Cousin Says Rafi Khan Was Mastermind of Share Scheme : Courts: Testimony in proxy fight links betrayal and fraud to stockbroker who seeks control of ICN Pharmaceuticals.

- Share via

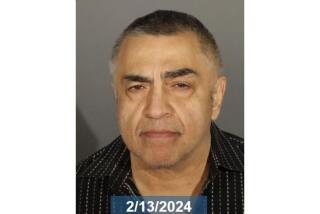

NEW YORK — In a twisted courtroom tale of family betrayal, kidnaping and financial fraud, a cousin of controversial stockbroker Rafi Mohamad Khan accused him Thursday of masterminding a scheme to buy shares illegally in British Gas PLC and then fleeing the country when the plot was unraveled.

The testimony in U.S. District Court here came during a hearing to determine whether Khan can continue his fight for control of ICN Pharmaceuticals Inc., the Costa Mesa-based drug firm headed by one-time Yugoslav Prime Minister Milan Panic. Khan owns about 1% of ICN’s stock.

The allegations by Tahir Rafiq Khan--which first surfaced last week and were reiterated in a federal court hearing--followed similarly dramatic testimony from a Scotland Yard detective.

In her testimony, Inspector Jacqueline Malton said she had sought to arrest Khan--known in England as Mohamad Rafi Khan--in connection with the failed scheme in 1987 and would arrest him today if she encountered him in London.

Khan, 43, is hoping to garner enough support among the owners of ICN’s 20.4 million outstanding shares to topple the company’s board of directors--including the 63-year-old Panic, who founded ICN in 1960 with $200 and a washing machine.

Khan’s proxy fight is expected to climax at ICN’s Dec. 15 annual meeting. If successful, Khan would replace ICN’s nine-member board of directors with himself and a six-person slate of handpicked candidates. He said he would not accept any pay as a director and would replace most upper-management officials at ICN in a purge that he thinks would turn the company around financially.

But ICN, clearly not eager to put the matter to a shareholder vote, is seeking an injunction to block Khan’s proxy battle on the grounds that he failed to tell the U.S. Securities and Exchange Commission in his so-called consent solicitation form that he is the subject of a criminal investigation.

Khan, for his part, is seeking an injunction to stop ICN from publicly impugning his integrity. He also said that the accusations by his 30-year-old first cousin, Tahir Khan, were absurd and motivated by longtime family jealousy.

The court battle is causing some analysts, brokers and investors to wonder if either side deserves to win the proxy fight.

“I’ve been in this business for 30 years,” said Eugene Melnitchenko, an analyst for Legg Mason Wood Walker in Baltimore, “and I’ve never seen anything like this.” He said he thinks Panic and ICN, however, will survive Khan’s attack.

Wall Street showed little reaction to Thursday’s courtroom drama. In trading on the New York Stock Exchange, ICN’s stock closed at $10.625 a share, down 25 cents.

Jim McCamant, who publishes the Berkeley-based Medical Technology Stock Letter, predicted that even if Khan fails, the proxy battle has soured so many people that Panic may face another challenge in the future.

He suggested that ICN’s own board members may turn against Panic, just as the board of directors at fast-food chain Carl Karcher Enterprises Inc. ousted founder Carl Karcher last month. “It’s a big soap opera,” he said of the ICN battle.

But the immediate decision-makers are the investors, analysts said, who are as frustrated and confused as the experts are.

Bob Lange, a senior vice president with Lindner Management Corp. in St. Louis, said Thursday that he has documents from both sides and plans to spend the weekend studying them.

It is not a duty he relishes.

“I know them both,” Lange said of Panic and Khan. “Whichever way we make up our minds, we are going to make a lot of enemies. I don’t like this at all.”

The proxy fight appears to be taking its toll on Khan as well.

Usually animated, he sat stoically in court Thursday as Tahir Khan testified about the failed securities scam.

Tahir Khan alleged that Rafi Khan had left him holding the bag when the share-purchasing scheme collapsed. Witnesses supporting Rafi Khan are expected to testify on his behalf beginning today.

Rafi Khan would not comment Thursday except to say, “Wait until you see my passport.” In an earlier interview with The Times, Khan showed stamps on his British passport that suggested he was not in England during key periods described by Tahir Khan.

Khan’s attorney, Robert J. Hasday, expects to offer proof that Tahir Khan and three others--none of whom were his clients--participated in the scheme and that Khan is being framed by both Tahir and ICN.

Thursday’s hearing began with testimony from Malton, an inspector with Scotland Yard’s Serious Fraud Squad who was in charge of investigating illegal share purchases in the 1986 privatization of British Gas.

The British government was selling the company, and all British citizens had the right to submit one application for up to 5,000 shares.

But some unscrupulous investors sought to acquire far more shares by filing multiple applications under false names. Malton testified that she received evidence about one such ring, dubbed the Khan Ring, that allegedly filed 166 applications.

In testimony that bolstered Tahir’s account, Malton said that in February, 1987, police raided Khan’s London residence.

Though Khan was not there, Malton and other detectives searched the premises, seized documents and brought Tahir Khan to police headquarters for questioning, she testified.

Malton said that she had received information that an M.R. Khan lived at the house, and that his signature was on some of the checks accompanying the applications.

If Rafi Khan had been there at the time, “I would have arrested him,” Malton testified. When asked what she would do if she encountered him in London today, she answered without hesitation: “I would arrest him.”

Tahir Khan then took the stand, recounting how he had grown up with Rafi Khan’s parents and how he worked for Rafi Khan’s restaurant and travel agency in London.

In October, 1986, Tahir Khan testified, he picked Rafi Khan up at the airport in London. It was then that Rafi Khan told him he had amassed about $1.4 million in British pounds and wanted to buy shares in British Gas.

Tahir Khan testified that he helped out with the British Gas purchases, filling out false applications that carried the addresses of seven or eight properties that Rafi Khan and his family owned in London.

Within weeks, they began to receive letters from Touche Ross PLC, the accounting firm handling the sales, indicating that accountants had discovered the multiple applications.

Rafi Khan “was absolutely devastated at the time,” Tahir Khan said. “The scheme had completely collapsed.”

Later, Tahir Khan testified, Rafi Khan was kidnaped and beaten by an associate, Peter John McGill, who was also part of the scheme and to whom Rafi Khan owed money.

When Rafi Khan saw that the scheme was collapsing, he left the country in December, 1986, Tahir testified.

Tahir Khan was eventually arrested. He pleaded guilty to the fraud and was fined about $20,000.

Tahir Khan said he had not seen his cousin since the late 1980s.

McGill is scheduled to testify today. In an affidavit signed last week, McGill defends Rafi Khan, saying Khan had nothing to do with the scheme. The plot involved four people, McGill states, none of whom were Rafi Khan.

Tahir Khan testified Thursday that he learned about the ICN proxy battle two weeks ago, when his employer pointed out a full-page advertisement in the Wall Street Journal.

The ICN advertisement, which cost the company $113,000, heavily criticized Khan and carried this headline: “Don’t be Conned by Khan.”

ICN also placed a full-page advertisement in the Los Angeles Times.

Tahir Khan denied that he is angry with his older cousin but acknowledged that lingering bad feelings over the British Gas events were part of the reason he contacted ICN’s attorneys.

ICN attorneys flew him to New York from Milwaukee, where he now lives, and are serving as his counsel.

Rafi Khan’s lawyers noted that ICN has hired a bodyguard for Tahir Khan and has paid for Tahir’s wife to move out of their house and into a hotel.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.