Illinois’ $105-billion public pension fix struck down by state Supreme Court

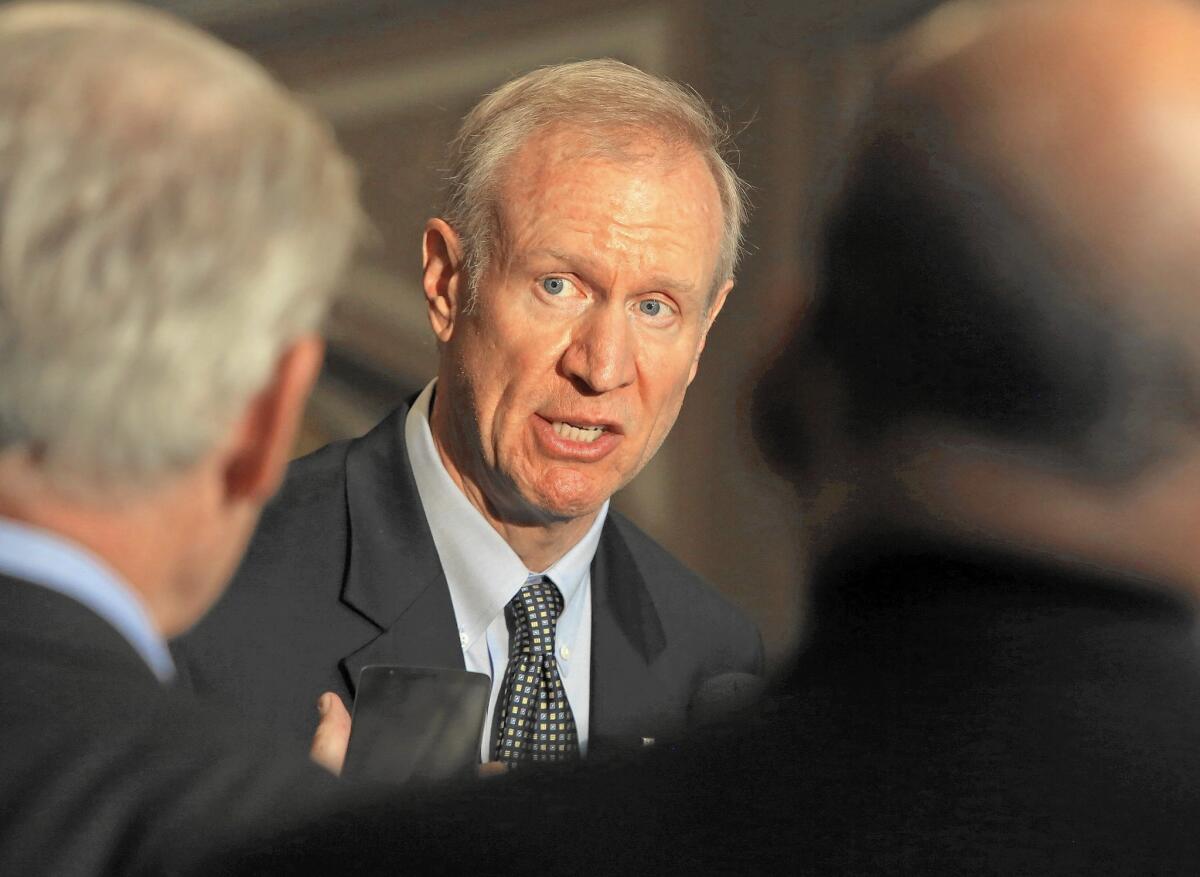

A ruling striking down Illinois’ pension law means Republican Gov. Bruce Rauner and the state Legislature will have to find another way to handle a massive budget deficit.

- Share via

Taxpayers are facing a $1-trillion public pension headache across the nation — and that remains untouched after an Illinois Supreme Court ruling on Friday.

The top court in Illinois unanimously threw out a legislative fix designed to erase a $105-billion pension liability the state is facing. In its 38-page written opinion, the court said that the state constitution bars public employee pension benefits from being diminished or impaired.

The ruling has a profound impact in Illinois, on its political system and on the city of Chicago, which also faces pension problems. But while many states face similar issues, the Illinois court decision had been expected, said Jean-Pierre Aubry, assistant director for state and local research at the Center for Retirement Research at Boston College.

“If the court decision had gone against the expectation then it would have had a greater impact,” Aubry said. “That would have been more meaningful and might have been more broad.”

The Illinois court did not mince words in making it clear that the constitution protected employees even if the state was facing acute problems.

“The financial challenges facing state and local government in Illinois are well known and significant. In ruling as we have today, we do not mean to minimize the gravity of the state’s problems or the magnitude of the difficulty facing our elected representatives,” Justice Lloyd Karmeier said, writing for the court.

“It is our obligation, however, just as it is theirs, to ensure that the law is followed,” he wrote. “That is true at all times. It is especially important in times of crisis when, as this case demonstrates, even clear principles and long-standing precedent are threatened. Crisis is not an excuse to abandon the rule of law.”

The public pension problem has been well-documented and touches municipalities across the country. Local governments negotiated contracts including what conservatives say are overly generous benefits. As the economy contracted in recent years because of the recession, meeting state obligations became more difficult. Payments to the pension systems took up a larger and larger share of municipal budgets, cutting the funds available for other government needs like roads and police.

Nationwide, state pension plans are about 72% funded with about 6% of the municipal budgets going to pension systems, Aubry estimated. The total shortfall is believed to be about $1 trillion.

Illinois is in especially dire straits, facing a hole of more than $100 billion. To solve the problem, lawmakers pushed through a deal near the end of 2013 designed to save an estimated $160 billion over 30 years by changing the rules for current employees. The new pension plan included a lower future cost-of-living adjustment, an increase in the age when employees could retire and a cap on pension payments for those at the high end of the scale.

The deal was politically contentious in a state with strong unions that tend to support the ruling Democrats. Still, state officials argued that they had no choice.

“Our economy is and has always been subject to fluctuations, sometimes very extreme fluctuations,” said Karmeier, a Republican.

But, he noted, “the law was clear that the promised benefits would therefore have to be paid and that the responsibility for providing the state’s share of the necessary funding fell squarely on the Legislature’s shoulders.”

According to Aubry, about 15 states that face pension problems have some form of constitutional language protecting existing pension rules. Those states include California, Georgia, Kansas, Nebraska, Oregon and Pennsylvania.

Though many of the states have altered how benefits are calculated for existing employees, the biggest changes, like those in California, involve major revisions for new hires.

That is important because it allows the changes to affect the new workforce over the long term instead of trying to impose the shock on workers who are approaching retirement age.

“If the system can tread water,” Aubry said, “eventually the cost of the system starts shrinking.”

Rick Pearson and Kim Geiger of the Chicago Tribune contributed to this report.

ALSO:

Jeb Bush to praise ‘Christian conscience’ at Liberty University

Marijuana laws pose dilemma for Republican presidential hopefuls

Dan Walker dies at 92; ex-Illinois governor worked to regain reputation

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.