Congress is set to approve a massive spending bill and tax measure, setting aside dysfunction

- Share via

Reporting from WASHINGTON — In an unusually ambitious swoop, Congress is poised this week to approve a mammoth legislative package that jams a year’s worth of work into one deal.

The compromise, headed for votes Thursday and Friday, would repeal a decades-old ban on exporting crude oil, make permanent $650 billion in tax breaks, adopt new cybersecurity rules, tighten visa requirements for some foreign visitors and ultimately expand the federal deficit by tens of billions of dollars a year.

It’s the kind of heavy lifting that has mostly eluded Congress in recent years amid partisan dysfunction.

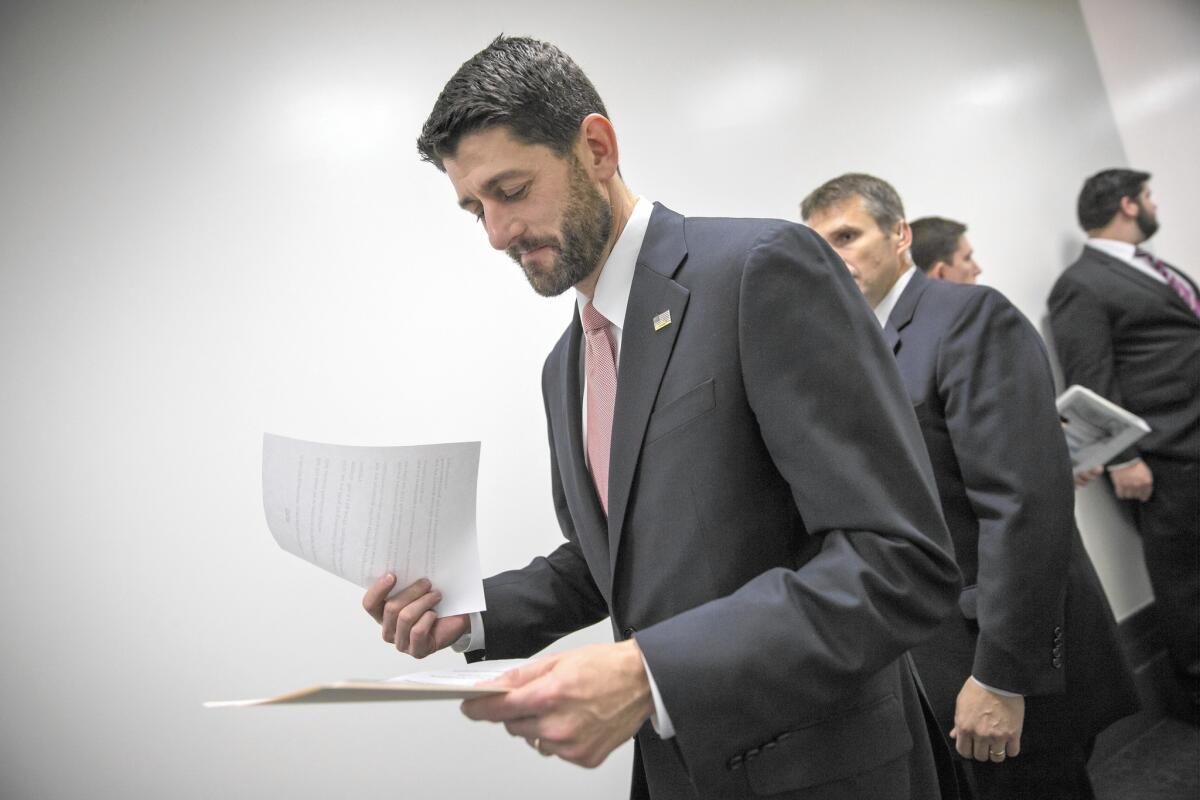

Passage would represent a significant victory for new House Speaker Paul D. Ryan (R-Wis.), who has been spared the sort of conservative revolt that plagued his predecessor, John A. Boehner.

The measure also would deliver several top priorities for President Obama and Democrats, including a push by Minority Leader Nancy Pelosi of San Francisco to make permanent the child tax credit, one of the most significant anti-poverty tools.

Together, the deal stands among the “most important domestic legislation in the past five years,” said Steven S. Smith, a political science professor at Washington University in St. Louis.

Although year-end packages usually carry many extras — they are often referred to as “Christmas trees” because of the legislative gifts they bear — this one goes much further, Smith said, “by including so many substantive policy matters. They add up to an amazing sum of public policy.”

Republicans, aiming for the White House in 2016, hope the deal will give voters confidence that their party, the majority in Congress, can overcome internal divisions to govern effectively. The tax provisions alone represent a government initiative nearly on par with Obama’s economic stimulus package after the Great Recession.

At the same time, Democrats showed their enduring strength by blocking more than 150 GOP-backed policy riders, including those to defund Planned Parenthood, roll back Obamacare and block Syrian refugees from entering the country.

They also tacked on their priorities, including a permanent extension of tax credits for low-income families that Obama had gotten on a temporary basis in 2009, an increase in college Pell grants and a $2-billion increase for medical research at the National Institutes of Health.

And the White House won a major reform of the International Monetary Fund that had been a diplomatic priority but had stalled in Congress for five years.

Facing a 2016 presidential campaign that probably will dominate Washington, lawmakers viewed the year-end deal as their last chance to push priorities.

The core of the package is the $1.1-trillion omnibus spending bill to keep the government funded through fiscal 2016, reversing some of the steep cuts to defense and domestic accounts both parties wanted to undo. Along with new spending are increases to combat heroin and opiate addiction, money for schools to prepare for terrorist attacks and improvements to national parks.

It also includes the Cybersecurity Act of 2015, a controversial measure that would require the Department of Homeland Security to make it easier for government agencies and the private sector to share information about cyberattacks and threats. The American Civil Liberties Union has called the initiative a veiled attempt to expand government surveillance of online activity, saying that existing private-sector information sharing programs are sufficient.

On top of that, lawmakers are also passing a $650-billion tax package that deficit hawks lambasted as fiscally irresponsible, even though the breaks are routinely renewed for both business and ordinary Americans. Included are looser rules for using college savings plans and a permanent extension of the earned income tax credit for low-wage workers. Business would benefit from a faster depreciation credit.

Two Obamacare taxes, including one on high-priced heathcare plans, would be temporarily postponed.

The spending bill and tax measure, drafted largely by leadership behind closed doors and released in the middle of the night, represent the kind of secret deal-making lawmakers, especially Republicans, have rejected.

But Ryan, in his first months as the new speaker, appears to have won goodwill among rank-and-file Republicans who did not blame him for cutting a deal many of them will not support.

“Let me be the first to say, I don’t think this is the way government should work,” Ryan said Wednesday. “Look, in divided government, you don’t get everything you want. Republicans didn’t get all that we wanted. Democrats didn’t get all that [they] wanted. This is a bipartisan compromise.”

In a nod to the difficulty of amassing support, Ryan broke the package, totaling nearly 2,300 pages, into two. The spending bill is likely to be approved with Democratic votes amid GOP opposition, and the tax package would be largely passed by Republicans because many Democrats view it as skewing too favorably toward big business.

One major trade-off, lifting the 40-year ban on oil exports in return for renewable energy credits and environmental conservation funds, emerged as too steep a price for some Democrats.

“This deal gives oil drillers an enormous policy win that does our economy no good,” said Rep. Raul M. Grijalva (D-Ariz.), co-chairman of the Congressional Progressive Caucus.

Renewable-energy companies, though, believe the tax breaks will provide the stability they need to further develop the industry.

Times staff writer Paresh Dave in Los Angeles contributed to this report.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.