A closer look at Biden’s $1.8-trillion plan for families and education

- Share via

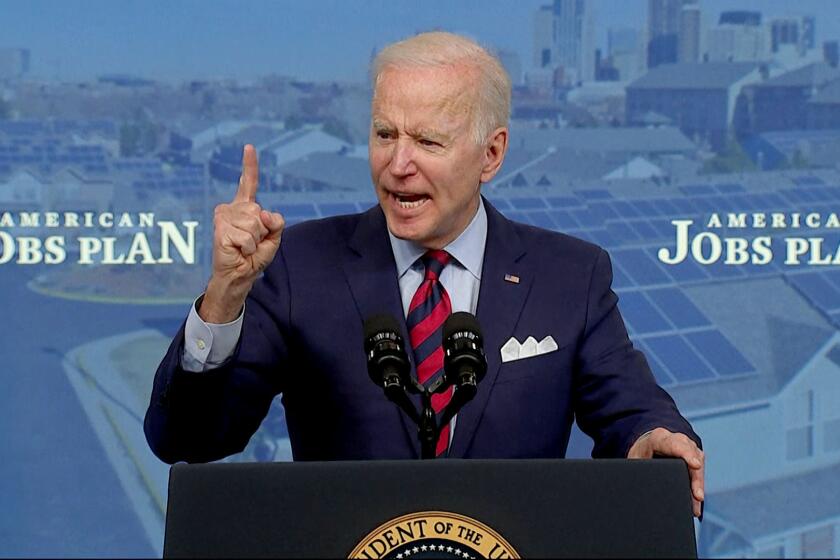

WASHINGTON — President Biden is set Wednesday to propose spending $1.8 trillion to help families and boost education, a plan he says will produce lasting benefits for the economy. Paying for his new “Families Plan” would require $1.5 trillion in tax hikes over the next decade on the wealthiest households.

Here is a closer look at where the money would go and where it would come from:

Initiatives

— $200 billion to provide free preschool to all 3- and 4-year-olds. The administration estimates that 5 million children would benefit and an average family would save $13,000.

— $109 billion to offer two years of free community college to all Americans. Also eligible for the program would be young immigrants living in the U.S. illegally who were brought to the country as children.

— Increase the maximum Pell Grant award by $1,400 per eligible student. Pell Grants provide financial aid to low-income students, and the increase would help to reduce the dependence on education loans.

— $46 billion for historically Black colleges and universities as well as tribal colleges and universities. This would include $39 billion to provide two years of subsidized tuition for students from families earning less than $125,000 a year.

President Biden’s Wednesday night speech to a joint session of Congress will be unlike others before it. Find out how and when to watch it — and why this isn’t the State of the Union address.

— $9 billion for scholarships and training for teachers.

— $225 billion to subsidize childcare for families and support child-care workers. Families earning 1.5 times their state’s median income would pay a maximum of 7% of their income for all children under age 5.

— $225 billion to create a national family and medical leave program. The program would provide workers up to $4,000 a month, with a minimum of two-thirds of average weekly wages replaced, rising to 80% for the lowest-wage workers.

— $45 billion to improve school meals and offer food benefits to children during the summer.

— Peg the length and amount of unemployment benefits to underlying economic conditions, creating an automated response to a downturn.

President Biden touted his $2.3-trillion infrastructure plan Wednesday, hoping to summon public support to push past the Republicans lining up against the massive effort.

— $200 billion to make permanent the currently temporary reductions in health insurance premiums for Affordable Care Act plans.

— Extend through 2025 an enhanced child tax credit that could be paid out monthly. Eligible families would receive $3,600 annually per child for children under 6. The payment would be $3,000 per child for children 6 to 17.

— Permanently increase tax credits for childcare. The credits would cover as much as half of a family’s spending on care for children under 13, up to a total of $4,000 for one child or $8,000 for two or more children.

— Make the expanded Earned Income Tax Credit permanent for childless workers.

— Allow the IRS to regulate paid tax preparers.

Wealthy Americans know the capital gains tax is their biggest loophole — and they won’t give it up easily.

Funding sources

Biden’s plan would cover these proposed expenses by:

— Increasing IRS enforcement funding to audit wealthier taxpayers and mandate that financial institutions report earnings from investments and business activity in ways similar to wages. This could raise $700 billion over 10 years.

— Raising the top tax rate on the wealthiest Americans from 37% to 39.6%. The rate had been 39.6% before the Trump administration’s 2017 tax cuts.

— Taxpayers earning $1 million or more a year, currently the top 0.3% of taxpayers, would no longer pay a 20% rate on income from capital gains such as the sale of a stock or other asset. They would pay 39.6% instead.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.