BIG 3 IN ROUND 2 OVER U.S. BAILOUT

- Share via

LOS ANGELES AND WASHINGTON — Their first attempt was a lemon, but the Big Three U.S. automakers get a second chance this week to convince Congress that it should give them a $25-billion bailout -- or as they call it, a bridge loan to the future.

Setting the stage for what could be a crucial moment for the car companies and American industry, General Motors Corp., Ford Motor Co. and Chrysler were scheduled to provide lawmakers with detailed plans today on how they would use federal money to ensure their long-term survival and not just dodge an immediate collapse.

Later in the week, the companies’ chief executives will return to Capitol Hill, attempting to reverse disastrous performances when they first asked for help last month.

One thing is certain: All three now see the wisdom of appearing humble. They’ve forsworn the use of private jets -- which became a symbol of corporate high-handedness in Round One -- for the return trip to Washington.

Ford Chief Executive Alan Mulally plans to drive to Washington in a gas-electric hybrid vehicle. GM and Chrysler said only their CEOs would not be flying in private jets.

But skeptics still abound. And the companies’ detailed reports to Congress, just like their executives’ new travel plans, may be more about public relations than economics.

Analysts say the expected promises to renegotiate labor contracts, cut benefit costs or reduce product lines may placate some in Congress but will be hard to achieve.

Selling brands and cutting costs

So far, only a few details of the proposals have emerged, including eliminating or selling brands. GM has had its Hummer unit on the block since June, and it is now understood to be considering the sale of Saab or even Pontiac and Saturn.

Ford, meanwhile, sold Jaguar and Land Rover to Indian carmaker Tata Motors this year. And Mulally on Monday added another high-end line to the for-sale list: Volvo.

But saying a brand is for sale and actually selling it are two different things, said Robert Schulz, an auto industry analyst for Standard & Poor’s. With lending for corporate acquisitions all but frozen, there may be few takers for even a prestige marque such as Volvo.

“There’s no obvious candidate to offload these assets to,” Schulz said.

Labor costs will almost certainly be on the line.

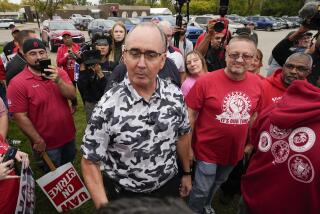

The United Auto Workers leadership appeared in Washington with the heads of Ford, GM and Chrysler last month, and industry experts say it’s likely that they will be asked to make further cost concessions.

Yet labor specialists wonder how much more the union can give. Last year, the UAW signed a landmark deal with the Big Three that will effectively allow the automakers to unload retiree healthcare costs starting in 2010.

Alan Reuther, legislative director for the UAW, said the union would discuss further givebacks, but added: “We’re not prepared to be the only ones making sacrifices.”

Savings from renegotiated UAW contracts are a huge future relief for the companies -- about a third of the frequently cited $74 hourly cost of UAW workers goes to retiree benefits.

But it also means that once those savings are realized, Detroit’s labor costs are likely to be on par with those of Asian automakers producing cars with nonunion labor in the U.S., such as Toyota Motor Corp.

Even if the UAW agreed to more cuts, the savings to the Detroit Three might be surprisingly small.

Only a few years ago, GM’s UAW payroll was well over 100,000. Today it’s barely 55,000. As a result, even an across-the-board 20% pay cut “would result in a savings of only $1.1 billion per year,” said Michigan State University professor Richard Block, a specialist in labor relations. “That’s enough to keep them going for what, two weeks?”

Plans to ensure long-term viability

Last month, saying Detroit’s Big Three had failed to make their case, House Speaker Nancy Pelosi (D-San Francisco) and Senate Majority Leader Harry Reid (D-Nev.) told the companies they would have to explain their plans for using federal money to ensure long-term viability.

“Members of Congress definitely proved their point last time that the money wasn’t going to come easy,” said Clint Currie, a Washington-based transportation analyst at Stanford Group Co. “We’ll see if they’ve paid their pound of flesh.”

GM and Chrysler have both expressed concern that they could run out of cash by early next year, whereas Ford has insisted that it does not necessarily need government aid and would take it only if there weren’t too many strings attached.

Ford’s sales are off by nearly as much as GM’s this year, but its cash position is stronger thanks to $23 billion the company borrowed in late 2006, and the fact that Ford still has an untapped credit line worth more than $10 billion.

GM, on the other hand, has been unable to borrow cash and exhausted its last line of credit this summer.

One possible cost-cutting move -- simply eliminating poor-selling brands like Buick, which is down nearly 24% this year -- may be a nonstarter because of the costs involved. Franchise contracts with dealers require the automakers to buy them out should a brand fold; the last to do so, Oldsmobile, cost GM more than $1 billion in payouts to dealers.

“The Big Three are trying earnestly to do what’s necessary to right-size, but it’s not easy,” said William Diehl, president and chief executive of BBK, a consulting firm specializing in auto industry restructuring.

Part of a turnaround plan has to focus on developing attractive products and revamping marketing to get consumers buying. But the current sales environment is dismal.

This year, U.S. vehicle sales are on pace to drop below 13 million units, compared with more than 16 million in 2007. Forecasters don’t expect sales to top 15 million before 2011 at the earliest.

Shelly Lombard, an auto analyst at debt research firm Gimme Credit, suggested that the Big Three should ask for more than the $25 billion now proposed.

“I’m not sure what they’re looking for is enough,” she said. “The last thing you want to do is come back for more, because then you’ll really get kicked in the teeth.”

--

ken.bensinger@latimes.com