House Democrats propose $1,400 payments in first draft of COVID-19 relief bill

- Share via

WASHINGTON — House Democrats on Monday released the first draft text for key pieces of legislation that will comprise President Biden’s COVID-19 relief bill.

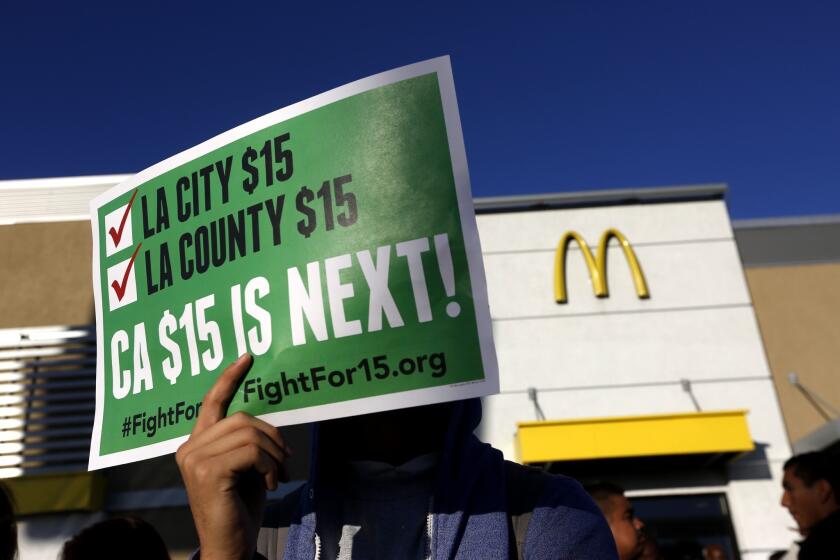

The legislative language from the Ways and Means, Financial Services and Education and Labor Committees show Democrats are forging ahead with plans to bump the federal minimum wage to $15 an hour by 2025 and make another round of stimulus payments. Billions of dollars are planned for airline staff, airports and trains.

In all, 12 committees are meeting in the coming days to assemble the stimulus bill for a House floor vote during the week of Feb. 22. Once the bill goes to the Senate, it is designed to be passed with just 50 members plus the tie-breaking vote of Vice President Kamala Harris using a special budget fast-track procedure.

The House Ways and Means Committee’s draft measures would send $1,400 payments to individuals earning up to $75,000 or couples making $150,000. Those payments phase out so singles earning more than $100,000 or married taxpayers making $200,000 and up get nothing. Eligibility would be based on 2019 or 2020 income. The bill would also send $1,400 payments to adult and child dependents in households that qualify.

The Ways and Means plan also includes:

- An extension and expansion of unemployment benefits that are scheduled to run out in mid-March. The bill would increase the weekly federal benefit to $400 from $300 and extend it through the end of August

- Benefits for self-employed individuals and gig workers, and those who have exhausted their regular jobless benefits, would also be extended

- Paid-leave benefits for workers and tax credits for employers with fewer than 500 employees to reimburse them for the cost of the leave

- An increase in the annual child credit to $3,600 a year for children 5 and younger and $3,000 for those 6 and up. The money would come in monthly installments from July through December

- A bump in the earned income tax credit for low-wage workers and the dependent care tax credit for children and adults

A Congressional Budget Office report says a higher minimum wage will cost jobs, but also that millions will benefit.

Biden campaigned on an expanded child tax credit, which has been a longtime goal of Democrats, who are already beginning a push to make the more generous provision a permanent fixture of the tax code. Republicans such as Sens. Mitt Romney of Utah and Marco Rubio of Florida have also expressed support for a larger child credit.

The draft bill by Education and Labor Chair Bobby Scott (D-Va.) includes Biden’s minimum-wage proposal, which also phases out the lower wage for tipped workers. The committee, set to meet Tuesday to hold votes on the bill, estimates that 27 million workers would see a pay increase under the provision by 2025, if it passed.

The Financial Services Committee is charged, under the terms of the 2021 budget adopted last week by Congress, with drafting legislation totaling $75 billion in deficit increases. Chair Maxine Waters (D-Los Angeles) will convene the panel on Wednesday to vote on this portion of the bill.

Amid arguments over the relief package, the move against child poverty hasn’t gotten much attention — but its long-term impact would be major.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.