Investor Accused of Stealing From Athletes

- Share via

SAN DIEGO — A financial advisor to professional athletes was charged Thursday with 38 felony counts of grand theft and forgery for allegedly stealing more than $9 million from 24 athletes and others over a 3 1/2-year period in which he allegedly maintained a lavish lifestyle.

“We want to see the money,” said Dist. Atty. Paul Pfingst, “because we would like to get restitution for the victims.”

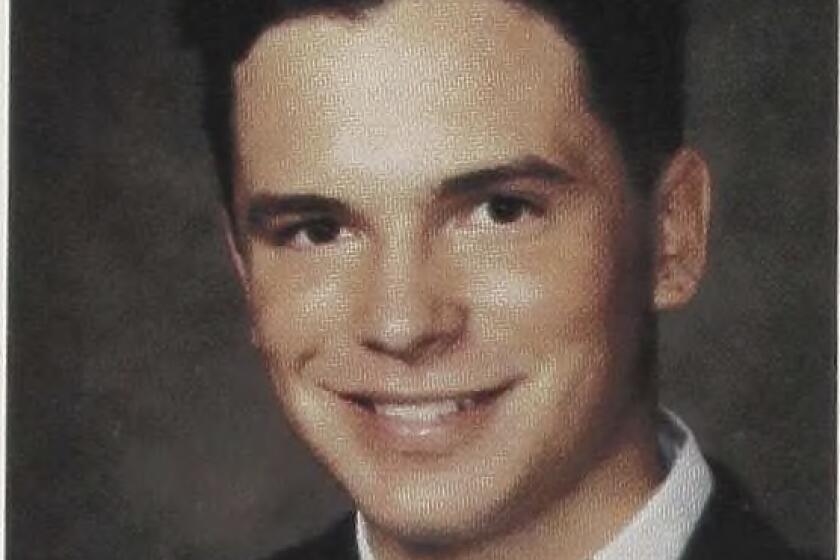

John Walter Gillette Jr., owner of Pro Sports Management Investment Co., has been under investigation since July and may face additional charges as the result of a federal probe. His investment company has been closed and forced into involuntary bankruptcy.

The scheme began to unravel, according to prosecutors, after former San Diego Padres pitcher Greg Harris and six-time Ironman triathlon champion Mark Allen filed a civil lawsuit against Gillette in June.

According to Pfingst, Gillette’s victims include San Diego Chargers All-Pro linebacker Junior Seau, who lost $1.25 million, Dallas Cowboys All-Pro defensive back Darren Woodson, who lost $2.5 million, and Tony Boselli, a first round draft pick for the Jacksonville Jaguars, who lost $250,000. Seau is partners with Gillette in Seau’s The Restaurant in San Diego.

Other alleged victims include Washington Redskins safety Stanley Richard, who lost $1.25 million, Jacksonville backup quarterback Rob Johnson, who lost $150,000, New Orleans Saints safety Je’Rod Cherry and Detroit Lions receiver Johnnie Morton, who each lost $100,000, and Mark Kotsay, a former outfielder with the Florida Marlins now playing in Class AA ball, who lost $350,000.

Minor league baseball players collectively lost $950,000 while non-athletes lost more than $1.4 million, the indictment said.

“We are following the money trail, and we will continue to follow the money trail in an effort to recover as much money as we can,” Pfingst said. He conceded that it is unlikely all of the money will be recovered.

Pfingst told reporters it was not a classic Ponzi scheme in which later investors’ money was used to repay early investors’ money. The lost money involved a number of different investors with a number of different investment vehicles, Pfingst said.

Investors were told their money was in various real estate holdings, including construction of a water theme park in Poway, Calif., and a nonexistent San Diego municipal bond, investigators said.

A large portion of the money has not been accounted for, but Pfingst said some of it was lost in bad investments and some was spent by Gillette on an “elegant, enviable lifestyle.”

“We’re claiming this money was stolen, plain and simple,” Pfingst said.

San Francisco 49ers receiver J.J. Stokes was named in the forgery charge against Gillette, but no financial loss was listed.

Gillette pleaded not guilty at a Municipal Court arraignment. The one-time stockbroker for Shearson Lehman Bros. does not deny responsibility and wants to reimburse his clients, according to his attorney, Jerry Coughlin, one of the city’s top defense attorneys whose clients have included an ex-judge convicted of bribery.

Gillette, looking downcast and remaining silent, was taken into custody in handcuffs. Bail was set at $250,000. He has been cooperating with state and federal investigators, prosecutors said.

“I’ve never seen anyone more willing to come forward and cooperate,” Coughlin told Municipal Court Judge Leo Valentine Jr. in an effort to get a lower bail. “He knows this is a state prison case. If he were going to flee, he would have long ago.”

A conviction on all of the charges could carry a maximum prison sentence of 17 years, prosecutors said.

Coughlin doubts that the case will go to trial. He challenged Pfingst’s description of his client’s lifestyle, saying it was more middle class. Gillette lives in a five-bedroom house in the gated Sings Hills Country Club in El Cajon and drives a late-model Mercedes.

Attorneys for Seau are setting aside Gillette’s share of profits from the restaurant in an attempt to recoup some of the losses. Coughlin said the restaurant is doing well financially, earning a profit of about $1 million annually.

“This is one of the most tragic situations I’ve seen in terms of getting in over his head and not catching up,” Coughlin said.

The Associated Press contributed to this story.

More to Read

Go beyond the scoreboard

Get the latest on L.A.'s teams in the daily Sports Report newsletter.

You may occasionally receive promotional content from the Los Angeles Times.