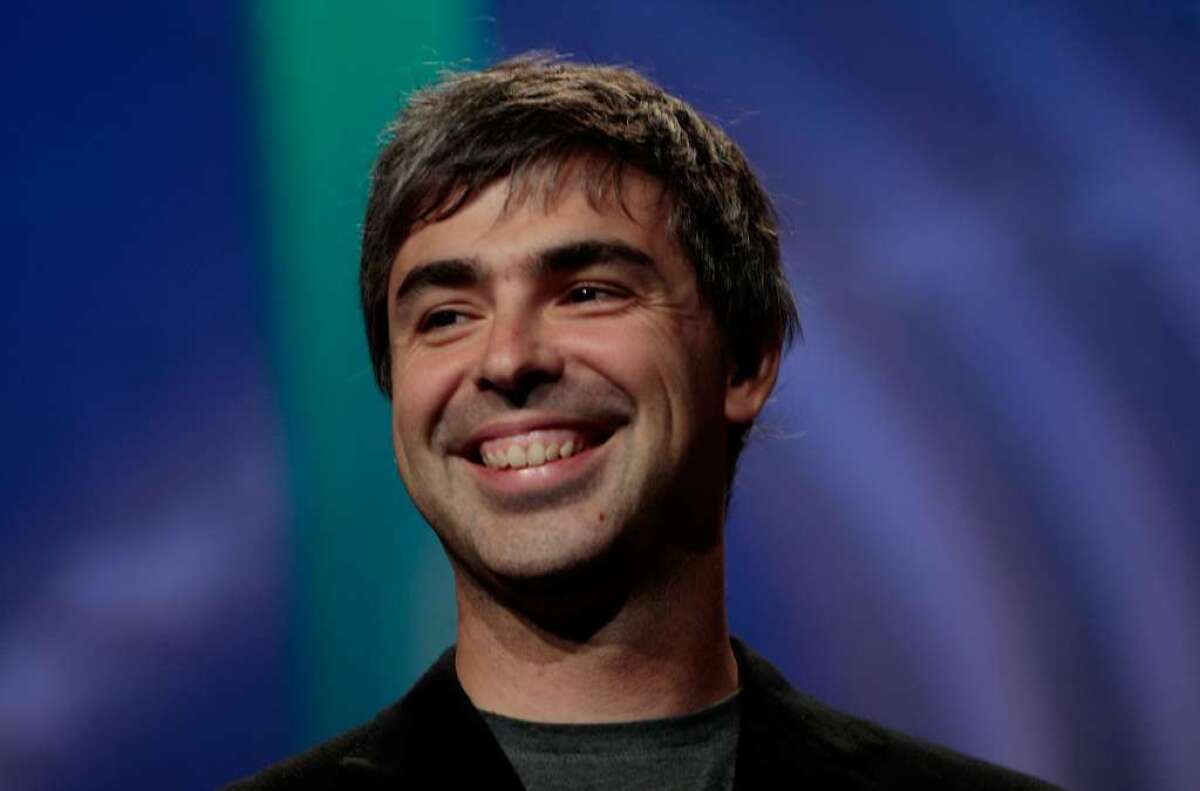

Google stock under Larry Page tops $800

- Share via

SAN FRANCISCO -- Google’s stock crossed $800 for the first time Monday -- a feat never before achieved by a technology company.

The $800 club that Google just joined is a pretty exclusive one. And though the all-time high for Google is largely symbolic, analysts are crediting Larry Page, its co-founder and chief executive, for the search giant’s dramatic resurgence since he took back the helm nearly two years ago.

Under his leadership, the undisputed king of web advertising is aggressively pushing into ambitious new areas that could generate even more opportunities to sell ads: video site YouTube and Android software that powers more than 600 million smartphones and tablet computers.

It’s experimenting with super-fast Internet in Kansas City and Google Glass, eyeglasses that are essentially a wearable computer. And the latest rumor is that it will open its own retail stores as it makes even more of its own hardware such as smartphones and tablets. (The company has already experimented with pop-up stores in airports and mini stores inside Best Buy stores).

Also key to renewing investors’ confidence: Analysts say Page has addressed many of the challenges that had weighed on Google stock such as the specter of a federal government antitrust lawsuit and the impact of the Motorola Mobility acquisition.

Google first hit $700 on Oct. 31, 2007. Its rise in good fortune coincides with the freefall of Silicon Valley rival and Wall Street darling Apple. Google’s stock has increased 20% over the last three months. Apple’s has decreased 19%.

“Apple’s losses in stock market performance, market share and overall mind share to a large extent seem to be Google’s gains,” S&P; Capital IQ analyst Scott Kessler said. “Bottom line: It seems like Google is doing a lot of things right.”

That wasn’t always the consensus on Wall Street especially during the recession. Google’s stock plunged to as low as $247.30 at the end of 2008. And some analysts say investors should still expect volatility. Google hit a 12-month low of $559.05 in June.

“Google is certainly positioning itself for new growth streams,” BGC Partners analyst Colin Gillis said. “That doesn’t mean there are not negatives. And that doesn’t mean the stock is not going to fall below $800 again.”

Topping the list of challenges: Its core business of selling ads on personal computers is slowing as people’s attention shifts to mobile devices where ads command lower prices. Google makes a fraction of the money from mobile ads that it does from online ads. Google is attempting to boost the prices that advertisers pay for ads on mobile devices by pushing them to buy mobile ads when they are creating campaigns for personal computers.

Page told analysts last month that Google this year will generate more than $8 billion in revenue from mobile ads, apps and video content. Last year Google said it was generating about $2.5 billion in annual revenue from mobile ads.

“I am not worried about this in terms of our business at all,” Page said.

ALSO:

Larry Page is fostering Google’s start-up spirit

Larry Page, back as Google CEO, shakes up top ranks

Google’s Larry Page will try to recapture original energy as CEO

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.