American businesses say working with China is getting harder, despite government rhetoric about free trade

- Share via

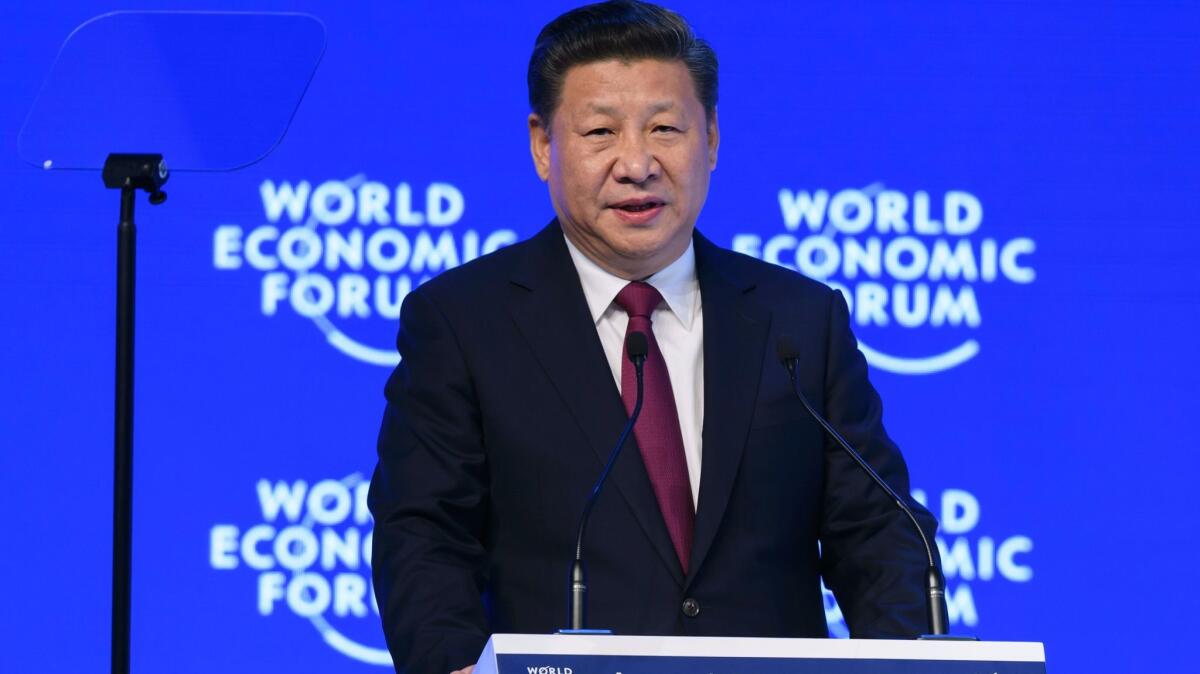

Reporting from Beijing — Chinese President Xi Jinping stood in front of the world’s financial elite this week and fiercely championed free trade. But for many foreign companies, doing business in China is getting harder.

Many American companies, confronted with a chillier reception and murky regulatory hurdles, are rethinking their investments, according to a survey released Wednesday by the American Chamber of Commerce in China.

These concerns come as the nation’s economy slows, new digital laws threaten to undermine foreign competition and tensions between China and the incoming Trump administration risk the dawn of a trade war.

Xi, speaking to CEOs and political leaders Tuesday at the World Economic Forum in Davos, Switzerland, likened the pursuit of protectionism to “locking oneself in a dark room.”

But 4 out of 5 U.S. businesses in China said the country feels less welcome to foreign businesses than in the past, up slightly from the previous year. Some attribute the change to increased protectionism and a challenging economic environment. Others see the rise of domestic companies — and favorable polices toward them — as a major factor. More than half said they were treated unfairly.

Xi’s free trade message “is certainly welcome,” William Zarit, the chamber’s chairman, said at a news conference announcing the annual report. “We just haven’t seen the follow-up.”

More than 500 members, including tech, manufacturing and other fields, participated in the 2017 business climate survey, which includes companies of all sizes.

Businesses listed fears of increased Chinese protectionism third in their five biggest challenges.

Companies that consider China among their top three global priorities dropped from 78% in 2012 to 56% in the latest survey. A third of businesses do not plan to increase investment in 2017; half will maintain or reduce their staff. The degree to which those do plan to expand investment has dropped to its lowest level since 2009.

Worries about U.S.-China relations may help fuel that hesitation. More than 70% of companies believe bilateral relations are critical to their business. But the vast majority think they will stay the same or deteriorate.

Incoming U.S. President Donald Trump, who takes office Friday, has labeled China a currency manipulator, accused it of “raping” America and vowed to raise tariffs. He also has threatened to turn the U.S. understanding that Taiwan is part of a united China — a bedrock of diplomatic relations between Beijing and Washington — into a bargaining chip.

Chamber officials have advocated a firmer stance in negotiations with China, but on Wednesday questioned Trump’s belief that China is devaluing the yuan against the dollar, which they say is an outdated notion. The group plans to send a delegation to Washington in February, several months ahead of its usual visit.

“If you are fighting against a government policy here that [China] depreciated currency to give China’s exporters an advantage, that hasn’t been the case in recent years,” said Lester Ross, the chamber’s policy committee chairman.

He also said tweaks in China’s policies, such as plans to raise tariffs on certain dried grain used for animal feed, suggest the country is preparing retaliatory steps in event of a trade war.

In a glimmer of good news, 58% of companies reported higher revenue last year, 3 percentage points more than 2015, but still far below historical levels. Companies point to unclear regulations, inconsistent enforcement and rising labor costs.

Businesses in China “continue to find growth and profits hard to come by,” the report said.

Dozens of global businesses and rights groups fought against a cybersecurity law that passed in November and will go into effect this summer. Officials insist that the new rules will prevent terrorist attacks. But foreign businesses see certain aspects — such as mandatory security checks on some industries and requirements to store data in the country — as efforts to raise costs and root them out.

China saw breakneck annual growth in past decades of 10% or more, but that pace has slowed in recent years. The government has not yet released its figures for last year, but Xi recently predicted that the country’s gross domestic product rose to 6.7%.

Companies still find China’s nearly 1.4 billion consumers a compelling market. But they’re increasingly attracted to lower-wage nations in Southeast Asia such as Vietnam and Indonesia.

About one-fourth of U.S. companies have moved capacity out of China or plan to do so. Half are relocating to other parts of Asia, and a little more than a third are going to North America, a similar pattern to the previous year.

Next year’s survey could have a far different outcome.

“So much about the economy is to create jobs or have jobs,” Zarit said. “We don’t think a trade war would do those things.”

Meyers is a special correspondent.

ALSO

Trump worries European allies before inauguration

Trump’s pick for Commerce secretary assures lawmakers he is not anti-trade

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.