U.S. Regulators Sue Janet McKinzie in Collapse of S&L; : FSLIC Accuses Her and Late Owner of Illegal Self-Dealing

- Share via

The business manager and confidante of North America Savings & Loan Assn.’s late owner has been sued by federal regulators, who charge she defrauded the Santa Ana institution of more than $21 million and caused its collapse last month.

In a suit filed late Tuesday in U.S. District Court, the Federal Savings and Loan Insurance Corp. accused Janet McKinzie and the late Duayne D. Christensen, sole owner of the failed S&L;, of illegal self-dealing, violations of federal laws and “conflicts of interest of the grossest order.”

In related developments in the increasingly complex case, a California Highway Patrol investigator said it might be possible that Christensen committed suicide when his speeding Jaguar smashed head-on into a freeway bridge support just hours before his S&L; was seized on Jan. 16. And two of Christensen’s children have indicated that they intend to contest his will, which names McKinzie as sole beneficiary.

The FSLIC suit claims that McKinzie, a paid consultant to the S&L;, in reality was the “de facto vice chairman” of North America Savings. The suit charges that she took part in falsifying information and forging $11 million worth of certificates of deposit and siphoning $19.8 million from the S&L; for her own benefit.

Credit Car Bills

The agency also claims that McKinzie and a company she owns collected more than $1.8 million in undocumented commissions and expenses and had the S&L; pay $151,481 for 27 separate trips on privately chartered Lear jets and an additional $129,193 in credit card bills.

In one transaction, the suit alleges, Christensen and McKinzie caused North America Savings to buy a 20-unit luxury condominium at Lake Tahoe for an inflated $14.7 million cash from a company in which Christensen had an interest. The condominium, which was placed on the S&L;’s books as a $17.7-million property, was not worth more than $10.2 million, FSLIC states.

The FSLIC suit also claims that McKinzie took part in a fraudulent scheme to transfer Christensen’s assets to a trust, which was created three days before his death. The trust, which names McKinzie as trustee and beneficiary, rendered Christensen insolvent, defrauded his creditors and should be dissolved, the suit claims.

FSLIC put the institution into receivership Jan. 23, a week after state regulators had seized it.

U.S. District Judge Harry L. Hupp on Wednesday ordered McKinzie not to dispose of any assets belonging to her or to Christensen, except her Newport Beach home and furnishings, said her lawyer, Jerry Graham of Sacramento.

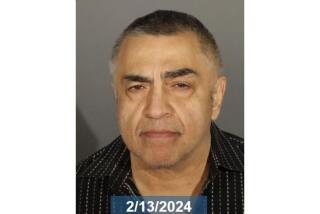

McKinzie, 37, is “quite ill” and will be hospitalized for at least another two weeks, Graham said. Because of her physical and emotional condition, Graham said, he has been unable to talk with her at length about her role at North America Savings.

But, he said, he was “flat denying” the FSLIC allegations and other claims, made previously by regulators, that McKinzie was involved in any fraudulent scheme with Christensen.

“Mrs. McKinzie is a victim every bit as much as the S&L; and the others are,” he said. McKinzie “had no idea” about Christensen’s allegedly fraudulent activities, he said.

Rescued Dogs

Graham said McKinzie has been hospitalized for the past two weeks but would not say where she is. He said a friend of hers, with the help of Newport Beach police, entered her house in the gated Newport Beach community of Belcourt on Wednesday to rescue McKinzie’s two dogs, which had been locked in her garage and were “near death.”

In addition to being sole beneficiary of Christensen’s will, signed three days before his Jan. 16 death, McKinzie also is sole owner and beneficiary of a $10-million insurance policy taken out last year on the life of the former Westminster dentist.

In documents filed with its suit Tuesday, FSLIC claims that proceeds of the policy belong to the S&L; and should not be given to McKinzie because she used S&L; funds to pay the $121,000 annual premium. Prudential Life Insurance Co. is investigating the circumstances surrounding the issuance of the policy and Christensen’s death, court documents state. A Prudential lawyer refused to comment Wednesday.

Two of Christensen’s three children indicated in a Minden, Nev., court Tuesday that they plan to contest the will. A third child, an admitted narcotics user convicted of robbery and burglary and awaiting trial on additional robbery charges, was disinherited.

Christensen, 56, was killed in a single-car crash when his 1985 luxury car ran off the Corona del Mar Freeway at 75 m.p.h. and slammed into a bridge piling in the middle of a wide median. There were no skid marks, the CHP has said.

Manner of Death

The circumstances surrounding his death have thrown some doubt on whether it was an accident or a suicide, according to the CHP.

“We have no evidence to say it’s a suicide, but we haven’t been able to determine why he left the roadway,” said CHP Officer Paul Cardwell. “We’ve been unable to find a specific mechanical defect or explain the collision any other way.”

Christensen apparently did not suffer any heart attack or any other ailment that might have impaired his driving, said Bruce Lyle, an Orange County coroner’s investigator. He said that he is awaiting the results of toxicological tests.

Lyle said his office also is checking fingerprints to make sure that the man who died was Christensen. The only identification made before Christensen’s funeral, he said, was to compare the body with a picture on Christensen’s Nevada driver’s license.

He said that the fingerprint identification was only a precaution and that he had little doubt that the dead man was Christensen. But some friends who had seen the body at the funeral had made comments that it did not look like the dentist.

Christensen maintained a Stateline, Nev., residence as his official address for income tax purposes, regulators have said. He lived in a condominium in a gated Newport Beach community.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.