Unlikely Pair at Center of Tempest

- Share via

Bernard J. Ebbers was an unlikely pioneer in the cutting-edge world of telecommunications. Though he transformed WorldCom Inc. from an idea on a coffee-shop napkin into the second-largest long-distance company in the country, Ebbers himself is known to shun cell phones, pagers and even e-mail.

Still, the folksy former-basketball-coach-turned-chief-executive managed to build a formidable company through an inspired series of more than 70 mergers and acquisitions that propelled WorldCom’s stock price into the stratosphere. The financial mind behind the deal making was Ebbers’ right-hand man, Chief Financial Officer Scott D. Sullivan.

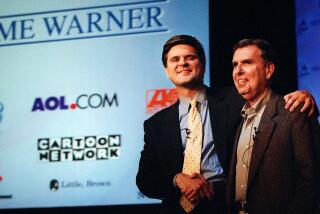

Ebbers and Sullivan were an odd couple--the laid-back Ebbers in cowboy boots and faded jeans, Sullivan an accounting whiz kid 20 years his junior. Yet together they made such frequent visits from WorldCom’s headquarters in modest Clinton, Miss., to the bankers and analysts of Wall Street that their presentations were dubbed “The Scott and Bernie Show.” Each time, they won over crowds with slide presentations showing WorldCom’s ever-rising stock.

Those gains have been wiped out by concerns about WorldCom’s ability to service the nearly $30 billion in debt that piled up during the spectacular buying spree, sinking demand for its phone and data network services and the meltdown of the telecom industry.

But the close partnership between Ebbers and Sullivan is generating new interest in the wake of WorldCom’s revelation this week that the company inflated its books by $3.9 billion over the course of 15 months, turning losses into profit and masking the dire financial health of what was once one of the nation’s most admired companies.

The two men occupied adjoining offices and held the center of power at WorldCom. And now both have left the company in disgrace.

Ebbers resigned as CEO in April amid concerns about WorldCom’s accounting practices and future prospects. Sullivan was fired by WorldCom’s board of directors this week after the accounting shenanigans came to light.

With few details emerging from the company and the two men shielding themselves from public questioning, it is impossible at this stage to gauge their motives for classifying some of the company’s routine expenses as capital expenditures. It also is unclear whether Ebbers was aware of the methods, though many Wall Street observers believe he must have been.

Growing up in Edmonton near Canada’s Rocky Mountains, Ebbers, now 60, showed few signs of becoming an icon of the accounting scandals that have undermined investors’ confidence in corporate financial information and sent the stock market into a tailspin.

Upon graduation from high school, the 6-foot-4-inch Ebbers took a job delivering milk door to door, sometimes in temperatures that reached 30 degrees below zero. As a refuge, he accepted a basketball scholarship to Mississippi College, a small Southern Baptist school in Clinton. He graduated in 1967 and became a high school PE teacher and basketball coach.

Ebbers gradually became interested in business. He managed a garment warehouse, then purchased a motel and expanded it to nine outlets. In 1983, he and a group of investors realized that the breakup of phone monopoly AT&T; Corp. offered an opportunity for start-ups to compete in the market for long-distance phone service. They sketched their plan for LDDS (short for long-distance discount service) on a napkin.

Over time, LDDS expanded its initial mission of selling cut-rate long-distance services and grew into a worldwide provider of voice and data networks with 20 million residential customers and thousands of corporate accounts. Ebbers achieved nearly all of this growth through a series of increasingly ambitious acquisitions, each one adding to the company’s portfolio and raising its profile among investors and customers.

The company changed its name to WorldCom to reflect its global ambitions.

“He is extremely aggressive and simply wants to build the biggest company in the industry,” John W. Sidgmore, WorldCom’s current chief executive, said of Ebbers at the height of his deal making.

In 1993, Ebbers bought Advanced Telecommunications Corp., a long-distance provider, for $720 million. Advanced Telecommunications’ CFO and treasurer was Scott D. Sullivan, who became one of the few executives from acquired firms to find a major role at WorldCom.

Sullivan, now 40, earned a reputation on Wall Street as the brains behind WorldCom’s flashy merger-and-acquisition strategy. He sharpened his skills in the 1980s, when his job was to audit potential deals for General Electric Co. Tony Ferrugia, an analyst who follows WorldCom for A.G. Edwards & Sons in St. Louis, has described Sullivan as “one of the brightest CFOs I have ever met.”

Sullivan earned that respect by juggling several major acquisitions at once--a skill necessitated by Ebbers’ voracious appetite for growth. At one point, Sullivan was working on a complicated three-way deal to acquire the network assets of online computer services firm CompuServe Corp. and America Online Inc. while simultaneously negotiating a $2-billion stock deal for Brooks Fiber Properties Inc., a local phone upstart challenging the entrenched Baby Bells.

In the midst of those negotiations, Sullivan made an off-the-cuff comment to an investment banker that WorldCom might be a better candidate to purchase No. 2 long-distance firm MCI Communications Corp., whose plan to merge with British Telecom was beginning to unravel.

“On a whim I said, ‘We might be able to help out,’ ” Sullivan recounted to a reporter in 1998.

Over the course of a plane ride, he ran the numbers and realized that MCI was worth more to WorldCom than to BT because WorldCom could blend the long-distance company’s assets with its own local network. WorldCom made an offer and ended up buying MCI for about $40 billion, setting a record in the telecommunications industry.

Sullivan was richly rewarded for his efforts. In 1998, he was rated the most highly paid CFO in America by the magazine CFO. On top of his base salary of $4 million, he took home $15.25 million in stock option profit.

Sullivan also earned the respect and confidence of Ebbers, and the pair became so close that they alienated other executives. They ran WorldCom in an informal manner that reflected Ebbers’ style.

Though he remained in Mississippi, Ebbers held on to his Rocky Mountain roots.

“He was very down-to-earth, no airs or nothing,” said Frank Latham, who often served Ebbers at his restaurant, Frank’s World Famous Biscuits, in Jackson, Miss. “In fact, when he came over for lunch, there would be three or four guys with him and he would be the worst dressed of them all.”

*

Times staff writer Christine Frey contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.