Independent Video Label Exploits Niche

- Share via

At a time when the casualty rate among independent video labels is high, Tanya York is coming off a record year as president and CEO of 6-year-old York Entertainment.

That York, which releases only low-budget, direct-to-video titles with names like “Beverly Hills Bordello” and “Convict 762,” has found a revenue shoal while some indies are drowning in red ink is a lesson in thrift and specialization.

“We’re very small and we watch every penny that we spend on overhead and acquisitions,” says York, her high-pitched voice a hybrid of her Jamaican-English ancestry. “The market is very difficult out there, but we’re small enough and flexible enough to do what makes sense.”

The 29-year-old single mother says her Encino-based company’s revenue quadrupled last year to about $8 million.

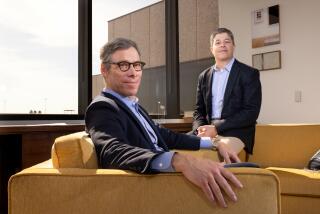

Driving the firm’s revenue gain is a deal York inked a year ago to jointly acquire and release films with Florida-based Maverick Entertainment. Maverick President Doug Schwab, a former video buyer for Blockbuster, has helped “focus the attention of the company,” York says.

“Before I teamed with Doug, we were in production, television, video,” she says. “Now, all our energies are focused on the video market.”

Schwab, 34, who began his career 19 years ago as a video store clerk, formed Maverick after Blockbuster moved its corporate headquarters from Fort Lauderdale to Dallas in 1997.

“Other companies develop lots of overhead,” he says. “The big independent companies during the glory days of video would overpay for movies because the video business wasn’t as hard as it is now. And they’re still in that cycle of overpaying for movies. That’s a bigger nut to meet each month. We do everything on a shoestring budget.”

In addition to holding down costs, Schwab cites a number of factors for York’s escalating revenue, among them forgoing worldwide rights on titles and producing high-quality video sleeve art. “We spend five hours a day on box art,” Schwab says.

According to Bob Tollini, senior vice president at distributor Major Video Concepts, video box art is the key to selling these secondary products. “With ‘B’ product, people rent sleeves, not movies,” Tollini says. “And dealers know what sleeves will rent, even though they can’t explain it. York’s sleeves are consumer attractive--they have great artwork.”

York also limits its acquisitions, which are typically budgeted between $1 million and $5 million, to four genres: sci-fi, urban-action, horror and erotic thrillers.

“ ‘B’ titles are very driven by the major theatrical market,” Schwab says. “We ride the trends, which right now are horror, action and sci-fi.”

Rental demand is so strong for urban-action and horror titles that York, which typically acquires the video rights to films at forums like the Cannes International Film Festival, has begun financing productions in both genres. The label plans to develop six low-budget urban-action films in the next year, beginning with “Blade Sisters,” about three sword-wielding sirens who battle a vampire in South-Central Los Angeles.

In a market groaning with products, video industry analyst Tom Adams says specialization is essential to the survival of independent companies.

“At a time when many independents are bemoaning the impossibility of the business, York has found a niche opportunity,” Adams says. “In any market that’s reasonably healthy, there’s always niches to be exploited by agile companies who can avoid getting trampled by the elephants.”

York’s revenue has grown along with the number of titles it releases, most of which premiere on cable channels such as Showtime and HBO before coming to home video. York had 10 releases in 1996, 26 in 1998 and plans to roll out 40 titles this year. “That would be the maximum we would ever release,” York says.

York has been helped by its solid relationships with two of the biggest video retail chains, Blockbuster and Hollywood Entertainment.

York, which typically sells 10,000 to 15,000 rental units per title at an average wholesale price of $46 per unit, signed a deal with Hollywood in August in which the company agreed to bring in every title York releases in the next year. Not coincidentally, York sold a record 28,000 units on its September release of the futuristic thriller “Spoiler,” and hit a new high-water mark this January with “The Shadow Men,” which shipped 50,000 units.

Hollywood Chairman Mark Wattles said that such deals “are not common with indies, but if they have a track record, then we’re interested in giving them shelf space.”

Many chains have grown reluctant to carry low-budget “B” videos because of the advent of programs that give them discounts and free tapes for bulk buys from the major studios.

“But once they see the revenues,” York says, “their confidence level increases.”

Schwab said Blockbuster brings in about half of York’s products on a “title-by-title basis.”

York, with its 12 employees, has ambitious growth plans for the coming year. It will expand its newly created sell-through arm and continue to sell videos directly to consumers from its more than 160-title library. York will also enter the DVD market in June with two titles, “Spoiler” and “Convict 762.” And it will continue to acquire exclusive distribution rights of smaller video lines, such as its November deal with Aurora Home Video.

“The market is tough,” Schwab concedes, “but instead of focusing on a fictitious Armageddon, we are focusing on what we can do best--and that is, bring alternative movies to the marketplace.”

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.