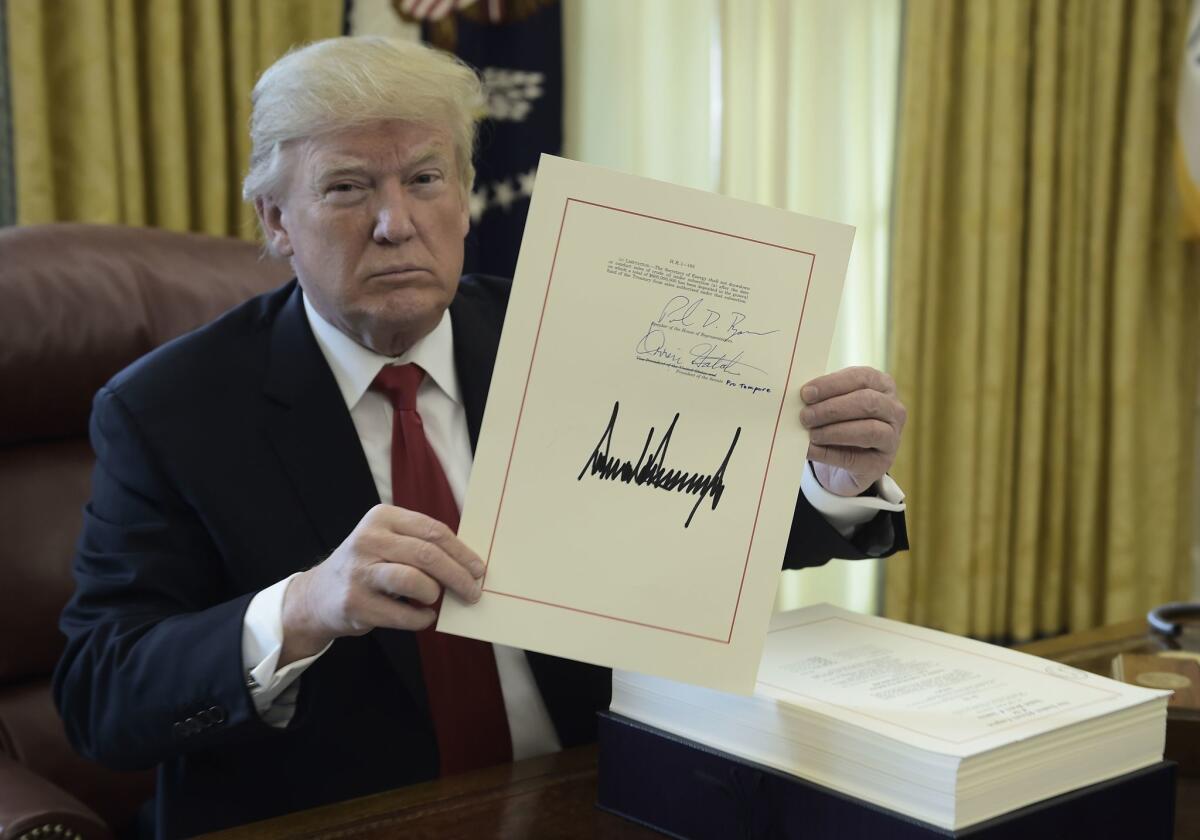

Federal judge tosses New York and New Jersey’s challenge to Trump’s local tax cap

- Share via

Four states in the eastern U.S. have lost a legal challenge to a provision of the 2017 law that limited write-offs for state and local taxes, as a federal judge threw out a lawsuit seeking to block the cap.

The Republicans’ 2017 tax law capped the amount of state and local tax, or SALT, deductions, which had been unlimited, to $10,000. Democrats in Congress and some state lawmakers said the change targeted Democratic-led states that tend to have higher taxes. New York Gov. Andrew Cuomo called it “economic civil war.”

On Monday, U.S. District Judge J. Paul Oetken threw out a lawsuit over the cap filed last year by New York, New Jersey, Connecticut and Maryland. The judge said the federal government has the “exhaustive” power to impose and collect income taxes and that the states can enact their own tax policies as they wish.

“To be sure, the SALT cap, like any other feature of federal law, makes certain state and local policies more attractive than others as a practical matter,” Oetken said. “But the bare fact that an otherwise valid federal law necessarily affects the decisional landscape within which states must choose how to exercise their own sovereign authority hardly renders the law an unconstitutional infringement of state power.”

The new limit on the state and local tax deduction will hit nearly 11 million taxpayers nationwide this year, according to a report by a Treasury Department inspector general.

Cuomo, one of the most vocal opponents of the SALT cap, said New York is considering appealing the decision.

“The bottom line is this policy is unprecedented, unlawful, punitive and politically motivated -- and it must be stopped,” he said in a statement.

The attorneys general of New York and New Jersey declined to comment on the ruling. Emails seeking comment from Connecticut’s and Maryland’s AGs weren’t immediately returned.

Lawmakers in high-tax states, including some from California, have been trying to overturn the limit on SALT deductions since the law passed nearly two years ago. The cap was one of the most politically contentious provisions in the tax overhaul.

In Congress, Democrats on the House Ways and Means Committee may consider legislation next month that would allow taxpayers to take larger SALT deductions. That bill will probably pass the House but will almost certainly be blocked in the Republican-controlled Senate.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.