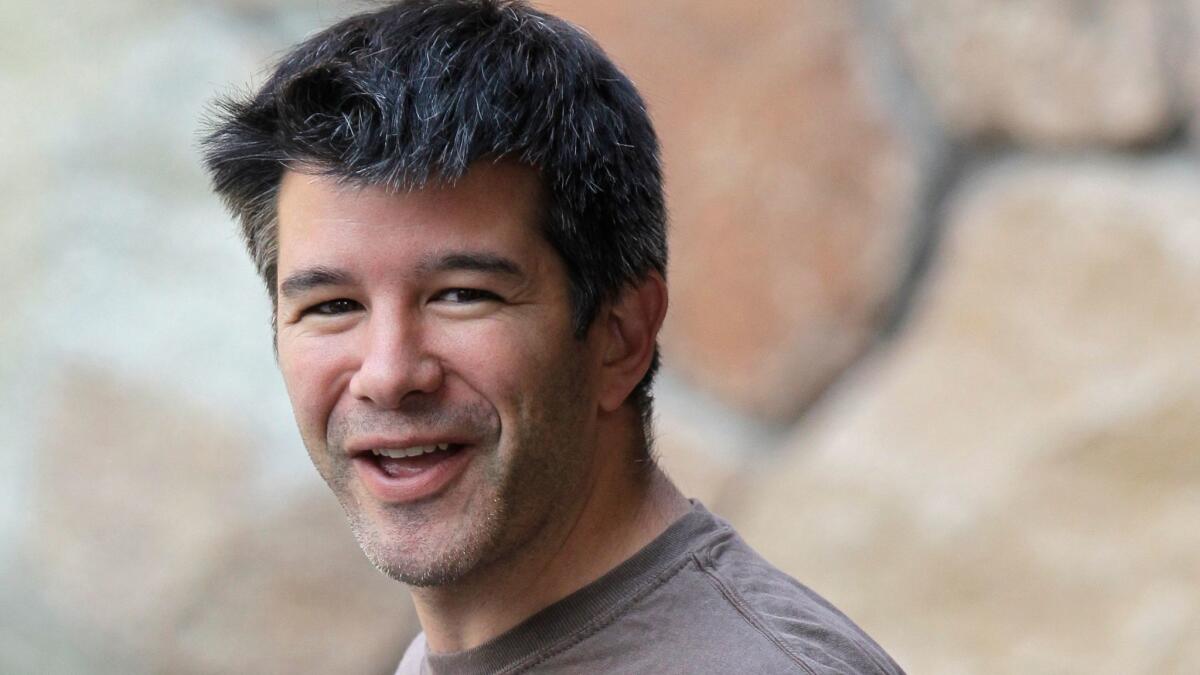

Former CEO Travis Kalanick adds two directors to Uber’s board ahead of governance vote

- Share via

Former Uber chief executive Travis Kalanick named two new directors to the ride-hailing company’s board ahead of an expected vote next week on corporate governance.

Ursula Burns, a former Xerox CEO, and John Thain, a former Merrill Lynch and CIT Group CEO, were named as directors in a statement late Friday attributed to Kalanick rather than to Uber.

Kalanick said he is “appointing these seats now in light of a recent board proposal to dramatically restructure the board and significantly alter the company’s voting rights.”

The board will meet Tuesday, according to a source familiar with the matter, to vote on the governance proposal.

Investors gave Kalanick the power to choose three directors last year. In June, he appointed himself to the board after he resigned as CEO amid a string of scandals at the San Francisco start-up.

Benchmark Capital, which holds more than a third of Uber’s voting power, is suing Kalanick and says he concealed information about internal problems and a lawsuit facing Uber before he gained authority to fill board seats.

Benchmark wants Kalanick to give up the seats. The case was moved in August to private arbitration.

Benchmark declined to comment. Uber likewise did not immediately offer comment, but said in a statement published by Bloomberg that Kalanick’s move came without warning.

“The appointments of Ms. Burns and Mr. Thain to Uber’s board of directors came as a complete surprise to Uber and its board,” the statement said. “That is precisely why we are working to put in place world-class governance to ensure that we are building a company every employee and shareholder can be proud of.”

Infighting has become the norm at Uber, as Benchmark and Kalanick battle behind the scenes at what’s thought to be the world’s most valuable privately held technology firm.

The next skirmish may come Tuesday when the board is expected to take up a governance proposal that could limit Kalanick’s ability to influence the company he co-founded.

Among the provisions drafted by Uber and Goldman Sachs Group, according to published reports and a source familiar with the matter, are calls to:

- Put in place a one-vote, one-share system. This would strip Kalanick and Benchmark of the extra voting rights that come with their early shares.

- Require the support of two-thirds of the board — and two-thirds of outstanding stock — to appoint as CEO anyone who has previously held an officer-level position at Uber.

- Offer one of Kalanick’s three board seats to potential Uber investor Softbank.

- Give Uber’s new CEO — the recently hired Dara Khosrowshahi — the ability to nominate candidates for three board seats, pending approval by the majority of board members and outstanding stock.

In his statement, Kalanick said he opted to make his board selection Friday because it’s “essential that the full board be in place for proper deliberation” of the governance proposal.

Burns and Thain boast business-world bona fides. Each has been chief executive and chair at a publicly traded multinational company.

To outside onlookers, it wasn’t immediately clear whether the goal of Uber’s proposed overhaul is to clean up the company’s practices, reduce Kalanick’s influence or both.

Eric Flamholtz, professor emeritus at the UCLA Anderson School of Management, said Uber is playing “governance games” by enacting company-wide policies to regulate a single person.

He questioned Uber’s proposal that former officer-level employees clear a higher bar to be appointed CEO — a rule that appeared intended to make it harder for Kalanick, who has reportedly expressed interest in “Steve Jobs-ing it,” to return to power.

“The whole idea that if someone has had an officer position they now need to go to a higher standard … what’s the rationale for that?” said Flamholtz, president of Management Systems Consulting Corp.

Twitter: @benmuessig

The Associated Press was used in compiling this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.