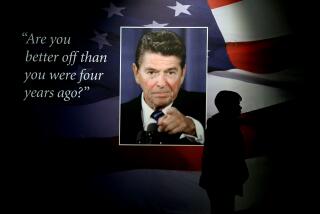

Reagan ‘Boom’ Just a Lot of Noise

- Share via

The propaganda machines continue to roll out their celebrations of the robustness and vitality of the U.S. economy. Here is another in my efforts to provide at least a partial corrective. I focus this time on a recent effusion on the New York Times Op-Ed page, a piece titled “The Reagan Boom--Greatest Ever” by Martin Anderson, former domestic adviser to the one-time actor and former President.

With all his hyperbole, Anderson sounds more like a circus barker than an economic analyst. He characterizes the “Great Expansion of the 1980s” or “Reagan’s Great Expansion” as “the greatest, consistent burst of economic activity ever seen in the U.S. In fact, it was the greatest economic expansion the world has ever seen--in any country, at any time. . . . If we look at the sheer size and immensity of it, at its scope and power, then it cannot be denied that this expansion was the greatest.”

Among several indicators of greatness, Anderson concentrates on two main achievements of the long economic expansion beginning in late 1982: the cumulative growth in employment and output that continued for seven years, until late 1989. His claims about these particular successes--to put it a little bluntly--are downright silly.

On the employment front, Anderson advertises the cumulative creation of 18.7 million new jobs as “a world record: Never before had so many jobs been created during a comparable time period.” But looking at the absolute scale of new employment makes little sense as a measure of an economy’s robustness since the volume of job generation depends substantially upon the scale of the economy. If a 1% annual increase in employment in China resulted in as many as 5 million new jobs, would we argue that its economy was growing more robustly than the U.S. economy in which a 2.6% annual increase in 1986-87 generated “only” 2.8 million new jobs? Claims of greatness should focus, in other words, on growth relative to the previous size of the economy, not the absolute volume of the growth.

And here Anderson’s claims dissolve.

Civilian employment, the aggregate upon which Anderson appears to be basing his assertions, grew by 18.9% in the seven years of expansion. By comparison, it grew by 19.7% in the seven years from late 1970 to late 1977. (Have you ever heard anyone refer to the “Great Nixon-Ford-Carter Expansion?”) And it grew by 21.1% in only four years from 1933 to 1937. Do we really want to herald the health of the U.S. economy in the middle of the Great Depression?

Or, since Anderson claims a world record, we might look elsewhere.

Civilian employment grew in the seven years from 1950 to 1957 by 20% in Japan and by 19.1% in Germany. Shouldn’t Germany and Japan be allowed at least a share of the title? Or check out this example: Employment in Germany grew by 46.7% in the five years from 1932 to 1937, 2 1/2 times more rapidly than during Anderson’s seven magical years. Wasn’t economic life fabulous as the Nazis prepared for global conquest?

The same kinds of problems apply to Anderson’s advertisements about the cumulative growth of aggregate output. He cumulates the annual levels of gross national product, or GNP, for the seven years from 1983 through 1989, totaling “some $30 trillion worth of goods and services.”

In this case he not only ignores the problem of relative (versus absolute) growth, but he also doesn’t even correct for inflation, using figures for nominal rather than real GNP. Once we correct for inflation and the scale of the economy, average real GNP during Anderson’s effervescent expansion was 18% higher than it had been in 1982. By contrast, average real GNP during the seven years from 1963 through 1969 was 21% higher than it had been in 1962. To which interval of seven years would you provisionally accord the “world record?”

How might we more sensibly assess U.S. economic performance during the 1980s?

A first guideline can help us avoid pitfalls such as overrating employment expansion during the mid-1930s. We should look at the economic record for an entire business cycle, not merely its expansion, since part of the health of the recent expansion merely reflected a rebound from the devastating recession of 1980-82 (just as the apparently impressive employment expansion from 1933 to 1937 pales considerably alongside the precipitous drop from 1929 to 1932).

By this standard, we should look at the full business cycle from 1979 to 1989 to assess the impact of conservative economic policies. Let’s look first at a comparison to our own past, concentrating on two crucial measures: the average rate of growth of real GNP and the average pace of investment.

From 1979 to 1989, real GNP grew at an annual (compound) rate of 2.6%. During the long boom from 1948 to 1966, the corresponding growth rate was 3.8%. During the cycle from 1966 to 1973, it was 3.1%. During the 1973-79 “stagflationary” cycle, it was 2.5%. So, during the much celebrated Reagan cycle, real GNP growth was as stagnant as during the previous, much reviled Ford-Carter cycle and only two-thirds as rapid as during the long postwar expansion.

The record for the pace of investment was at least as bad.

The average rate of growth of the real net productive capital stock, a measure of how much we’re expanding our productive stock of plant and equipment over time, reached 4.4% a year in the Vietnam-fueled 1966-73 cycle, dropped to 3.5% in 1973-79 and dropped again to 2.7% in the Reagan cycle. Should we rank this the best business cycle in history if its pace of accumulation averaged only 60% of the rate achieved during the postwar expansion?

Perhaps these comparisons are unfair. Perhaps the global economic climate during the 1980s inexorably condemned any individual country to relative economic torpor when compared to its own past. We might therefore compare the U.S. economy during the 1980s to the six other largest advanced capitalist economies: Japan, West Germany, France, Italy, the United Kingdom and Canada. The conservatives promised to revive productivity growth in the United States. But if we look at comparative rates of productivity growth from 1979 to 1988, the United States ranked seventh among the largest capitalist economies. Dead last.

The conservatives also promised to rev up investment to fuel our engines of growth. But if we look at the economy’s relative investment performance, comparing the share of gross domestic product going into gross non-residential investment, the U.S. economy again limps across the finish line behind all six of the others.

In short, judged on either of these two tests, the U.S. economy during the 1980s flunks decisively.

I don’t call this the “greatest economic expansion the world has ever seen.” I call it a limp and faltering economy in need of immediate rescue from the ravages of right-wing economic policies.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.