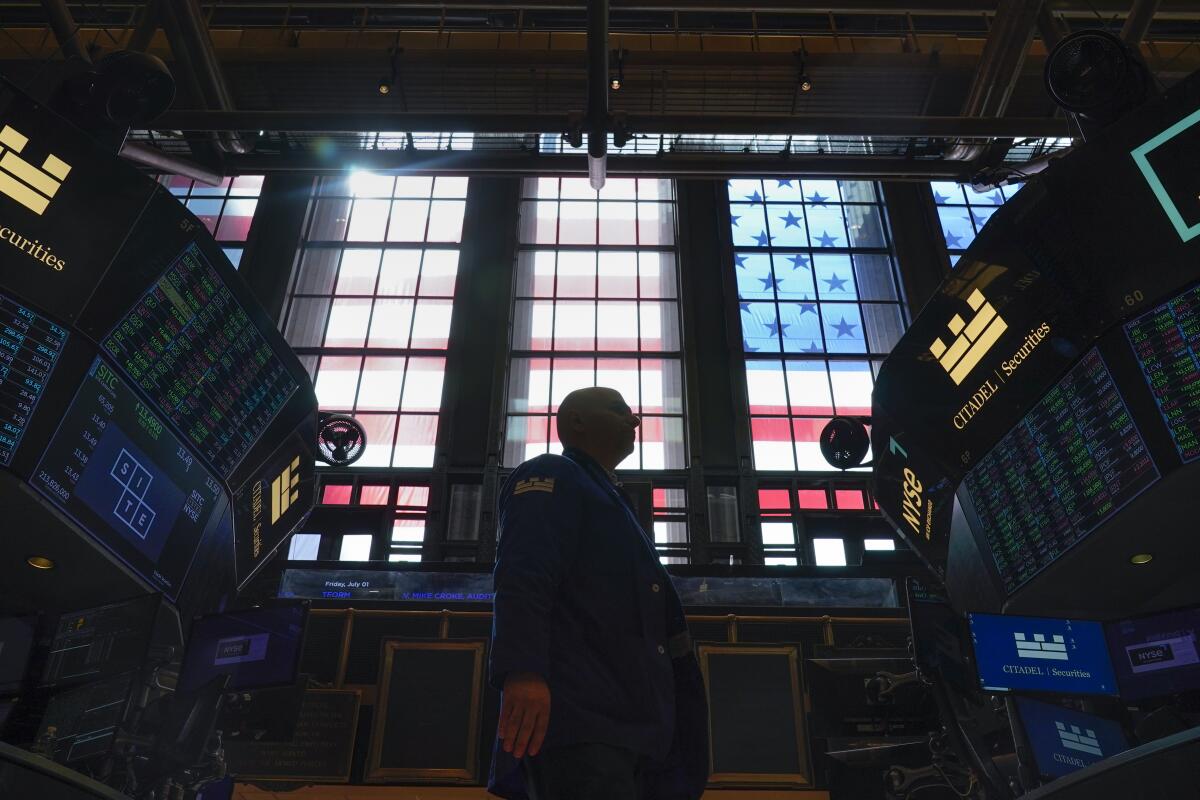

Wall Street closes higher but still ends week in the red

- Share via

Stocks on Wall Street shook off a downbeat start and ended broadly higher Friday, though the rebound was not enough to erase their losses for the week.

The Standard & Poor’s 500 rose 1.1% after having been down 0.9% in the early going. The gain snapped a four-day losing streak for the benchmark index, which still posted its fourth losing week in the last five.

The Dow Jones industrial average rose 1%, while the tech-heavy Nasdaq gained 0.9% after a sell-off in technology stocks eased.

The latest choppy trading comes a day after the S&P 500 closed out its worst quarter since the onset of the pandemic in early 2020. Its performance in the first half of 2022 was the worst since the first six months of 1970.

The S&P 500 has been in a bear market since last month, meaning an extended decline of 20% or more from its most recent peak. It’s now down 20.2% from the peak it set at the beginning of this year.

Bond yields fell significantly. The yield on the 10-year Treasury, which helps set mortgage rates, fell to 2.89% from 2.97% last Thursday. The yield on the two-year Treasury slipped to 2.83% from 2.92%.

The market’s deep slump this year reflects investors’ anxiety over surging inflation and the possibility that higher interest rates could bring on a recession.

Many companies say they’ll help employees access abortion post-Roe. But questions remain about how they’ll handle privacy and potential prosecution.

“What we’re seeing today is reflective of really what we’re going to see here in July, which is continued pressure on the markets, unless we see outsized economic reports on jobs or inflation, or some more meaningful change in Fed policy,” said Greg Bassuk, chief executive at AXS Investments.

The S&P 500 rose 39.95 points to 3,825.33. Roughly 85% of the stocks in the index finished higher.

The Dow gained 321.83 points to close at 31,097.26, while the Nasdaq rose 99.11 points to 11,127.85. The Russell 2000 index of smaller companies rose 19.77 points, or 1.2%, to 1,727.76.

The market’s latest gyrations precede a long holiday weekend. Financial markets in the U.S. will be closed on Monday for the Fourth of July.

Wall Street remains concerned about the risk of a recession as economic growth slows and the Federal Reserve aggressively hikes interest rates. The Fed is raising rates to purposely slow economic growth to help cool inflation, but could potentially go too far and bring on a recession.

Economic data over the last few weeks have shown that inflation remains hot and the economy is slowing. The latter has raised hopes on Wall Street that the Fed will eventually ease off its aggressive push to raise rates, which have been weighing on stocks, especially in pricier sectors such as technology. Analysts don’t expect much of a rally for stocks until there are solid signs that inflation is easing.

The latest economic update on Friday for the manufacturing sector showed a continued slowdown in growth in June that was sharper than economists expected. On Thursday, a report showed that a measure of inflation that is closely tracked by the Fed rose 6.3% in May from a year earlier, unchanged from its level in April.

Earlier this week, a worrisome report showed that consumer confidence slipped to its lowest level in 16 months. The government has also reported that the U.S. economy shrank at an annual rate of 1.6% in the first quarter and weak consumer spending was a key part of that contraction.

Kohl’s dived 19.6% after the department store’s potential sale fell apart amid the shaky retail environment as consumers cut spending. Kohl’s was in talks with Franchise Group, the owner of Vitamin Shop and other retail outlets, for a deal that was potentially worth about $8 billion.

Other retailers, restaurant chains and companies that rely on direct consumer spending helped lead the market rally. Amazon rose 3.2%, Home Depot gained 1.8% and Starbucks rose 3.8%.

Banks and healthcare stocks also notched gains. Wells Fargo rose 1.9% and Johnson & Johnson closed up 1.1%.

Technology stocks largely bounced back from their broad morning slump, though many still closed lower. Chipmaker Micron slid 3% after giving investors a disappointing profit forecast amid concerns about falling demand. That weighed heavily on other chipmakers. Nvidia fell 4.2% and Qualcomm lost 3.3%.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.