Washington is getting tough on China. Why that’s bad for California

- Share via

WASHINGTON — Whatever Gov. Newsom’s China trip in the last week might achieve on climate change, the financial and economic stakes are just as huge — and in many ways of even more immediate concern for California.

Whether it’s tourism, education, real estate or high tech, no state has more riding on the future of U.S.-China relations than California. And the deepening rift at the federal level between the world’s two economic superpowers is already exacting a price.

That reality explains part of Newsom’s motivation in visiting China as he seeks to rebuild economic relationships with the country following the COVID-19 pandemic. His visit may help soften when possible the Biden administration’s increasingly tough stance in order to protect his state’s best interests.

Movie-going in China has seen a resurgence from the pandemic, but U.S. films accounted for just 16.6% of Chinese box office receipts so far this year, according to the Motion Picture Assn. That appears to be the smallest share in a decade.

International students from China at UC campuses were down 22% last year from 2019, and likely slipped further this fall.

And while Chinese tourists recently have begun to return to California, there are only one-third as many as in 2019, when more than 1.5 million visitors came and plowed in excess of $4 billion into the state economy.

China’s government is relaxing restrictions on night markets and street vendors to stimulate spending and create jobs, especially for young people.

Paul Orlando, director of USC’s business incubator program, remembers how a few years ago he was getting inquiries or visits once a month from Chinese investors eyeing Los Angeles start-ups. This last year: zero.

“Definite drop in interest in both directions,” he said, noting that newly formed U.S. firms are wary of talking with Chinese investors as well. Chinese foreign direct investment to the U.S. last year was about one-tenth of the peak in 2016, according to the Rhodium Group.

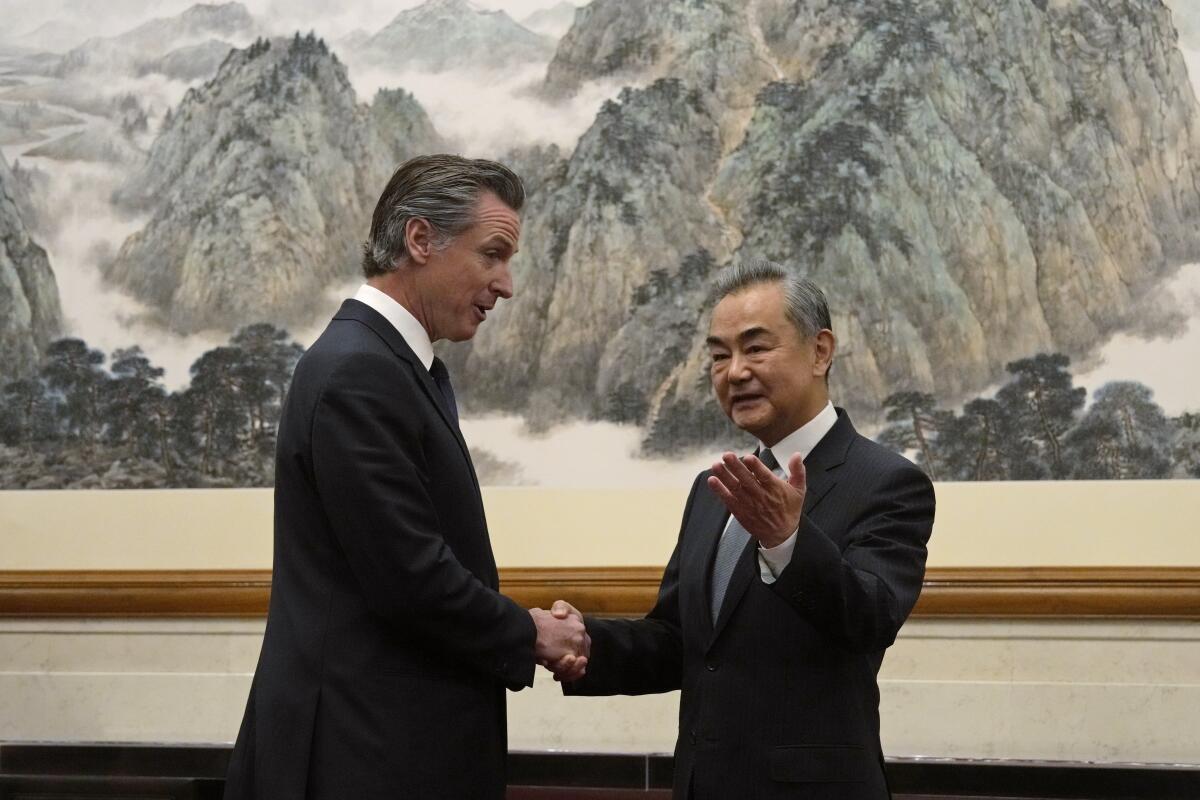

Newsom’s weeklong trip to China, which included a meeting with Chinese President Xi Jinping, was focused on collaborating on climate change, but it was also meant to promote California’s industries and ameliorate the significant impact to the state.

Summing up what might come out of his meetings, Newsom told reporters in China: “More tourism, I hope. More two-way trade, I hope. More economic development, more economic growth and prosperity, more peace, more collaboration, a little less stress, a little less anxiety. We’re all stacked with stress. I think we need to take the temperature down broadly.”

U.S.-China relations have deteriorated further since Newsom’s predecessor, Jerry Brown, met Xi in early June 2017, a few days after then-President Trump pulled out of the Paris climate agreement.

Since then, Xi has tightened and extended his iron-fisted rule, cracking down on dissent at home and strengthening his alliance with Russian leader Vladimir Putin. Heightened tensions over Taiwan and incidents like China’s spy balloon over the U.S. have roiled relations, and President Biden, depicting China as an existential threat, has imposed even tougher policies on China than Trump.

Not only has he maintained the Trump-era trade tariffs, the Biden administration has blacklisted additional Chinese entities, placed export controls on advanced computer chips, and most recently, authorized restrictions on certain U.S. investments of sensitive technology in China. Biden has hit China on human rights, too, and enlisted allies to curb Xi’s geopolitical ambitions, something Trump resisted.

Long-standing concerns about theft of intellectual property, using the know-how of U.S. investors in China as models for creating Chinese rivals, have added a private-sector element of concern about expanding trade between the U.S. and China.

The conflict between the U.S. and China over Taiwan’s sovereignty is political theater with drastic consequences.

In reaching out to China, Newsom has generated some flak, especially from China hawks in the GOP, and there are political risks for Newsom himself should he run for president. The trip will have seemingly burnished his foreign policy experience, but could backfire if it is perceived as being soft on a major U.S. rival.

At the same time, Newsom’s visit to China was more acceptable, even welcomed, by many in California, given its roles as home to more than 2 million Chinese Americans and as a global leader on climate change. Newsom also sought to grease the wheels of the APEC leaders’ meeting to be hosted by San Francisco next month, saying he formally invited Xi to the summit. By the end of the week, news broke that Biden and Xi agreed to meet on the sidelines of the global conference.

Still, Newsom is circumscribed by national policies and the current mood on both sides. The governor can’t do anything directly about tariffs, investment restrictions or the stream of negative news flowing in both directions.

“At the state level, we’re dealing at a very modest level,” Brown said in an interview.

Newsom is building on past top-level visits, Brown added, including one from Gov. Arnold Schwarzenegger in 2005. And it can only help California’s economy to cooperate on climate change work, he said, although they may not amount to a whole lot given the toxic atmosphere between the two nations.

China’s economic problems at home, including high unemployment among young people, a debt-bloated real estate market and an aging population, add to the future challenges. And those ripples can be felt in California.

It wasn’t so long ago that foreign Chinese buyers were scooping up houses and other properties in the state. Los Angeles housing economist G.U. Krueger, in modeling home price trends, once added a bonus appreciation of 1% to 2% in communities with strong Asian populations, in part due to the high demand from Chinese nationals in the upper-end market.

That was pre-pandemic. “These days you don’t hear stories of Chinese buyers coming with bags of cash,” he said. In fact, nationally, the number of existing houses bought by Chinese nonresidents of the U.S. or recent arrivals was down about 75% this year from 2017 and 2018 levels, according to the National Assn. of Realtors. A third of Chinese home purchases nationally are in California.

UCLA economist William Yu doesn’t see the decline as a bad thing. In California, strong Chinese demand had added fuel to the state’s housing market and the run-up in prices that made homeownership unaffordable for most people.

The UC admitted a record number of California first-year students for fall 2023, led by Latinos and an increase in Native Americans who helped make up the largest ever group of underrepresented students offered admission.

In a similar positive vein, the dramatic decline in international Chinese students at UC campuses — from 25,571 in 2019 to 20,970 last year, almost all of that undergraduates — has opened up more seats for California residents.

But experts see a cost, too, such as the loss of foreign talent and the chilling effect on collaborative research, not to mention the financial hit to universities.

“That international students generally pay the sticker price means you can afford to give greater financial aid to domestic students, have a larger faculty and a bigger library. The economic benefit is substantial,” said Clayton Dube, director of the USC U.S.-China Institute.

The issue came up during a meeting Newsom held with students and faculty at Peking University in Beijing when a professor told the governor that academics are concerned it’s become difficult for Chinese students to study in California.

“You’re right, it is getting harder. And it’s part of the national discourse,” Newsom replied. “I’m deeply mindful of that. I also deeply understand the benefits.”

In the short term, the prospects for increased Chinese tourism look promising. Beijing has reopened group tours to the U.S., and more direct flights between China and California are expected to be announced soon.

Between the pandemic and the frosty bilateral relations, direct flights from China to California were only up to 56 as of July. That’s double a year earlier, but still far from the more than 500 in 2019, according to Visit California, the nonprofit tourism promotion group.

California business leaders weren’t part of the official delegation with Newsom, but his China trip included a stop at Tesla’s factory in Shanghai, highlighting China’s globally leading electric vehicle market and the opportunities — as well as risks — for U.S. firms operating in China, in renewable energy and other areas.

“The advantages here are self-evident, in terms of the supply chains,” Newsom said after touring the Tesla factory.

But the collaboration between engineers at the factories in Shanghai and California, Newsom said, “is a benefit to both countries, and certainly to the state of California.”

Many California-based and other multinational companies, especially those that both make and sell goods in China, are still expanding there, but in recent months more businesses have been taking out their China profits and bringing them back home, said David Loevinger, a China expert at Los Angeles-based TCW Group, an asset management firm.

Apple not only makes its products in China, it counts on that country for nearly 20% of overall sales. That percentage is even higher for some other California-based tech firms, including Intel, Broadcom and Qualcomm, which derived a whopping 64% of its revenue from China in 2022. Disney, Amgen, Herbalife and many other California businesses also have made big bets in China.

California businesses and workers may have more to gain from China compared to those in states such as Florida and Texas, which have sought to restrict Chinese property ownership and pension fund investments involving China.

U.S.-China ties are fraught with tension, and political campaigning ahead of the 2024 election means anti-Chinese rhetoric will probably heat up.

“It’s hard to be optimistic about the broader U.S.-China relationship,” said Loevinger. But California might still be able to distinguish itself, he said.

“It doesn’t hurt California to say, ‘We can’t do things covered by national security, but outside of that, we want to do business with China.’”

Lee reported from Washington and Rosenhall from Beijing and Shanghai.

More to Read

Sign up for This Evening's Big Stories

Catch up on the day with the 7 biggest L.A. Times stories in your inbox every weekday evening.

You may occasionally receive promotional content from the Los Angeles Times.