Stocks close mostly lower, but McDonald’s and PayPal soar

- Share via

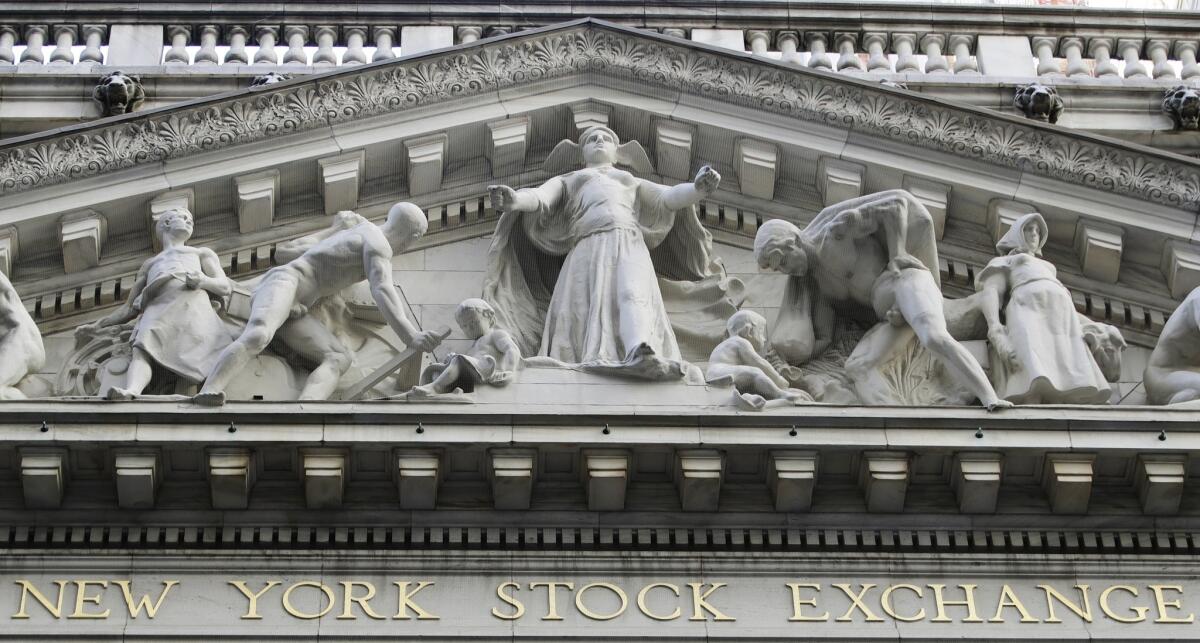

The major U.S. stock indexes closed mostly lower Friday, capping a day spent wavering between small gains and losses.

Phone companies were the biggest drag on the market after reports that AT&T was considering a deal to acquire the media conglomerate Time Warner. AT&T, Verizon, Sprint and T-Mobile USA all fell.

Healthcare and energy stocks also took some losses, while consumer staples and technology companies held on to slight gains.

Investors continued to focus on corporate America, reviewing earnings from General Electric, McDonald’s and other big companies. Earnings from banks and other financial companies have been mostly better than anticipated, which has helped boost that sector.

“We’re seeing a lot better earnings come out of the financial sector in particular, and some good earnings come out of technology,” said David Schiegoleit, managing director of investments at Private Client Reserve at U.S. Bank. “That is reflected in some of the sector performance, but when you look at the market overall, we’re still being weighed down by energy.”

The Dow Jones industrial average fell 16.64 points, or 0.1%, to 18,145.71. The Standard & Poor’s 500 index slipped 0.18 of a point, or 0.01%, to 2,141.16. The Nasdaq composite index rose 15.57 points, or 0.3%, to 5,257.40.

The three indexes ended slightly higher for the week. The Dow is up 4.1% for the year, the S&P 500 is up 4.8% and the Nasdaq is up 5%.

Roughly two weeks into the third-quarter financial reporting period, earnings for companies in the S&P 500 are projected to be down about 0.8% overall from a year earlier, according to S&P Global Market Intelligence. That forecast is largely due to the energy sector, which has been hit hard by falling energy prices.

Several companies that reported results Friday failed to impress investors.

Skechers U.S.A. slumped 17.3% to $18.98 after the Manhattan Beach footwear maker reported disappointing results for the second quarter in a row.

General Electric slipped 0.3% to $28.98 after the industrial conglomerate said its latest quarterly sales fell more than anticipated because of weaker results from its lighting and transportation businesses. It also trimmed its revenue forecast for the year.

Others companies fared better.

McDonald’s rose 33% to $113.93 after the world’s biggest hamburger chain served up earnings and revenue that exceeded Wall Street’s expectations.

PayPal Holdings jumped 10.1% to $44.15 after the San Jose payment technology company posted results that were better than anticipated: Transactions and payment volume jumped.

Microsoft climbed 4.2% to $59.66 — eclipsing its previous record close of $59.56 set in December 1999 — the day after the software giant posted a surprisingly high profit for its fiscal first quarter. The results help validate the company’s increased focus on software and online services.

News and corporate deal talk also fueled big moves Friday.

Reynolds American jumped 14% to $53.78 after London-based British American Tobacco offered to buy out the 57.8% stake in Reynolds that it doesn’t already own. Reynolds was evaluating the offer, which analysts say would help both sides overcome a decline in smoking rates in their home markets and competition from electronic cigarettes. Reynolds was the biggest gainer in the S&P 500.

AT&T fell 3% to $37.49 after reports that the company was considering a deal to acquire the media conglomerate Time Warner.

Read more: In yet another giant media merger, AT&T may be trying to buy Time Warner Inc. »

Beyond earnings, concerns about the implications of a rising dollar and a possible interest rate hike from the Federal Reserve this year have kept the market in a listless state recently, said Krishna Memani, chief investment officer at OppenheimerFunds.

“The market is not taking a significant turn in a negative way, but it doesn’t really see any positive impetus in the near term to go higher,” Memani said.

After an early slide, crude oil prices recovered in afternoon trading. Benchmark U.S. crude rose 22 cents to $50.85 a barrel. Brent crude, used to price international oils, rose 40 cents to $51.78 a barrel.

The major stock indexes in Europe barely budged Friday as investors increasingly factored in the likelihood of a U.S. interest rate increase this year. Germany’s DAX rose 0.1%, while France’s CAC 40 and Britain’s FTSE 100 each fell 0.1%.

Earlier in Asia, Japan’s benchmark Nikkei 225 index fell 0.3%, while South Korea’s Kospi lost 0.4%. Hong Kong’s stock market was closed due to a typhoon.

In other U.S. energy futures trading, wholesale gasoline rose 4 cents to $1.53 a gallon, heating oil rose a penny to $1.57 a gallon and natural gas fell 15 cents, or 4.7%, to $2.99 per 1,000 cubic feet.

Gold rose 20 cents to $1,267.70 an ounce, while silver fell 6 cents to $17.49 an ounce. Copper slid a penny to $2.09 a pound.

Bond prices rose. The yield on the 10-year Treasury note fell to 1.74% from 1.76%.

In currency markets, the dollar slipped to 103.85 yen from Thursday’s 103.95 yen. The euro weakened to $1.0871 from $1.0926.

ALSO

Here’s why so many popular websites aren’t working right now

California adds 30,000 jobs as unemployment holds steady at 5.5%

Don’t think of Amazon Echo as just a speaker. It’s a whole new way of life

UPDATES:

2:25 p.m.: This article was updated with closing prices, analysis and additional information.

1:30 p.m.: This article was updated with the close of markets.

7:45 a.m.: This article was updated with more recent market information.

This article was originally published at 6:55 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.