CBO says $15 wage would reduce poverty and increase debt

- Share via

WASHINGTON — Increasing the minimum wage to $15 an hour would reduce the number of Americans living in poverty and boost wages for millions of Americans while adding to the federal debt and joblessness, a new report from the Congressional Budget Office projects.

The federal deficit would increase by about $54 billion over 10 years under a Democratic proposal to gradually increase the federal minimum wage to $15, largely because the higher wages paid to workers, such as those caring for the elderly, would contribute to an increase in federal spending, the estimate found.

Democrats are pushing to include the higher minimum wage as part of their $1.9-trillion COVID-19 relief plan. House committees this week will begin crafting the legislation along the lines that President Biden has requested, but it’s unclear whether the minimum wage proposal will make it into the final product. The bill is expected to include another round of direct payments to Americans, an expansion of the child tax credit and aid to states and local governments.

The decision on the minimum wage is a key early test for Biden as he seeks to build public support for his proposal and navigate differences within his own party about how far the COVID-19 legislation should go. Voices on the left including Sen. Bernie Sanders (I-Vt.), the author of the wage legislation, want Democrats to fight now for the pay increase, but some moderates are wary, fearing the effect on small businesses during the pandemic.

The report from the Congressional Budget Office cites several positive and negative effects from raising the minimum wage. On the positive, the number of people living in poverty would fall by about 900,000 once the $15 wage was fully in place in 2025. On the negative, the number of people working would decline by about 1.4 million.

Rep. Bobby Scott, the Democratic chair of the House Education and Labor Committee, said the report strengthened the case for including the $15 minimum wage in the COVID-19 relief bill. He emphasized that the report projected that 17 million workers making below the minimum wage would see a pay increase once the requirement was in place. An additional 10 million workers making slightly more than the proposed minimum could also see a boost in pay.

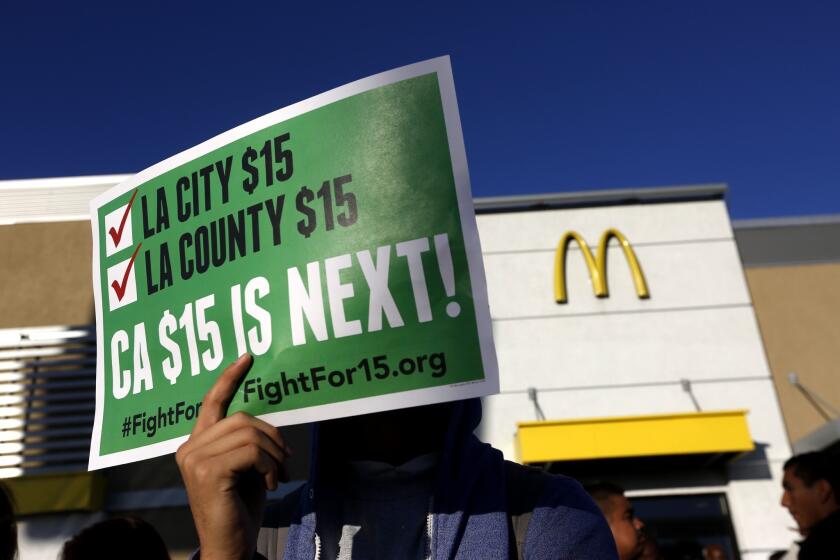

A Congressional Budget Office report says a higher minimum wage will cost jobs, but also that millions will benefit.

“At a time when many of our essential workers are still not being paid enough to provide for themselves and their families,” Scott said, “we must do everything in our power to give these workers a long-overdue raise.”

But lawmakers worried about the ability of small businesses to pay the higher minimum wage will undoubtedly point to the job losses that the CBO said would occur. Business groups such as the U.S. Chamber of Commerce said they could support efforts to increase the minimum wage but cited $15 as too high.

White House press secretary Jen Psaki said Biden remained “firmly committed” to a $15 minimum wage. But Psaki also noted that the Senate parliamentarian had the final say on whether the minimum wage hike survived in the final package. The fast-track process that Democrats are using does not allow changes to spending or taxes that are “merely incidental” to a larger policy purpose.

The current federal minimum wage is $7.25 an hour and has not changed since 2009. Most states also have minimum wage laws. Employees generally are entitled to the higher of the two minimum wages. Currently, 29 states and Washington, D.C., have minimum wages above the federal minimum wage of $7.25 per hour.

Also Monday, Democratic lawmakers unveiled legislation to permanently expand the child tax credit, with backers saying that Democratic leadership has agreed to include their legislation for one year as part of the COVID-19 relief measure.

Under the legislation, the value of the tax credit would become fully refundable and would be expanded from $2,000 to $3,000 for children ages 6 though 17, and from $2,000 to $3,600 for children younger than 6.

Treasury’s Janet Yellen says the U.S. is in a ‘deep hole’ but Biden’s $1.9-trillion plan could generate enough growth to restore full employment by next year.

“If we don’t act now, we’ll miss a historic opportunity to give millions of children a brighter future,” said Rep. Suzan DelBene (D-Wash.).

Democratic lawmakers are also pushing for payments to be made on a monthly basis rather than in an annual lump sum.

“If we can land men on the moon, then we can get a monthly check out to folks,” said Rep. Rosa DeLauro (D-Conn.), the chair of the House Appropriations Committee.

Perhaps the biggest question in the COVID-19 relief bill is who will get another round of stimulus payments. In December, lawmakers approved $600 checks for individuals making up to $75,000 a year and $1,200 for couples making up to $150,000, with payments phased out for higher incomes.

Many lawmakers have called for the next round of government checks to be more specifically targeted to those whose incomes have been harmed by the pandemic.

Psaki said that Biden believed families making $275,000 or $300,000 might not need direct checks, but the terms of the relief payments were still being debated.

“There is a discussion right now about what that threshold will look like. A conclusion has not been finalized,” Psaki said. “His view is that a nurse, a teacher, a firefighter who’s making $60,000 shouldn’t be left without any support or relief either.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.