Jury Reportedly Opens Probe of Rose’s Taxes

- Share via

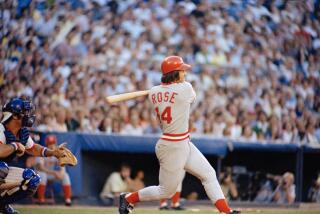

CINCINNATI — A federal grand jury today began hearing evidence in an investigation of whether Cincinnati Reds Manager Pete Rose may have evaded income taxes, the Cincinnati Post said.

A business partner of Rose, a former friend and a race track official were scheduled to testify today before the grand jury in Cincinnati, the Post said, quoting an unidentified source close to the case.

The grand jury inquiry follows an Internal Revenue Service investigation of Rose last year. The IRS probe, which began after federal officials infiltrated a gambling and drug trafficking ring involving acquaintances of Rose, reportedly focused on the possibility that the Reds manager evaded taxes involving alleged gambling winnings. Rose has said he did nothing illegal.

Federal marshals escorted Michael Fry, serving an eight-year prison sentence for drug trafficking and tax evasion, into the grand jury room today. He was the first person to testify, the Post reported.

The newspaper identified others scheduled to testify as Randy Thyberg, owner of Thyberg Sports Marketing Co., a Los Angeles firm that specializes in baseball memorabilia shows; Gerald Kramer, director of pari-mutuel betting at Turfway Park in Florence, Ky., and River Downs in Cincinnati; and Michael Bertolini, Rose’s business partner from New York.

More to Read

Go beyond the scoreboard

Get the latest on L.A.'s teams in the daily Sports Report newsletter.

You may occasionally receive promotional content from the Los Angeles Times.