Tenet Continuing Its Resurgence

- Share via

Continuing its rise as one of the most powerful players in the health-care industry, hospital operator Tenet Healthcare Corp. on Friday reported its strongest quarterly operating earnings growth ever in the period ended Nov. 30 and boosted its fiscal 2002 profit outlook.

Tenet’s resurgence, after a shaky period in the 1990s, illustrates how some hospital operators have succeeded in pushing through major price increases, restoring a once-beleaguered business to profitability while fueling a new round of double-digit growth in overall health-care costs for insurers and consumers.

Tenet said Friday that its fiscal second-quarter operating profit rose 47% because of increased patient load and higher prices. Profit from operations rose to $258 million, or 77 cents a share, from net income of $175 million, or 54 cents, a year earlier, the company said. Revenue increased 16% to $3.39 billion.

The Santa Barbara-based company also said it anticipates fiscal 2002 operating earnings per share of at least $3.10, a 35% gain over 2001.

The news sent shares prices up $2 to close at $62 on the New York Stock Exchange, topping a calendar year in which shares rose 32%, beating Standard & Poor’s super-composite health-care index. Tenet, the nation’s second-largest for-profit hospital chain, has seen its shares climb 35% since the start of 2001. During the same period, shares for the nation’s largest chain, Nashville-based HCA Inc., fell 13.3%.

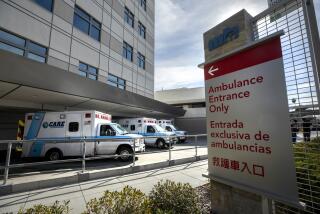

Tenet runs 116 hospitals in 17 states, including 33 in Southern California, making it the largest private hospital operator in the region with more than 7,000 beds and about 26,000 employees.

Its tough-minded and analytical approach to business represents the changes that are upending the nation’s health-care system. For one, it is a symbol of a nationwide backlash by hospital and physician groups against low fixed payments for services from the managed-care industry. That also means it has helped fuel the double-digit growth in health-care costs for employers, which are increasingly inclined to pass on those increases to employees.

“What’s happened has been a banding together of hospital groups and doctor’s groups, partly in response to past consolidations in the managed-care industry,” said Albert Lowey-Ball, who heads ALBA, a Sacramento-based management consulting firm specializing in the managed health-care sector. “The result is that the market pressures to keep premiums and costs low has been lessened.”

But Lowey-Ball points out that although hospital and physician groups may be the winners here, consumers are not. “This increasing concentration of power on both sides of the market, between the health plans and the health providers, greatly weakens the position of smaller [businesses] and individual consumers.”

Peter Boland, an author and independent consultant who is president of Boland Healthcare in Berkeley, said Tenet and some other hospital groups have in recent years acquired the technical equipment and expertise to track their costs more closely.

“Five years ago, those care providers signed contracts with insurers and hoped they didn’t lose their shirts. Now they can track the impact of those contracts department by department, right down to individual patients, and they realize that they have been subsidizing the managed-care companies.”

That’s why several hospital groups and some physician groups have been shedding low-paying HMOs and have been refusing so-called capitated, or fixed, payments per patient.

“We are out of the capitation business. We don’t do them anymore. Those payments in the 1990s were supposed to be the wave of the future, but they proved to be a dismal failure that bankrupted some groups,” said Harry Anderson, Tenet’s vice president for corporate communications. “We still have contracts with most major HMOs, but we now get paid a negotiated rate for all medical services provided.”

Tenet also has become more aggressive, acquiring six hospitals in 2001, including Daniel Freeman Memorial in Inglewood, Daniel Freeman Marina in Marina del Rey and other facilities in Atlanta, St. Louis and Palm Beach, Fla.

It also is shedding several hospitals, including St. Luke Medical Center in Pasadena, which are either old, under-performing or in areas where Tenet lacks market-share strength. Tenet said Thursday that it will close St. Luke in April.

“Our strategy is either to be No. 1 in the market or a strong No. 2,” Anderson said, adding that market share is what gives the company leverage in contract negotiations.

Much of the credit for these strategies goes to Tenet Chief Executive Jeffrey C. Barbakow, former managing director of Merrill Lynch Capital Markets in Los Angeles, who was brought in to oversee in the early 1990s the settlement of the last major federal probe of a hospital company, National Medical Enterprises, which was subsequently renamed Tenet.

Tenet officials said they also are expanding current facilities, building several more emergency rooms and planning a 10-story building for the USC teaching hospital.

Tenet also has increased spending on cardiology, orthopedics and neurology.

“Tenet has moved very aggressively in a band that runs across Southern California, Texas, Louisiana and South Florida, where there is a lot of population growth and aging baby boomers,” said Charles Lynch, an analyst with CIBC World Markets. “That’s the driver of their volume growth and their continued move from sub-acute to more expensive acute care, to serve a swath of the American population that is still very [physically] active, but finding it more painful to maintain that activity.

“It’s both a push and pull. They are driving volume into their hospitals with better doctors, services and facilities, and they are in markets where there are more people who will use that health care,” Lynch added.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.