Defense in Executive Life Lawsuit Tries to Dent Claim of Deception

- Share via

Attorneys for French billionaire Francois Pinault renewed their efforts in court Thursday to show that Insurance Commissioner John Garamendi was aware that banking giant Credit Lyonnais was backing a group of French investors bidding for the assets of failed California insurer Executive Life Insurance Co. in 1991.

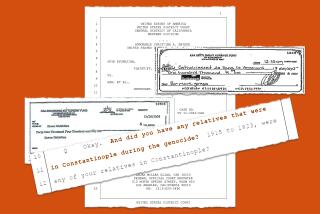

Garamendi, in a lawsuit being tried in federal court in Los Angeles, contends that Credit Lyonnais, controlled at the time by the French government, used a series of front companies to acquire Executive Life’s assets -- including its troubled junk bond portfolio -- in 1991. These front companies had secret side deals that were never disclosed to state regulators, the suit alleges.

Though other defendants in the suit, including Credit Lyonnais, have agreed settle with Garamendi, Artemis, a holding company controlled by Pinault, is contesting the suit in court. Artemis was created in 1992 and bought Executive Life’s junk bond holdings from the French investor group that bought the portfolio from Garamendi.

Garamendi’s lawyers claim Artemis was created only to further a scheme to hide the bank’s ownership role in the deal. State law prohibits foreign banks from owning insurance companies doing business in the state.

Pinault’s lawyers are trying to show that Garamendi and others were aware of Credit Lyonnais’ involvement.

Under questioning from Pinault attorney James P. Clark Thursday, Garamendi admitted that he received what he called a “comfort letter” from the chairman of Credit Lyonnais in April 1991 -- the same month Executive Life was seized by the state -- guaranteeing backing for the French buyers.

“We understand the transaction, if completed, will require a cash equity investment of $300 million dollars,” the letter stated. “We are holding for the account of the investor group, or will make available to the account, funds in the amount referred to above.”

Attorneys for Pinault argued that Garamendi knew the French bank was the deep pockets behind the deal. “It gave you some comfort, did it not, that Credit Lyonnias was standing behind that transaction?” Clark asked.

Garamendi said the letter showed the bank was the provider of a “guarantee, not where the money ultimately comes from.”

The case is in the second week of what is expected to be a 10-week trial. Pinault also is expected to testify.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.