Why employers are really cutting healthcare (it’s not Obamacare’s Cadillac tax)

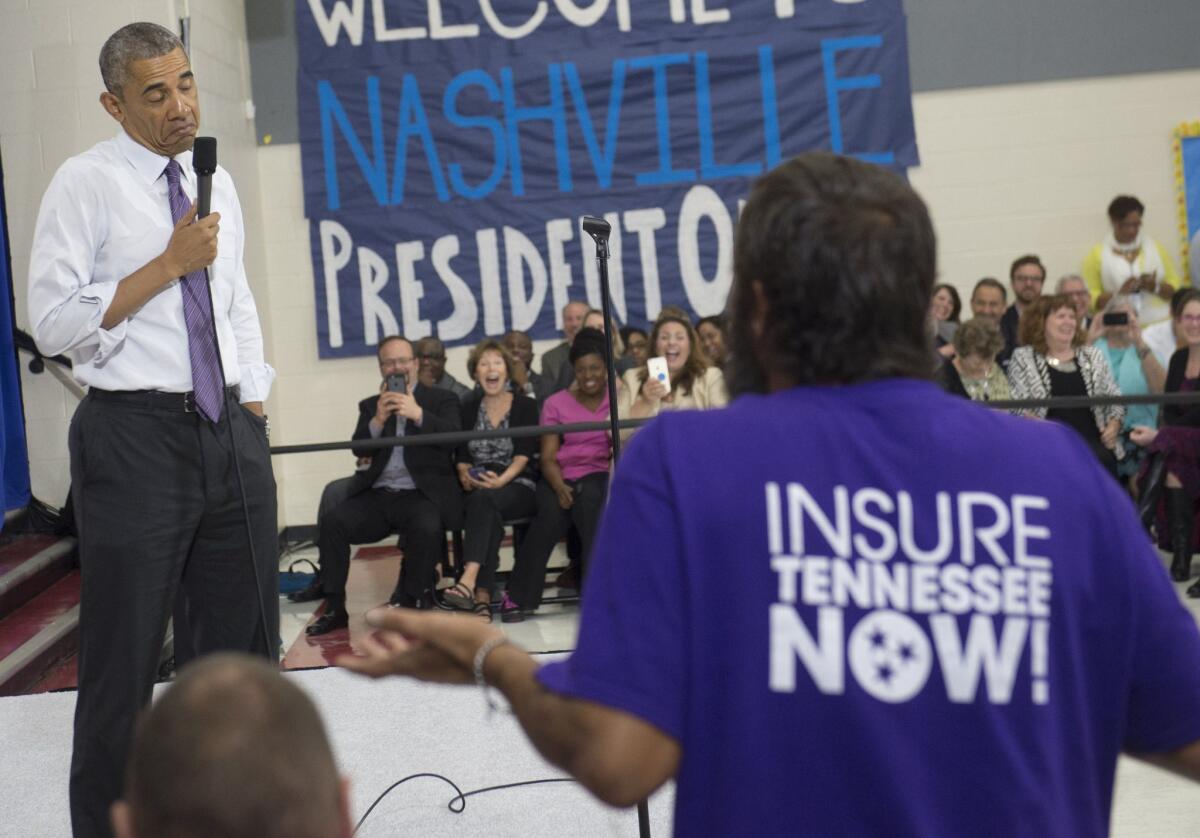

President Obama takes a question about the Affordable Care Act at a Tennessee forum in July.

- Share via

For employers, the big ogre still lurking in the mists of the Affordable Care Act is the so-called Cadillac health plan tax, a levy on employer-sponsored health insurance plans valued above a certain threshold.

The tax starts in 2018, when the thresholds will be $10,200 for single coverage and $27,500 for family plans, adjusted thereafter for inflation. Any value over those thresholds will be taxed at 40%. For a single employee whose coverage comes to $12,000, for example, the employer would pay tax of $720.

But how many employers would be subject to the tax? The Kaiser Family Foundation is just out with an estimate, and it’s substantial. Assuming that health plan premiums grow by only 5% a year between now and 2018, the foundation’s study says, 26% of employers would have at least one component of the healthcare offerings triggering the tax at its inception. Because the inflation index the government applies would undercut healthcare cost increases, that figure would rise to 42% by 2028.

The Kaiser paper based its estimate only on single coverage, in part because the costs of family plans, which cover two persons or more, are harder to parse.

But it’s obvious that the tax is going to become a major political issue as its implementation grows near. Here are a few points to consider:

— There’s a good rationale for a tax of this nature. That’s because employer-sponsored health insurance gets a huge tax subsidy — premiums paid by the employer and employee alike are tax exempt, and employers have the further option to offer tax-advantaged health savings accounts and flexible spending plans and even to help employees with their contributions. The value of these benefits gets counted when the Cadillac plan is calculated. The FSA allows workers to set aside an annual pre-tax sum (up to $2,550 this year) to pay healthcare costs other than premiums.

Tax subsidies for premiums alone cost the government an estimated $250 billion a year, swamping the value of the tax subsidies allocated to individual insurance buyers under the Affordable Care Act (about $45 billion in 2014). The Cadillac tax is partially an attempt to bring these tax breaks into line. Healthcare economists say the tax break for employer-sponsored insurance encourages companies to offer more generous plans than they should, driving up costs and leading to unnecessary usage.

— The pushback against the tax is coming chiefly from the largest employers and labor unions. Big companies tend to offer the widest range of Cadillac-taxable benefits and make it easiest for workers to participate; the Kaiser analysts estimate that 46% of companies with more than 200 employees will pay some Cadillac tax in 2018, rising to 68% in 2028. Unions have spent decades negotiating better health benefits for their members as alternatives to wage increases, only to find their hard-won benefits tipping over the Cadillac thresholds.

— What’s most important about the Cadillac tax is how employers respond. Some may raise deductibles on health plans to lower premiums, or place limits on FSAs or even eliminate them outright. Some may eliminate or scale back benefits that aren’t required by law but serve as recruitment tools. “For the most part,” the Kaiser report says, “these changes will result in employees paying for a greater share of their healthcare out-of-pocket.”

Some companies started cutting benefits and raising deductibles years ago, citing the tax, even though it’s still two years off. This amounts to bosses scapegoating Obamacare while doing something they wanted to do for their own reasons. As we observed in 2013, when this practice first materialized, “If your company is cutting back your benefits now, it’s because it wants to cut its payroll costs, period.”

The argument seems to be that waiting until 2018 to bring health benefits below the trigger would lead to such sharp reductions that workers would be “shocked” by the sudden changes.

This doesn’t make much sense. Cutting benefits now to ease workers into the concept of a cheeseparing package three or four years down the road resembles the old story of turning up the heat on a cauldron bit by bit so the frog inside doesn’t realize he’s dinner until it’s too late. It’s probably a safe bet that most employees would prefer to keep all their traditional benefits until it’s absolutely necessary to slash them and deal with the “shock” when the time comes.

The concept also resembles the familiar plea that we need to cut Social Security benefits today because if we wait until it may be necessary 20 years from now, the reduction will be too sudden. Cutting bit by bit now so we don’t have to cut more later doesn’t hold water in that context, either.

— There’s reason to believe that the Cadillac tax may never be implemented, at least in its current form. The opposition from unions and big companies is one reason. Another is that its complexities will produce inequities within companies, with some workers choosing packages that exceed the thresholds while others are thriftier with their employers’ money. As it’s set up, the tax must be calculated on each individual worker’s benefit. There may also be geographical inequities, as the tax will fall harder on employers in regions with high healthcare costs.

A functioning and grown-up Congress would have every opportunity to adjust the tax to make it easier to administer, more equitably applied or smaller. Of course, it first would have to find another revenue source to make up the $87 billion the tax is expected to bring in. Any such tweaks will have to wait, as the current Congress majority is unequipped to address any changes in the Affordable Care Act without braying for full repeal.

Keep up to date with the Economy Hub. Follow @hiltzikm on Twitter, see our Facebook page, or email michael.hiltzik@latimes.com.

MORE FROM HILTZIK:

You really want to privatize Social Security in THIS market?

Public pension shocker: Shutting a pension plan actually costs taxpayers money

Planned Parenthood: A terrified business partner abandons the organization

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.