Vaccine Pipeline Is Ailing

- Share via

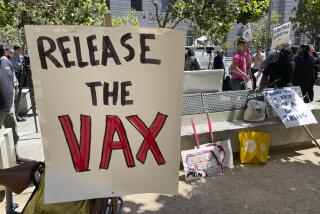

As U.S. health officials met with British regulators Thursday to learn what caused the loss of half the nation’s supply of flu vaccine, attention turned to overhauling a supply pipeline that depends on a dwindling number of producers even as demand is on the rise.

The shutdown this week of Chiron Corp.’s factory in Britain because of bacterial contamination exposed the weakness of a system in which only two companies produce flu shots for all of the U.S. And the problem extends to other vaccines: For example, the measles, mumps and rubella shots universally prescribed for infants are supplied in the U.S. solely by Merck & Co.

“It is, on its face, an extraordinary circumstance that this most-developed country on the Earth has ... a very fragile supply of vaccines,” Dr. William Schaffner, chairman of the department of preventive medicine at Vanderbilt University Medical Center in Nashville, said Thursday. “If you want some redundancy in the system to help you deal with glitches that will occur from time to time, you need more manufacturers.”

At a news briefing, officials with the Department of Health and Human Services said they had discussed offering financial incentives, such as purchase guarantees, to lure more vaccine suppliers, but gave no details.

A hearing on Chiron is set for today before the House Committee on Government Reform. Its ranking minority member, Rep. Henry A. Waxman (D-Los Angeles), said the situation showed that “our vaccine infrastructure is in disarray.”

“Public health is at risk because we are dependent on a limited number of suppliers,” he said. “We need more production capacity and better vaccine technologies.”

Waxman said he wouldn’t oppose having the government guarantee the purchase of vaccines if it would draw more suppliers to the market. He also said that having the government get into the vaccine business was “an idea that deserves further consideration.”

To the shock of public health authorities in the U.S., British regulators on Tuesday suspended production for three months at Chiron’s Liverpool plant, which had been expected to supply about 46 million of 100 million doses of vaccine for the upcoming flu season.

Chiron, based in Emeryville, Calif., dominates the U.S. market along with Aventis-Pasteur Inc., which is expected to distribute about 54 million doses. A third company, MedImmune Inc., will supply about 1.1 million doses of its FluMist nasal spray vaccine.

Top scientists from the U.S. Food and Drug Administration met Thursday with British regulators in London to review test results that showed contamination by a bacterium called serratia. They planned to inspect the factory to see if any impounded vaccine could be salvaged.

Health officials have urged physicians and the public to save available flu vaccine for those most at risk for disease or death, including people over 65, children i6 months to 2 years old and those with chronic respiratory or cardiac conditions.

Because it takes six months to produce the vaccine, health officials say there is no way to make up for the Chiron loss by revving up output elsewhere.

Making the vaccine requires predicting the dominant strains of influenza, then growing the virus in millions of chicken eggs. The government is funding research on growing the virus in cell cultures instead of eggs, Dr. Anthony S. Fauci, director of the National Institute of Allergy and Infectious Diseases, said at Thursday’s briefing. That would make it easier to boost output quickly, he said.

Over the years, some authorities have argued the government should regulate vaccine makers the way it does public utilities or banks or that it should make vaccines itself to make sure public health isn’t subordinated to profit concerns.

Industry consolidation, liability fears and the allure of more lucrative drugs have thinned the ranks of vaccine makers, despite wider vaccine use. Flu immunizations for the coming season were expected to set a record because the Centers for Disease Control and Prevention for the first time prescribed them for all 6-to-23-month-old children.

The loss of suppliers “has to do, as you might expect, with money,” Schaffner said. Vaccines bring modest returns to pharmaceutical firms; while drugs generate big profits, he said.

Bruce Gellin, director of the national vaccine program office at the Department of Health and Human Services, noted that after the 2002-03 flu season, suppliers had to throw out some 12 million doses of vaccine that no one bought. Wyeth, which had been a major supplier, quit the flu vaccine business at that time.

“If they don’t sell all the vaccine that they make, then they make zero profits,” said Neal Halsey, director of the Institute for Vaccine Safety at Johns Hopkins Bloomberg School of Public Health.

Chiron’s shares fell $1.79 to $36.53 Thursday on Nasdaq.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.