Morgan Stanley: Tesla stock up ‘for the wrong reasons?’

- Share via

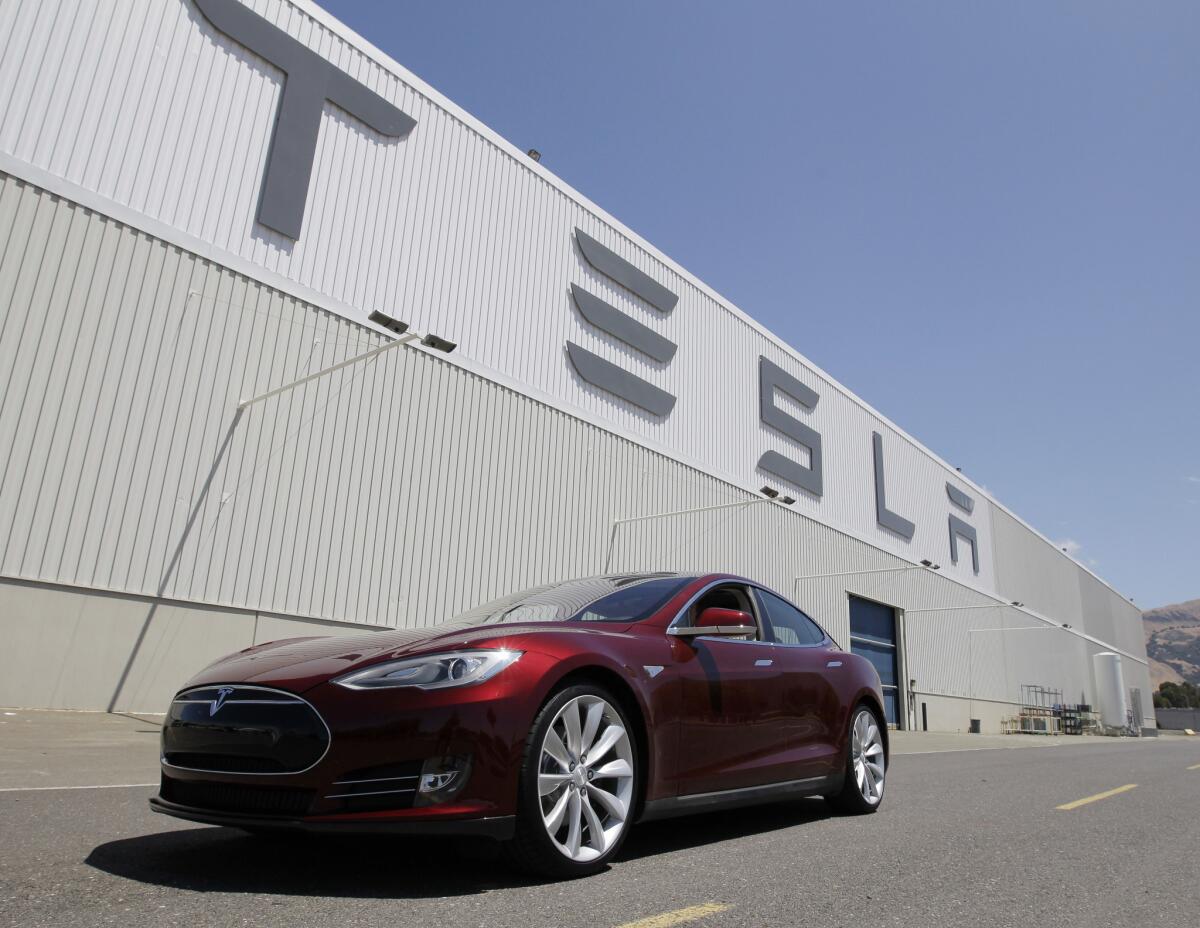

Morgan Stanley, which recently pronounced Tesla Motors Inc. “the world’s most important car company,” now wants to take a little heat out of the electric car company’s overheated stock price.

Tesla shares, which closed Friday at $279.20, rose to their highest level last week on news that the Palo Alto, Calif., firm had closed a lucrative deal to build a $5-billion lithium-ion battery plant, the so-called gigafactory, in Nevada.

Morgan Stanley recently set a target price for Tesla at $320 a share. Other analysts have suggested the stock price could go as high as $400 a share.

But now, with “sobering factors to consider,” the Wall Street firm asked early Monday whether Tesla stock was rising for the wrong reasons, and answered the question in the affirmative.

Shares dropped nearly 11% during trading and ended the day losing $25.34, or 9.1% Monday, to $253.86.

Morgan Stanley cited four factors in its analysis.

First, the company said, the move toward electric vehicles is losing energy. “EVs are failing categorically on a global scale,” the report says. “In fact, many of the world’s largest [automakers] appear to have put EV development on ice ... pushing hydrogen as the future of emission-free transport.”

Second, demand for Teslas in China, the company’s next big market, “may be severely limited by Tesla’s ability to develop the supporting dealer and service infrastructure.” The automaker’s Model S and upcoming Model X crossover vehicle will be so popular that Tesla will not be able to meet supply.

Third, Tesla may be wrong in its assurance that the new gigafactory will allow it to produce a new Model 3 mass-market sedan for half the cost of the current Model S -- $40,000 or so, compared to $70,000. “Gigafactory benefits should be expected to make the Model 3 a better product, not a cheaper product,” the report says. “We view Tesla as a niche player, not a mass manufacturer.”

Finally, with increasing competition in the electric-vehicle market and a generational shift toward car-sharing and away from personal car-buying, future consumers may not buy Teslas at all. “Assuming people even buy cars at all, what will determine Tesla’s strategic and competitive advantage?”

Tesla representatives declined to comment.

Follow me on Twitter: @misterfleming