State Seizes Escrow Firm After Funds Disappear : Torrance: The owner, also missing, is being investigated for possible embezzlement. About $1.3 million held by his second firm is unaccounted for.

- Share via

A Torrance escrow company has been seized by the state and its owner is under investigation by police for possible embezzlement in connection with the apparent disappearance of $1.3 million held by the businessman’s other firm, authorities said this week.

Although authorities say no money appears to be missing from the escrow company, Reynolds Escrow Co. Inc., clients of the second firm owned by businessman Derek L. Reynolds may have losses ranging up to $400,000. That firm, Exchange Channels, was holding proceeds from real estate transactions for nine clients who planned to transfer their money into new real estate purchases.

“I’m looking at it as embezzlement, basically,” said Torrance Detective Randy Kjenstad, who is investigating the activities of Exchange Channels. “I know the funds were there. I’m trying to figure out where they went.”

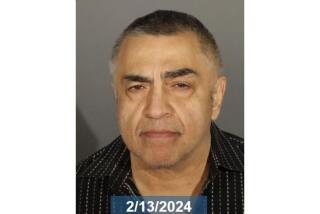

Reynolds, 57, of Manhattan Beach was the owner and founder of both Exchange Channels and Reynolds Escrow Co. Inc. Both businesses operated at 23440 Hawthorne Blvd. until earlier this month, when they were abandoned by Reynolds, authorities said.

The businessman has not been heard from since the companies were closed, authorities said.

Reynolds’ attorney, Steven Graff, could not be reached for comment. Reynolds’ wife has reportedly told Torrance police she last saw him in San Francisco on June 17.

On Monday, officials with the state Department of Corporations took control of Reynolds Escrow after determining that the firm had not been in contact with customers or the state for more than two weeks.

In an administrative order issued last week, agency officials also said they were seizing the escrow company because it did not employ a person with at least five years’ experience in escrows and did not maintain current books and records of transactions, according to DiAun Burns, the department’s special administrator for escrow laws.

Since the takeover of the company and the appointment of a conservator to oversee its closure, state officials have found no reason to believe that about $200,000 held for 40 escrows is at risk. “There doesn’t appear to be a shortage of funds,” said Dale Lucas, chief examiner for the department’s financial services division.

The funds will be transferred to another escrow company for disbursement, he said.

Although those funds are apparently safe, authorities say they do not know what happened to the $1.3 million held by Reynolds’ other company, Exchange Channels.

That business specialized in holding proceeds from income property sales until they could be transferred to another purchase to legally avoid taxes. Such transactions--known as 1031 Exchanges for a section of the Internal Revenue Service--are permissible under IRS regulations and allow companies to act as a depository for funds before they are disbursed to another real estate purchase.

But in the case of Exchange Channels, Kjenstad said, the $1.3 million held for nine clients was transferred at least twice by Reynolds after it was received by the company and deposited with a Torrance bank.

One of Reynold’s former clients, Kjenstad said, suspects that the funds were transferred from one bank to a second bank and then to an escrow account in Switzerland for investment in a diamond company. But pending receipt of bank records or other evidence, Kjenstad characterized that as “supposition.”

If the funds are not recovered in a timely manner, the nine clients of Exchange Channels face sizable federal and state taxes because their money was not transferred to the purchase of new properties, according to Peggy Collins, a Torrance real estate and tax attorney who has been contacted by some of the company’s customers.

In one case, Collins said, the income tax liability for a client of Exchange Channels is $180,000--almost the amount of the individual’s proceeds from the sale of a property.

Collins and Kjenstad added that the operation of Exchange Channels, like other so-called “accommodators” of 1031 Exchanges are not regulated by federal or state agencies. Thus, they said, clients of such companies have no avenue of recovery except the courts.

Meanwhile, Kjenstad said he will subpoena records from the second bank to pinpoint where the funds went and determine if a crime has been committed. Police will not make an effort to recover the money, he said. “We are not a collection agency.”

As for Reynolds, “at this point, unless he wants to come forward and explain what happened, I’m not looking for him,” Kjenstad said. “I’m trying to find out what happened to the money.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.