Program to Make Bad Checks Good Widened by D.A.

- Share via

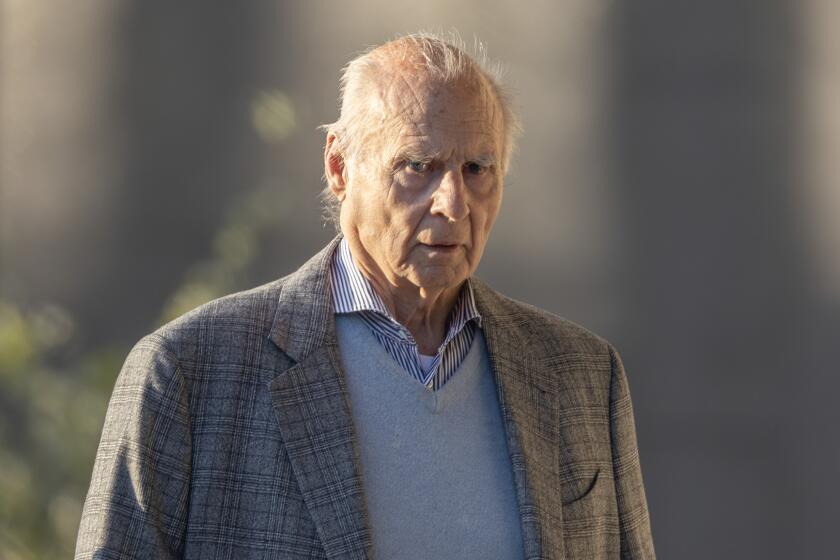

Alexander Hugh looked harried as he sat in his office, holding a bulging packet that contained nearly 500 bad checks that have been passed at his Pasadena discount food store in the last 18 months.

Last year, Hugh’s Daisy Farms Discount Food store on North Fair Oaks Avenue was stuck with $15,000 in bad checks--enough to wipe out more than a week’s worth of profits.

“We work 12 to 14 hours a day to survive,” he said. “Then these people come and break our backs.”

Bad checks have been a constant source of anger and frustration for businesses, costing California grocers an estimated $440 million a year.

$98,442 Recovered

They hope a new program introduced in the western San Gabriel Valley this week by Dist. Atty. Ira Reiner will give them a weapon to help turn the tide.

The Bad Check Enforcement Program, which has been operating for the past year in east San Gabriel Valley, has resulted in the recovery of $98,442 for the victims holding bad checks, plus another $35,832 that bad check writers have had to pay to cover the county’s administrative costs, Reiner said.

The expanded program will now cover the entire San Gabriel Valley from the San Bernardino County line west to the Pasadena Freeway, and from the foot of the San Gabriel Mountains south to Interstate 5 and the Orange County line.

Reiner said the program eventually will include the rest of the county, although no timetable has been set for the expansion.

“No longer do you have to eat these checks or settle for 50% less when you go to a collection agency,” Reiner said to a group of law enforcement and business people in Pasadena Monday at a press conference unveiling the expanded program. “We’re out to show that writing a bad check is more grief than the whole thing is worth.”

The program is based on legislation passed in 1985 that for the first time allows the district attorney’s office to initiate action against a bad check writer, Reiner said.

In the past, business people and residents had to go to small claims court, a police department or a collection agency to recover losses from bad checks.

Small Claims Route

Most business people say small claims courts are little help since most bad checks are too small to make it worth going through the time-consuming process of filing a case. Collection agencies are too costly and police departments largely ignore the problems because relatively little money is involved.

For example, Lt. Robert Montoya of the Pasadena Police Department said because of limited manpower, his department pursues a criminal case only if the check is written for more than $500.

Under the program, the victim must first complete a special form, available at law enforcement agencies and chambers of commerce, and send it to the Bad Check Enforcement Program, 210 W. Temple St., Room 16-111, Los Angeles, 90012.

Program officials will then send a letter to the person who wrote the check, telling the writer to make good on it within 10 days or face prosecution.

To be eligible for the program, checks must be for more than $25; written and passed in the San Gabriel Valley; submitted to the bank for payment twice, and turned over to the bad check program within 90 days.

Fictitious, forged and out-of-state checks that bounce must still be handled by the police.

Money-Management Classes

Under the program, the check writer must pay $25 to cover the county’s administrative costs and $40 for a four-hour, money-management class, as required by state law.

If he or she fails to respond, the county issues a second letter and begins preparing an arrest warrant.

The maximum punishment for writing a bad check is six months in jail and a $500 fine, Reiner said.

Reiner warned that under the program, bad check writers have “one chance, and only one chance” to make their checks good.

So far, about 40% of the 3,000 checks sent in since last October have been paid off, said Larry G. Mulligan, the program’s assistant administrator.

He added that in June, 100 arrest warrants were issued and 47 people were arrested in a sweep of bad check writers.

‘Carrot-and-Stick Approach’

“This is a carrot-and-stick approach,” Reiner said. “The carrot is diversion (paying off the check in exchange for dropping criminal charges), the stick is arrest.”

Janice Marugg , executive vice president of the Monrovia Chamber of Commerce, called the program an “excellent idea” that was long overdue.

“It’s not the complete answer, but in a small town like ours, it’s going to be a great help,” she said.

Stanley Cruse president of the Arcadia Chamber of Commerce, said one of the most attractive facets of the program is that its administrative costs are borne by the people who write bad checks.

For many business people like Hugh, the program’s chief benefit is that it sends a message that resources are finally being focused on the bad check problem.

But Hugh said after years of living with bad checks, he doubts a program staffed only by a handful of workers can turn the situation around.

“Now (the program and staff) are hot, but as time goes on, they will cool off,” he said. There has been a mixed reaction from business people and residents in the east San Gabriel Valley who have already seen the program in action.

Some Unabashed Boosters

Some, like the Stater Bros. chain of grocery stores, which operates 12 stores in the east San Gabriel Valley, are unabashed boosters, ecstatic over recovering an average of $3,000 a month through the program.

“It’s been great and I expect it will only get better,” said David Ramirez, the company’s check investigator.

But many small business owners and residents say the program has had little or no impact on them.

The amount of money recovered through the program is still minor compared with the millions of dollars in bad checks passed each year, and many small business owners do not know the program exists.

Tom Ruka, manager of Alfred M. Lewis Inc., a wholesale grocery in Pomona, said he had never heard of the program before.

“This is real eye-opening,” he said. “I’ll have to look into this.”

Al Correia, executive vice president of the Pomona Chamber of Commerce, added that only a few business people have picked up forms there.

“The concept is good,” Correia said. “It’s just a matter of getting the word out.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.