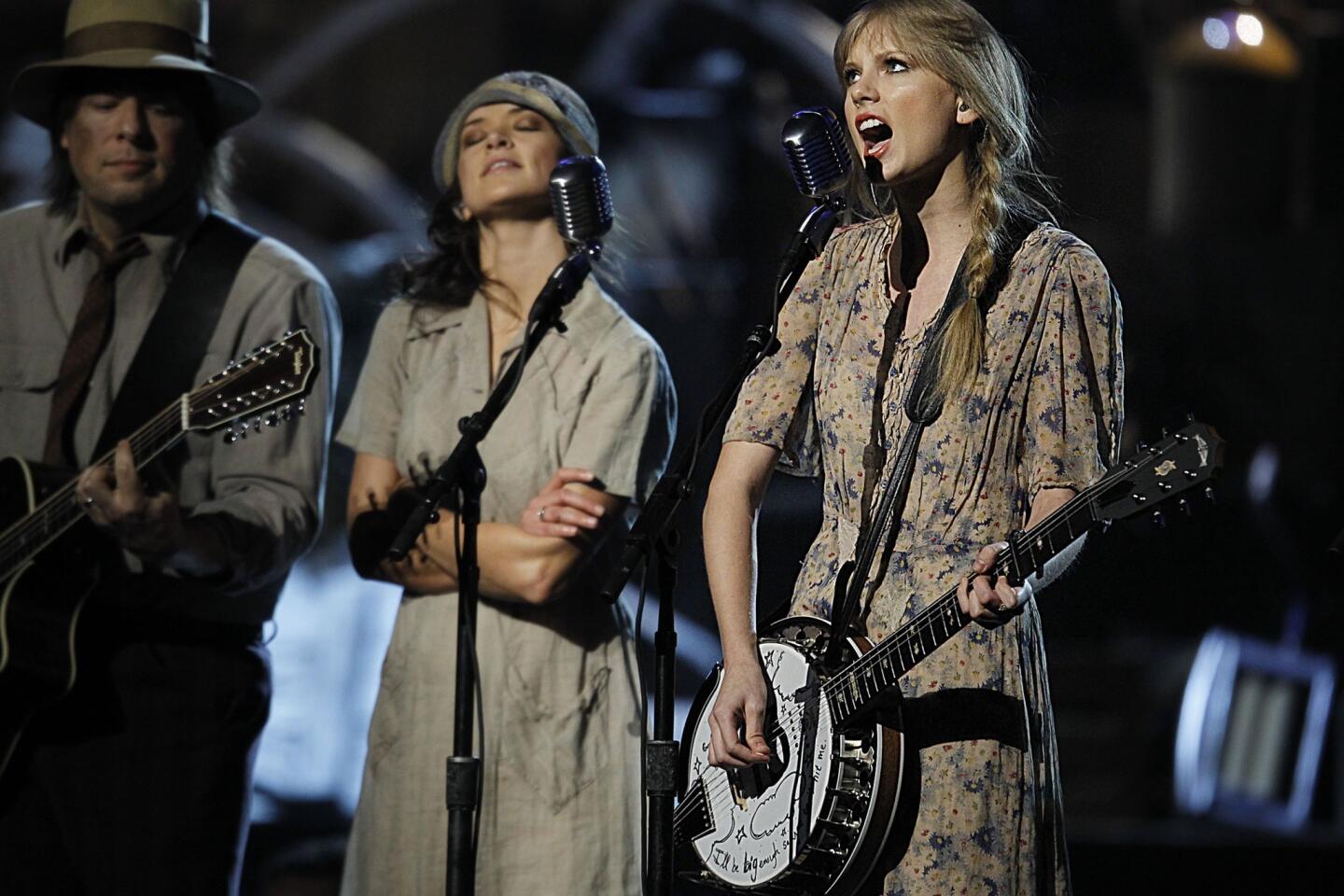

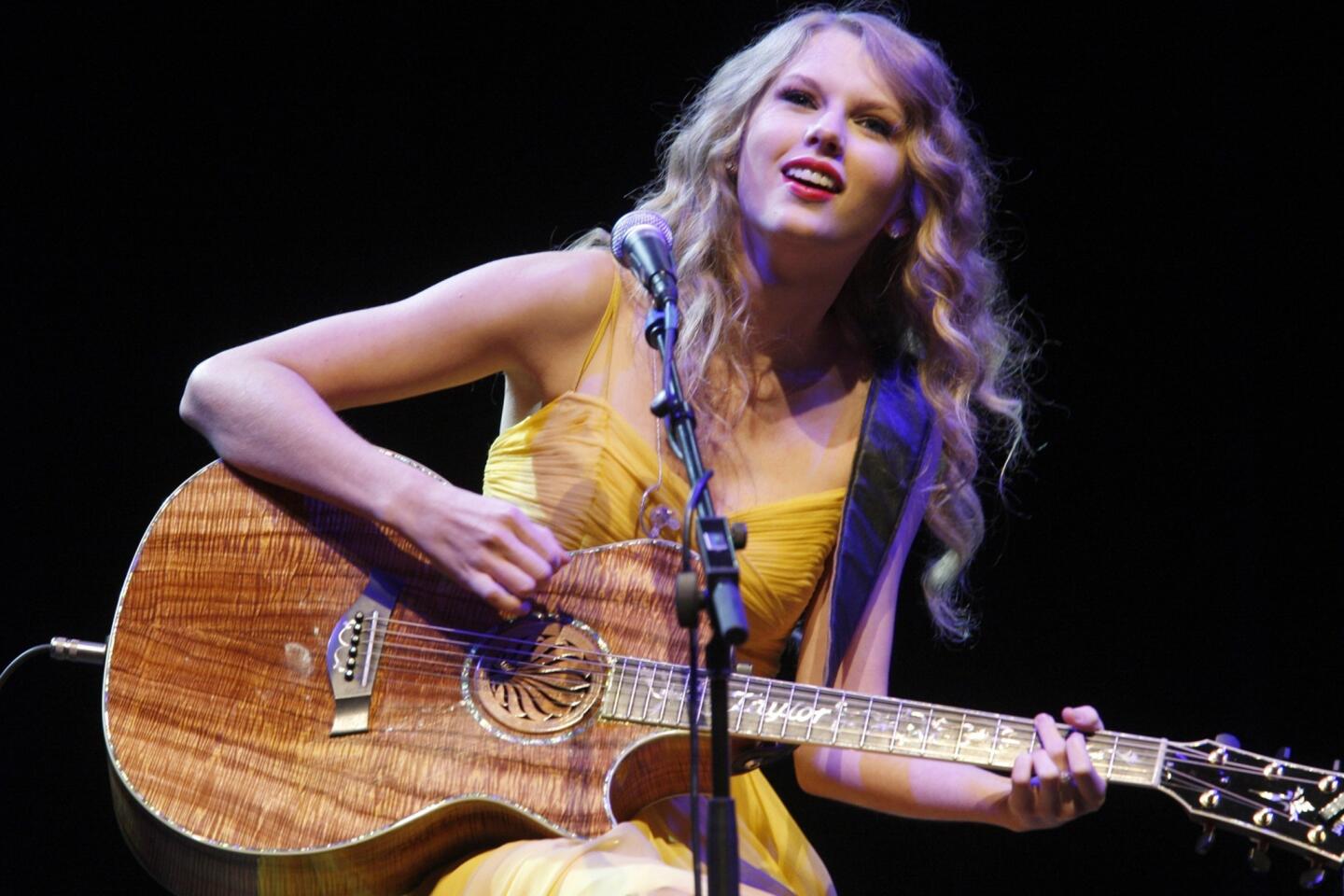

Sony manages 3 million copyrights and a roster of songwriters that includes the likes of Taylor Swift, Lady Gaga and Ed Sheeran, pictured.

- Share via

Sony/ATV Music Publishing has made a killing from famous songs like the Beatles’ “Yesterday,” but what tomorrow brings is far from certain for the company that controls some of the world’s biggest hits.

The music publisher manages 3 million copyrights and a roster of songwriters that includes the likes of Taylor Swift, Lady Gaga and Ed Sheeran. Since 1995 it has operated as a joint venture, split evenly between Tokyo-based tech giant Sony Corp. and the estate of Michael Jackson.

Ownership of the world’s largest music publisher is likely to change now that Sony has begun a process to potentially sell its half of the enterprise, which as a whole is said to be worth close to $2 billion. Sony’s bankers are trying to determine the joint venture’s current valuation, and music executives and financiers have held meetings in the last week to discuss the catalog’s future.

SIGN UP for the free Essential Arts & Culture newsletter >>

The Jackson estate appears to want to use this moment as an opportunity to find a new strategic partner, according to a person familiar with the talks who was not authorized to speak publicly. Potential candidates include rival music companies like Warner Music Group, as well as private equity firms such as Apollo Global Management, the person said.

A transaction could generate a big cash pile for Sony, which has struggled lately in other areas of its electronics business. Speculation about a sale has been in the wind for roughly a year, and even came up in emails exposed in last year’s cyberattack on Sony Pictures.

The impending changes come at an uncertain time for music publishers, which handle the songs and compositions behind the sound recordings heard on iTunes, radio and streaming services. Sony/ATV and rivals have been trying to get higher royalty rates from the growing industry of online streaming services such as Pandora, Spotify and Apple Music.

“When, at some point, the current debate around royalties and streaming gets worked out, this may prove to be a shortsighted trade,” said Joe Rapolla, a music professor at Monmouth University and former record label executive. “But since no one knows how long that will take. Sony may want the cash now.”

Sony executives told employees this month that the company has triggered a clause in its contract with the Jackson heirs that could lead to a change of ownership, allowing either Sony or the estate to buy out the other partner’s 50% stake. It’s one major step in a process that “will play out over the next several months,” according to an internal memo Chief Executive Martin Bandier, 74, sent to staff.

“I remain confident that for all of us it will be business as usual during this process and that our best years are still ahead of us,” Bandier wrote.

Indeed, Sony has continued to make deals with songwriters, announcing worldwide publishing agreements with singing group Pentatonix and Norwegian deejay Kygo in just the last month. It’s also preparing to move into new offices in New York and the Los Angeles area. The L.A. operations will relocate from Santa Monica to Sony Pictures’ Culver City lot.

When, at some point, the current debate around royalties and streaming gets worked out, this may prove to be a shortsighted trade.

— Joe Rapolla

Theories abound over Sony/ATV’s future.

In one of the scenarios being discussed, Sony would sell its half and the Jackson estate would also cash out a portion of its share to a new co-owner. The estate may want to partner with a company already in the publishing business.

Warner Music Group, the third-biggest record label, is expected to take a look, and it already owns a major publisher in Warner/Chappell Music. Rights management company BMG, a subsidiary of German media firm Bertelsmann, could kick the tires with the help of outside investors. However, BMG Chief Executive Hartwig Masuch told the Financial Times this week that it would not be tempted to make a play.

Vivendi-owned industry titan Universal Music Group is not expected to be a buyer, due to antitrust hurdles.

Sony/ATV did not make Bandier available for interviews.

Representatives for Sony Corp. of America, the estate of Michael Jackson, Warner Music Group, Universal Music Group and Apollo Global Management declined to comment.

Jackson paid $47.5 million for ATV Music, the publishing company that owned the Beatles catalog, in 1985. That deal sent shock waves through the music industry at the time and would badly damage the relationship between Jackson and former Beatle Paul McCartney, who had collaborated on songs like “The Girl Is Mine” and “Say Say Say.”

In 1995, Jackson merged the business with Sony’s music publishing arm to form Sony/ATV. Jackson died in 2009.

Sony took in $591 million in revenue from music publishing in its most recent fiscal year, according to a public filing from the company, up about 6% from the previous year. By comparison, the Sony Music record label that represents the likes of Adele and Beyonce generated nearly $3.2 billion in sales during the same period.

Larry Miller, director of the music business program at NYU Steinhardt, said the publishing business could be particularly attractive to companies looking for long-term, stable bets rather than assets they can flip in a few years. Publishers make money when their songs are placed not only with recording artists for their albums, but also in TV shows, movies, video games and commercials.

“There are more uses for music every day,” Miller said. “Music publishing as an asset class is looking better and better.”

Though publishing remains a valuable business amid the industry’s shifts, analysts believe one stumbling block to a deal includes Sony/ATV’s high valuation. Many logical buyers would have to raise money to make a play. A bid from a major competitor, such as Warner Music, would also invite regulatory scrutiny.

Analysts do not expect the sale of Sony/ATV to be simple.

“The whole thing’s an animal,” said a music executive who asked not to be named as to not damage business relationships. “If you’re going to sell it, you have to clean it up.’’

Follow me on Twitter: @RFaughnder

ALSO:

New book chronicling Michael Jackson’s final days to become a TV series

Lady Gaga named Billboard’s ‘Woman of the Year’

Does Adele have her sights set on Taylor Swift’s double play?

More to Read

Sign up for The Envelope

Get exclusive awards season news, in-depth interviews and columnist Glenn Whipp’s must-read analysis straight to your inbox.

You may occasionally receive promotional content from the Los Angeles Times.