Editorial: The California budget’s shrinking surplus

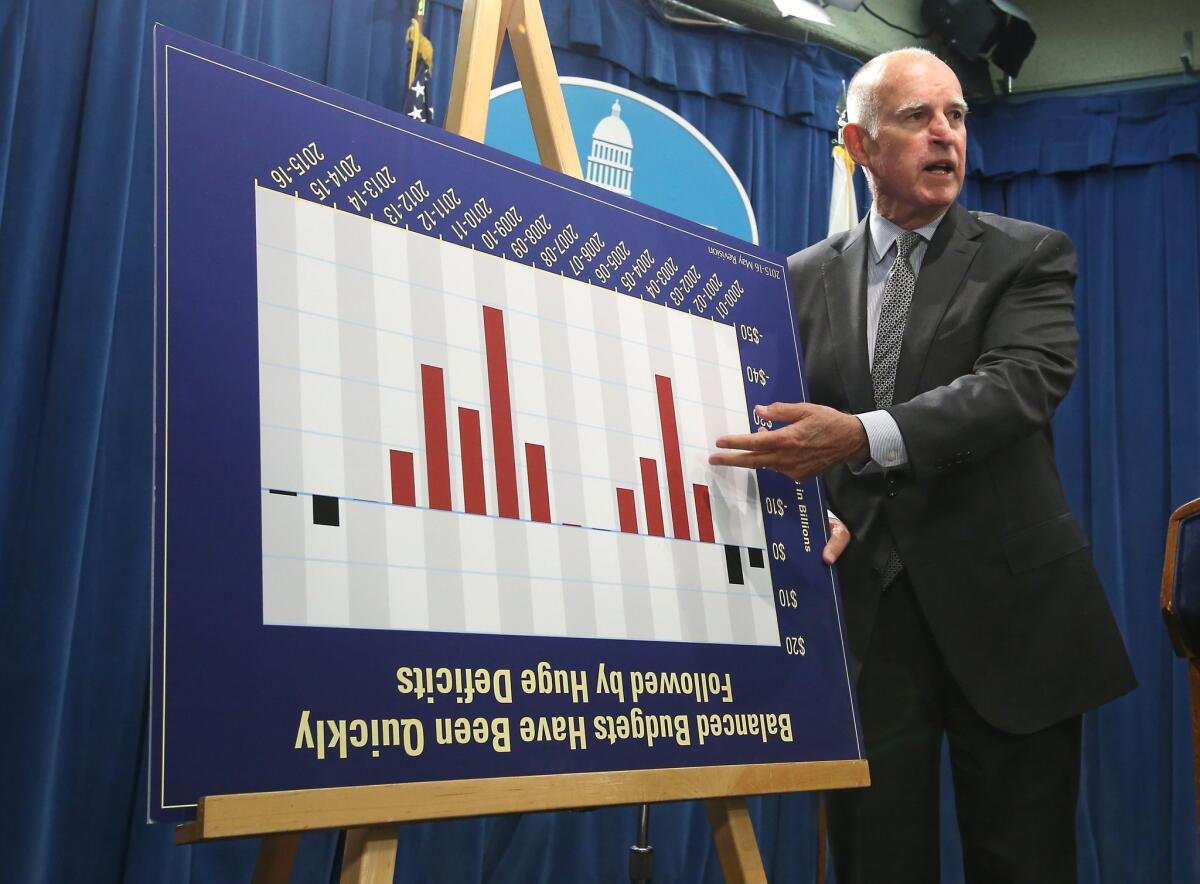

Gov. Jerry Brown jokes with reporters by turning a budget chart upside as he discusses his revised state budget plan during a news conference in Sacramento on May 14.

- Share via

Only Gov. Jerry Brown can make so much money seem like so little. His revised $169-billion budget proposal for the fiscal year that starts July 1 estimates that state revenues will be nearly $7 billion higher than he had predicted in January. Once the state sets aside the required amounts for public schools and its rainy-day fund, however, it will have enough for only a handful of initiatives, Brown argued Thursday. It’s rare to see a politician in this state with as much discipline as Brown has shown, but it’s welcome in light of the huge unfunded liabilities that Sacramento has yet to confront.

The governor’s caution is partly responsible for the seeming windfall. He has consistently relied on lower revenue estimates than other Democrats in Sacramento have sought to use, resulting in state coffers that are regularly more flush than anticipated. The continued growth of the economy has helped too, raising incomes and the personal income taxes that account for so much of the state’s general fund.

Little of the extra tax revenue is truly up for grabs, however. Most will go to schools and community colleges, thanks to the handcuffs state voters slapped on lawmakers when they passed Proposition 98 in 1988. Ordinarily, that measure would steer a bit less than half the extra money to K-14 education. But in Brown’s budget, the share is closer to 80% because the state has to repay billions it withheld from schools during previous budget crises. In other words, the budget gimmickry of years past continues to haunt Sacramento. And even with the latest repayment, the state will still owe schools $772 million.

Now subtract the money deposited automatically in the rainy day fund, and you’re left with an Incredible Shrinking Surplus. Brown has proposed to spend most of what’s left on a new tax credit for the poor, more aid for higher education and, potentially, health insurance for immigrants temporarily granted legal status by President Obama. These are all good ideas, yet they leave other glaring needs unmet, such as restoring cuts in Medi-Cal payments that have made it harder for the poor to obtain care.

Lawmakers can and should tussle over these priorities. They should also explore overhauling the state tax code to temper the wild swings in revenue caused by recessions and recoveries. But they shouldn’t see the state’s improved fiscal picture as a justification to launch expensive new projects, certainly not before the past cuts in vital programs have been restored. One of the most telling figures in Brown’s revised budget is this: Despite the enormous progress the state has made in recent years in paying down debt, it will still face nearly $214 billion in unfunded pension and retiree health liabilities. That’s the clearest warning the governor can give lawmakers about the potential budget dangers ahead.

Follow the Opinion section on Twitter @latimesopinion and Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.