The man behind the Chinese equivalent of YouTube

- Share via

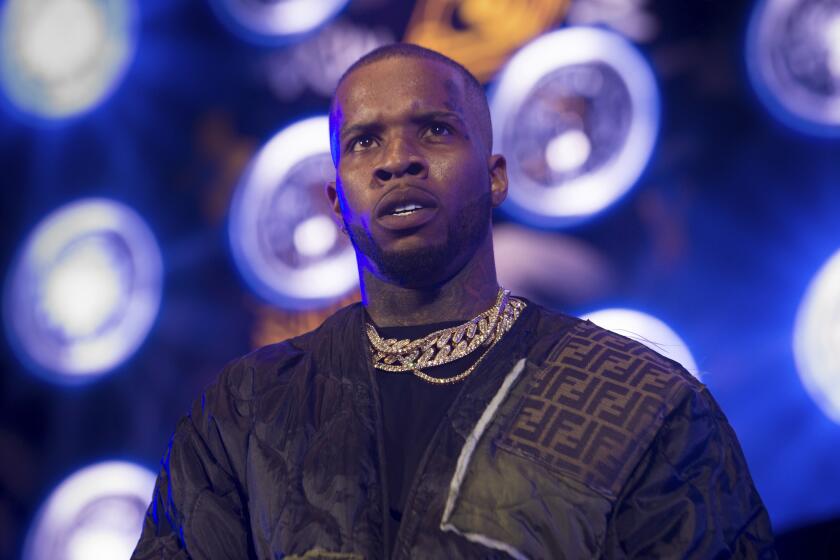

The gig: Koo, 43, founder and chief executive of Youku.com, the leading video website in China. He’s based in Beijing.

Number of unique visitors a month: 200 million.

How to pronounce Youku: Yo-koo.

Video sensation you may know: The Houston Rockets-jersey-wearing, lip-syncing duo the Back Dorm Boys first hit it big on Youku before going viral elsewhere, including YouTube.

But please don’t call it YouTube: Less than a third of Youku’s content is user-generated, setting it apart from the U.S. video-sharing mega-site. The U.S. has long had programs such as “America’s Funniest Home Videos.” But “in China, user-generated video has chiefly been around for only five years,” he said. That’s why Koo is more focused on providing licensed, original content from various stations in China’s fragmented television industry. Koo wanted them to converge on his website. “The Chinese media environment is almost upside down compared to the United States,” he said. “In the U.S., there’s like six or seven media conglomerates. In China, every city has its own TV and newspaper.”

What’s hot: By far the most popular show found on Koo’s site has been “Narrow Dwellings,” a series that irked authorities for portraying modern-day China a little too realistically. (Think mistresses and corrupt government officials.) Its episodes have garnered 115 million total views. The company is now eyeing pay-per-view video and targeting mobile phone users.

This will make you laugh: Kung Fu Bunny.

Background: Koo was born in Hong Kong and left for Australia as a teenager. He moved to the United States for undergraduate studies at UC Berkeley and earned an MBA at Stanford in 1994.

Lasting lesson: Always a high-achiever, Koo was taken aback after being denied a transfer to UC Berkeley -- three times. The school didn’t recognize Koo’s Australian university credits. So he spent a year at De Anza College in Cupertino to earn enough units to qualify. “I don’t take things for granted,” Koo said. “Things don’t come easy. You’re always going to face challenges and pressure.”

Biggest influence: Studying business at Stanford and listening to entrepreneurs and venture capitalists discuss start-ups and the future of technology. His favorite guest lecturer: Apple Inc.’s Steve Jobs. “In China, the whole idea of entrepreneurship was relatively new,” Koo said. “So this was a very important part of my thinking.”

Breaking away: While classmates took jobs at Yahoo, Netscape and Cisco, Koo headed for China to work for a venture capital firm as the nation’s economic expansion was starting to heat up.

Moving up: Koo left private equity deal-making, wanting to seize on China’s online potential. In March 1999, he was named chief financial officer of Sohu.com, a major Chinese Internet portal similar to Yahoo, with a search engine, news and games. Koo later became the company’s president and chief operating officer. He left in March 2005 to realize his lifelong dream of starting his own business. Youku was launched in June 2006 in Beijing. It became available nationwide six months later. Within a year, its viewership grew twentyfold.

Management philosophy: “People talk about empowering your team. But that has to come in stages. You have to lead by example first. Once you have that trust and relationship, you can begin to pull back and let your team take over.”

Controlled environment: Koo’s site early on ran afoul of China’s strict censorship laws. So he assigned teams of hundreds of workers to remove sexual content uploaded by users. Workers also squelched material that Beijing considered politically sensitive. Censorship is one of the reasons that Google Inc. has threatened to pull out of China. Cooperation won Youku one of the first official licenses for a video-sharing site, a decision Koo defends. “Any country has its own rules and regulations for its development,” Koo said. “When dealing with this environment, you have to be ready to work within the rules.”

Funding: Since 2006, Koo has raised $10 million in debt and $110 million in private equity funds from U.S. and Chinese investors, including Brookside Capital, Maverick Capital and Chengwei Ventures. The company posted revenue of $29.3 million last year and is eyeing a public offering in Hong Kong or the U.S. “Going from zero to IPO, that’s the goal you want to reach,” Koo said.

Reminds himself every day to: “Be open, honest and direct.”

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.