Herbalife CEO confirms discussions with investor Carl Icahn

- Share via

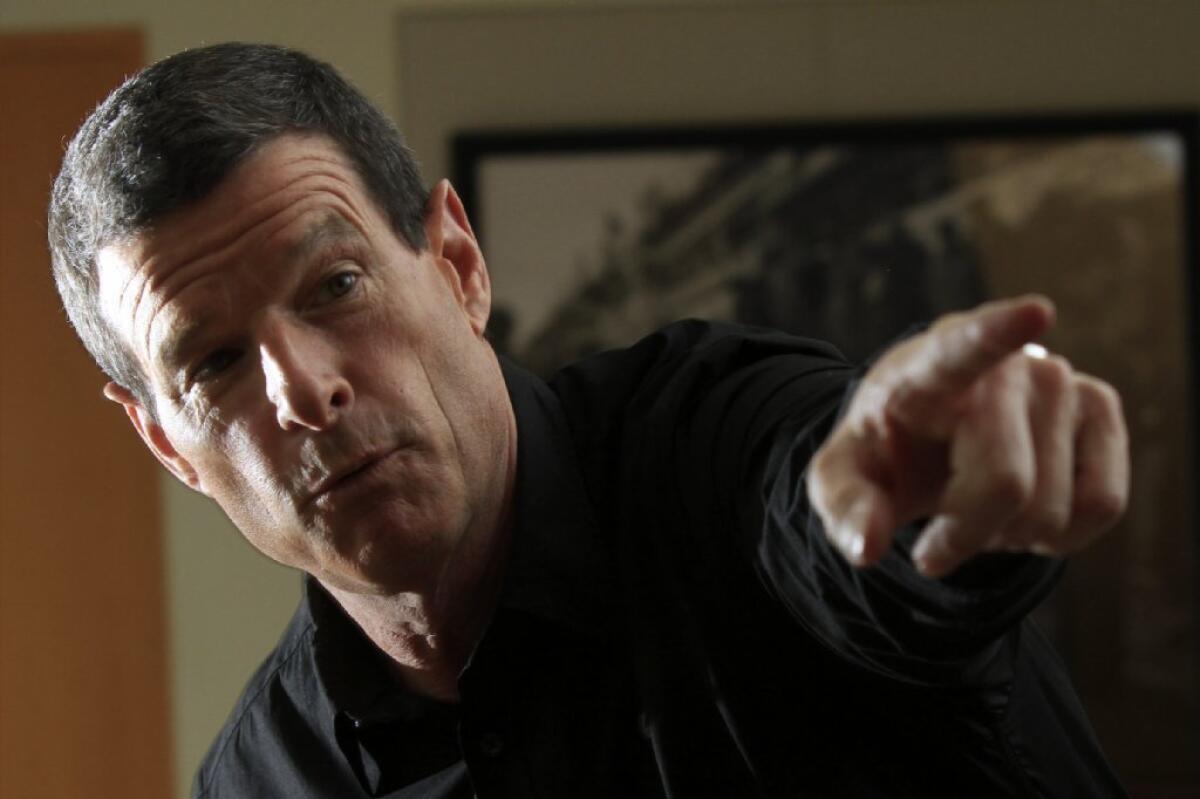

Herbalife Ltd. Chief Executive Michael Johnson said the company has had “short discussions” with billionaire investor Carl Icahn, who last week disclosed that he had purchased 13% of the company’s stock and would consider efforts to take the company private.

Johnson, speaking to analysts in a conference call Wednesday morning, did not elaborate.

“Yes, we’ve had short discussions with Mr. Icahn but beyond that nothing concrete to discuss,” Johnson said.

Icahn and hedge fund manager Bill Ackman have engaged in a public battle about the value of Herbalife, a Los Angeles maker of weight loss and nutritional products.

In December, Ackman accused Herbalife of operating a fraudulent pyramid scheme in which about 90% of its independent distributors make no money while a fortunate few at the top of the pyramid get rich from commissions of those they brought into the business. He said his fund, Pershing Square Capital Management, had a $1-billion short against Herbalife shares. If the stock falls, Ackman and his investors profit.

Icahn said he thinks Ackman’s attacks were misguided. He disclosed last week that he had gone long on the stock, buying nearly 13% of the company’s shares and planned to discuss bringing the company private, a move that could drive up its share price.

In his call with analysts, Johnson said Ackman’s attacks were “unprecedented, untrue and unfair.” He noted that many of the company’s independent distributors do not get into the business to profit, but instead to obtain the opportunity to buy its products at wholesale prices for personal consumption.

In response to Ackman’s allegations, the company has decided to include a new compensation disclosure to all potential distributors, Johnson said. The disclosure will note that about 90% of distributors make little or no income.

On top of that, Johnson said, the company intends to create a new job title for distributors who buy for personal use, a title that would make it more clear that they’re not selling the product for a profit.

Herbalife said it sells its weight-loss shake mixes, supplements and vitamins through a network of independent distributors who counsel consumers about their health needs while selling them appropriate products.

In a regulatory filing Tuesday, Herbalife said it achieved record sales of $4.1 billion in 2012. The company also raised its guidance for 2013, but disclosed that it planned to spend $10 million to $20 million fighting Ackman’s allegations.

Herbalife also said the Securities and Exchange Commission was reviewing the company’s business model and it’s possible that regulatory agencies from other countries might also get involved.

Herbalife shares were down 93 cents, or 2.3%, in morning trading.

ALSO:

Herbalife fires back at hedge fund giant

Herbalife fourth-quarter sales, profit beat Wall St. forecasts

Hedge fund manager alleges Herbalife is ‘pyramid scheme’

Follow Stuart Pfeifer on Twitter

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.