He built a fortune on a widow’s funds

- Share via

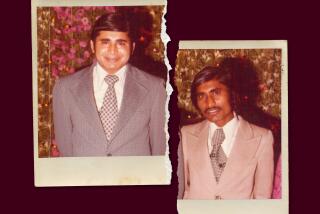

Neil Kadisha is one of Los Angeles’ richest people, with a fortune based largely on his stake in the once-highflying wireless tech firm Qualcomm Inc.

The 51-year-old venture capitalist and father of three -- worth $910 million by one estimate -- also is known as a generous benefactor of charitable causes here and in Israel.

But a recent court decision casts him in a far harsher light, finding that he relied on more than savvy for his success.

Over an eight-year span beginning in 1988, Kadisha looted the trust funds of a young widow and her children and then parlayed the ill-gotten gains into a sizable chunk of his wealth, a judge ruled.

“Kadisha was no more than a common thief in his monumental takings of [their] money for his own use and benefit,” Judge Henry W. Shatford wrote in a blistering, 190-page decision that capped a four-year civil trial in Los Angeles County Superior Court.

Portraying Kadisha as self-serving and deceptive, Shatford said the Beverly Hills resident took $6.2 million from Dafna Uzyel, a family friend who sought his help after her husband died. While acting as trustee for Uzyel and her children, he used their money to replenish his Union Bank credit line, buy real estate and acquire Qualcomm stock.

“Kadisha could have been charged under the Penal Code for Grand Theft ... for his misappropriations,” Shatford wrote. The allegations have never been investigated as a crime.

Shatford ordered Kadisha, a former Qualcomm director and once one of its largest shareholders, to pay the family $100 million, including $5 million in punitive damages.

Kadisha, who declined to be interviewed, has asked for a new trial and plans to appeal. He contends that the funds he took from the family’s trusts were legitimate loans, ultimately repaid in full, with interest.

“I am deeply disappointed that what began as an effort to help a family friend, at her request, resulted in these unfair claims,” he said in a written statement.

Kadisha’s lawyers say that Shatford’s references to him as a criminal are unjustified and should be removed from the decision, which was made public last month, after the bench trial.

The case is remarkable for several reasons, including the size of the award, which legal experts say is extraordinary among trust cases involving individuals. It also stands out because the Uzyels’ trusts eventually gained $20 million despite Kadisha’s actions, unlike cases in which unscrupulous trustees have left their victims penniless.

“It is undisputed that while I was the trustee, the Uzyel trusts increased in value from less than $6 million to more than $27 million, representing a 22% average annual return over 12 years, and guaranteeing the financial security and independence of the Uzyel family,” Kadisha said.

Friend of the family

The case is detailed in 20,000 pages of testimony and 3,000 exhibits generated since Uzyel sued Kadisha in 1999. Shatford, an 89-year-old retired judge, heard the case by special assignment.

Its genesis was the May 1986 death of Rafael Uzyel, 40, who suffered a fatal heart attack while driving back from Mammoth Lakes, Calif., with his wife, then 28, and their children, Izzet, 6, and Joelle, 4.

The couple had married in Israel in 1979 and later moved to Los Angeles, where Rafael ran a successful business importing fabrics to sell to manufacturers. He managed the couple’s assets, which included a house in Beverly Hills, an apartment in Israel and $2 million in a Swiss bank account.

Dafna, a native of Israel who spoke little English, had worked only briefly, as a makeup artist, and had almost no financial experience, Shatford wrote.

After Rafael’s death, his sister in Switzerland, Lillian Nomaz, sought to restrict Dafna’s access to the couple’s bank account there, contending that the widow’s prolific spending would threaten the children’s interest in the $2 million.

With almost no liquid assets and in need of a lawyer to fight Nomaz’s challenge, Dafna turned to Kadisha, then a young entrepreneur and friend of her late husband. He put her in touch with his own attorney, who settled the dispute with Nomaz by creating a trust fund for the children.

The lawyer also set up a trust for their mother, and at her request, Kadisha became trustee of both funds.

But the lawyer built in “escape clauses” that effectively relieved Kadisha of all legal liability, Shatford said, calling it “almost unbelievable but true.”

Another lawyer drafted three “shocking” amendments that Kadisha induced Dafna Uzyel to sign, Shatford wrote. One of the documents authorized Kadisha to lend trust money to enterprises in which he had a financial interest and to make loans and investments “that might be deemed imprudent.”

Kadisha wasted no time in taking advantage of Uzyel’s lack of sophistication to tap the trusts as his “veritable piggy bank,” Shatford said.

In his first official act as trustee, Kadisha borrowed $500,000 from Uzyel’s trust and secured it with her Beverly Hills house, the judge wrote. In a series of unsecured, undocumented loans that followed, Shatford said, Kadisha took more than 10 times that much.

“Kadisha never stopped to consider the welfare of Dafna and her children,” the judge wrote. “He was solely interested in his own financial welfare.”

Uzyel told The Times that, while Kadisha was trustee, she was unaware that he had taken vast sums from her funds.

“Neil Kadisha was a family friend and someone I trusted to take care of my finances for me and my young children after my husband died,” she said in a statement. “We were shocked to learn during this case how he used our money for his personal gain.”

Reconstructing transactions

Kadisha’s misuse of the funds might not have come to light if he had granted Uzyel’s request in the late 1990s for $250,000 of her own money to make household repairs and for other uses.

When he refused, she hired an Encino law firm to investigate. Attorney Samuel Krane reconstructed 12 years of transactions involving the funds, unearthing extensive evidence of Kadisha’s alleged wrongdoing from mounds of financial records.

“I knew I had uncovered a major fraud here,” said Krane, Uzyel’s lead trial attorney, who noted that he racked up 12,000 hours, devoting virtually his entire practice to the case.

When the trial began in May 2002, Kadisha relinquished his seat on Qualcomm’s board, saying he wanted to concentrate on Omninet Capital, an investment firm of which he is chief executive. Its investments include Sky Las Vegas, a $325-million luxury condo development nearing completion on the Strip.

Kadisha spent 34 days on the witness stand and was on hand for nearly every session, people who attended the trial said.

Shatford ultimately found that the venture capitalist had looted the trusts and tried to cover his tracks with fraudulent accounting, backdated records and phony transactions. He said Kadisha was pressed for cash at the time and needed the money to prop up his investments -- an allegation Kadisha denied.

Among other things, in 1988 Kadisha lent $300,000 of the trusts’ money to Qualcomm, then a struggling San Diego company that designed and sold microchips for mobile phones. Earlier that year, Kadisha had secured a seat on Qualcomm’s board when the company merged with Omninet Corp., a satellite communications company he co-founded.

“The loan was an extremely bad gamble by Kadisha and violated every investment rule for trustees in the book,” Shatford wrote. “But Kadisha got lucky and the gamble paid off.”

Kadisha converted the loan to stock and in 1992 sold it for $805,000. He used the proceeds to fund another loan, for $1.4 million, to a David Rahban, who he said lived in Israel, Iran or Switzerland. But Rahban “might just as well be living on the moon,” the judge wrote, because he saw no evidence that Rahban even existed. The money, and an additional $1.2 million lent to Rahban, really went to Kadisha, he ruled.

Rather than diversifying the trust’s investments, Kadisha put virtually all of the money in Qualcomm stock. Had Qualcomm failed, Shatford said, Uzyel would never have recovered the trust fund money. Qualcomm instead went on to become a tech success story, with its stock trading as high as $200 a share before the dot-com crash of 2000. Qualcomm was not a party to Uzyel’s suit and declined to comment.

Kadisha had gained a major stake in the company when it merged with Omninet. As part of the complex merger transaction, he acquired more than 1 million Qualcomm shares at $1 each.

Kadisha’s stake in Qualcomm catapulted him onto Forbes magazine’s list of wealthiest Americans in 2001. Last May, the Los Angeles Business Journal placed him 41st among its 50 wealthiest Angelenos, with a net worth of $910 million.

Despite his wealth, Kadisha has largely stayed out of the public spotlight. He and his wife, Dora, live in an 11,000-square-foot house in Beverly Hills, where they are active in community and religious causes. He has served on the boards of the Jewish Federation of Greater Los Angeles and Phoenix House, a substance abuse program. He and his wife also support a variety of Israeli charities.

Kadisha disputes the judge’s harsh characterizations of him. In a motion for a new trial, Kadisha’s lawyers said 25 references to him as an embezzler and perjurer in Shatford’s decision “have no proper place” in a civil suit and should be excised.

“There has been no criminal investigation, charge or adjudication,” they said. Kadisha “has never been afforded any of the due process rights essential to a criminal investigation and trial -- a grand jury, the presumption of innocence, a jury trial and the requirement that guilt be established beyond a reasonable doubt.”

More than half of the $100-million award stemmed from Kadisha’s 1992 sale of Qualcomm stock. Shatford ruled that the sale deprived the trusts of the shares’ future gains.

The motion for a new trial states that Kadisha should not be held liable on that claim, and others, and calls the damage award excessive.

William M. McGovern, a UCLA Law School professor emeritus and an expert on trusts, said Shatford’s ruling in the Kadisha case underscored “clear and uncontroversial” legal principles. He said trustees have a fiduciary duty to make prudent and diversified investments and that all benefit from them must go to the trust.

“If I invest and it makes a million dollars, the profit goes to the trust,” he said. “If I take a million dollars and invest it improperly, I take the full loss.”

Kadisha insisted that he would be vindicated.

“I remain confident that in the end the claims against me will be rejected,” he said.

For his part, Shatford expressed no doubt about Kadisha’s actions.

“Kadisha’s defenses rest beyond denials but upon a grossly contrived conception that a thief can steal money and keep the benefits therefrom,” he wrote. “He is sadly mistaken.”