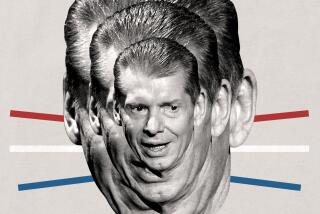

McNall Actively Seeks Plea Bargain : Jurisprudence: Former King owner faces possible federal indictment if agreement is not reached.

- Share via

Bruce McNall, former sole owner of the Kings, is actively negotiating a plea agreement to resolve a criminal investigation into his banking practices and is likely to reach a deal with federal prosecutors this week.

If he fails to reach an agreement, McNall is likely to be indicted on counts in connection with fraudulent loans that total at least $100 million, sources have told The Times.

The U.S. Attorney’s office has imposed a Friday deadline for the Kings’ president to decide. If McNall strikes a deal, he is expected to enter a plea in U.S. District Court in mid-September. It is unclear how any of this will affect McNall’s role with the Kings.

Although previous deadlines for a deal have been extended, sources said Friday’s deadline appears firm.

The latest action is another indication of how far McNall’s financial empire has fallen since 1993, when he was regarded as one of the nation’s most successful sports entrepreneurs as the Kings’ popularity skyrocketed.

McNall, who sold most of his interest in the Kings in May, has interests in ancient coins, race horses, sports memorabilia and movies, among other enterprises.

Although a final decision has not been made, McNall is leaning toward resolving the matter before a federal indictment is issued. Negotiations are focusing on how much prison time McNall would serve, sources said Monday.

If McNall decides not to plead, indictments would likely be brought against him within two or three months.

Sources said part of McNall’s agreement would include cooperation in testifying against many of the lenders with whom he was involved. They are targeted in a secondary investigation, focusing on lenders who loaned money to McNall, using falsified net-worth statements and secured by items such as coins that were considered of dubious value.

McNall’s criminal defense attorney, Tom Pollack, declined comment on the negotiations.

But those familiar with the investigation said McNall is one of about 12 business associates who are negotiating pleas with federal prosecutors.

One of those surfaced last week when Joanna Orehek, former vice-president and controller of McNall’s chief holding company, McNall Sports and Entertainment, Inc., was charged with helping unidentified conspirators fraudulently obtain more than $100 million in loans from three lenders.

Orehek, 46, appeared before U.S. Magistrate Judge Charles Eick on Monday to hear the charges against her. She is expected to enter a plea Aug. 23 during an arraignment before U.S. District Judge Richard Paez.

“We expect other charges,” U.S. Attorney Peter Spivak said. “She is merely the first.”

Orehek and unidentified conspirators are charged in part with creating false tax returns and financial statements overstating McNall’s net worth to persuade banks to make loans.

According to a 15-page criminal information complaint, at least three of the companies in McNall’s empire are “shams,” created to conduct fraudulent loan transactions. Prosecutors allege the companies performed no legitimate services and had no legitimate assets.

The complaint said Bank of America fell victim to the largest fraud when it lent $80 million to McNall’s company and another $20 million to McNall personally during a four-year period that began in 1990.

In 1992, Orehek and others told bank officials that collateral for the personal loan, $15 million in rare U.S. coins, had been traded for a collection of sports memorabilia. The complaint alleges there was no coin collection or sports memorabilia.

But Orehek bought about one million trading cards that were nearly worthless, and told the bank they were worth millions, the complaint said.

Later, she obtained trading cards on consignment from national dealers and told the bank McNall’s company owned them. When dealers demanded those cards back, Orehek allegedly bought replicas and attempted to age them. She allegedly said they were worth $300,000 when they only cost about $200.

Those familiar with the investigations into McNall’s business dealings said Orehek did not have a major role within the organization. She was primarily a bookkeeper.

Orehek apparently is cooperating with federal authorities in hopes of gaining a reduced sentence.

“Everyone played a role in this activity (and) she has to take responsibility for what she did,” said William Greysen, a Century City criminal defense attorney representing Orehek.

“If McNall gets off scot-free, it would be quite unfair. McNall went to Joanna, and said, ‘You’re my friend, you’re like family. I’m in trouble. I need help. Everything will work out, no one will get hurt.’

“She knows right from wrong. She made the judgment to help her boss knowing it was wrong.”

Greysen said Orehek, who has a 2 1/2-year-old son, is working as a waitress at a coffee shop.

Spivak said Orehek, who left McNall’s employ in April, is free on $10,000 bond. She faces up to 10 years in prison if she pleads guilty.

But the prime focus of federal investigators has been on McNall, whose financial condition has deteriorated in the last year.

He was sole owner of the Kings until May, when he sold 72% of the franchise for $60 million as part of a plan to pay off a $92-million business loan made by Bank of America. The team is currently controlled by telecommunications executive Jeffrey P. Sudikoff and entertainment executive Joseph M. Cohen.

Shortly after selling his interest in the Kings, McNall was forced into bankruptcy proceedings.

How much McNall owes is in dispute. Public records and interviews with his creditors place the amount at about $200 million. McNall is known to dispute at least half that.

McNall is said to be trying to put together a plan to repay creditors.

More to Read

Go beyond the scoreboard

Get the latest on L.A.'s teams in the daily Sports Report newsletter.

You may occasionally receive promotional content from the Los Angeles Times.