Battered Drug Stocks Still Reeling From Study

- Share via

American and European investors showed their concerns Wednesday about hormone replacement therapy, again fleeing stocks such as Wyeth Inc., Schering, Galen Holdings and other companies with HRT products on the market.

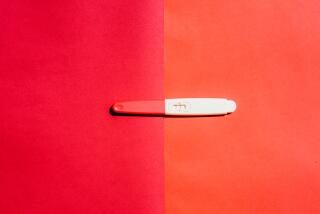

A clinical trial of the effects of hormone replacement therapy for women after menopause was halted because of slightly increased risks of dangerous side effects. The news, released Tuesday by the Journal of the American Medical Assn., was another blow to a pharmaceutical industry that is reeling from a series of regulatory setbacks and mounting political pressure to control drug prices.

But the big question now for drug companies is what women should do in the wake of the most exhaustive study ever on hormone therapy combining estrogen and progestin. The 5-year-old, 16,608-woman study conducted by the National Institutes of Health found that healthy women who take Wyeth’s hormone replacement drug Prempro in the long term faced a significant increase in risk for breast cancer, heart disease, blood clots and strokes. The NIH is continuing a clinical study of estrogen-only therapy.

Hormone replacement therapy is used by an estimated 38% of post-menopausal women to treat symptoms such as hot flashes, night sweats, mood swings and vaginal dryness. The study, part of the government-funded Women’s Health Initiative, is viewed as a setback to the prospect of using HRT as a disease prevention strategy.

Financial analysts on both continents were making favorable comments about the HRT industry, saying that Prempro, which is an orally delivered combination of estrogen and progestin, is a dated delivery system, and that the negative clinical trial does not necessarily discredit hormone replacement therapy.

Richard R. Stover, an analyst for Arnhold & Bleichroeder, said there are more modern synthetic hormones on the market and better delivery systems, such as dermal patches that may not have the same health risks.

Added Bear Stearns analyst Joseph Riccardo, “I don’t see this affecting the industry as a whole. That was a study that suggested one product with a problem.”

Wyeth’s European competitors were quick to distance their estrogen replacement therapies. Guenter Stock, head of research and development for Germany-based Schering, said his company’s products are based on a different class of estrogens and progestins.

A Wyeth spokesman said the company was not planning to change its oral formulations or move to a dermal patch system.

Dr. Howard Judd, a principal investigator of the study and vice chairman of the department of obstetrics and gynecology at UCLA, said he believed a transdermal patch delivery system for hormones could negate the risks of stroke, blood clots and even heart attacks because patches better mimic a woman’s natural delivery of estrogen through the bloodstream.

But Judd also delivered three major caveats that women should consider before making a decision to try HRT patches.

First, Judd acknowledged that his belief in the efficacy of patches is a minority position among researchers and clinicians. He also added that he suspected that there would be no diminution in the risk for breast cancer, regardless of the hormone or the delivery system used. Finally, he said the study had set a new standard for long-term research and that nothing short of the same rigorous standards would prove that other forms of HRT therapy were safer.

The results of such studies would be years away, if they ever occur, Judd said, leaving other companies to tout their estrogen replacement therapies without evidence to the contrary.

The impact on Wyeth, which sold $2.2 billion in HRT products in the 12 months ended March 31, could be severe, amounting to possible sales losses in the hundreds of millions of dollars. But analysts said the blow is survivable, pointing out that Wyeth has a store of other products and promising new drugs in the approval pipeline.

Wyeth shares finished down 4.2%, off $1.55 to $35.75 on the New York Stock Exchange, after a 24% plunge Tuesday. Galen, Northern Ireland’s largest drug maker, fell 7% in Irish trading. Schering was down 7.2% in German trading.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.