Coronavirus will hurt us all. But it will be worst for those who have the least

- Share via

For many salaried, white-collar employees, the coronavirus crisis will be burdensome, scary, even painful, but financially survivable.

Most have the security of a home with all the services they need to remain productive while telecommuting, assuming their employer allows it — and they don’t fall ill themselves.

Their 401(k) plans are taking a hit, but the lights are on, the larder is stocked, the internet is working. The next mortgage and credit card payments are scheduled. They will have received emails from the banks and retailers they patronize, assuring them that the firms stand ready to serve them online if they can’t shop in person for whatever reason.

That’s not the case for Jim Conway, 63, who has been a server at an Olive Garden restaurant in Pittsburgh for 16 years. During that time, his hourly wage has gone from $2.83 plus tips when he started, to $2.83 plus tips now. That’s the Pennsylvania minimum wage for tipped employees, which hasn’t changed by a penny in all that time.

I think we all know this crisis will extend beyond two weeks.

— Jim Conway, Olive Garden worker

Two weeks ago, Darden Restaurants, the corporate owner of Olive Garden, announced that it would provide full-time workers with up to five paid sick days. I praised the company for this initiative, but here’s the reality on the ground.

Conway is a part-time employee, working six hours a day, four days a week. He’s the breadwinner in his household. His job ended March 15, without advance notice, when the Olive Garden he worked at ended restaurant dining.

Since paid sick leave at Darden will accrue based on worked hours, he won’t build sick days at the same rate. Under Darden’s policy of advancing its workers paid sick days based on their last six months of work, he’s entitled to two days.

Darden also says it will provide all workers at restaurants forced to close or curtail their hours with two weeks’ emergency pay. That’s a plus, but not a panacea.

In recent days, alarm about the economic impact of the novel coronavirus have turned conservatives who weeks ago were boasting about the shrinking of the U.S. government into raving Keynesians, proclaiming the virtues of deficit-financed economic stimulus.

“I think we all know this crisis will extend beyond two weeks,” Conway said Friday at a news conference sponsored by Restaurant Opportunities Centers United, a nonprofit that advocates for better pay for restaurant workers.

The rift between the experience of Americans able to work from home and those in the service sector, now out of work, underscores how dramatically the crisis is separating the haves in the U.S. economy from those who don’t have much.

When a crisis strikes, it’s the latter who bear the brunt of the damage. That’s going to play out this time with particular ferocity in the United States for several reasons. One is that since the last recession we’ve become increasingly dependent on low-income jobs with poor benefits and fragile guarantees of continued employment.

Production and non-supervisory workers in the leisure and hospitality industries have risen to 9% of the civilian workforce this year from 7.4% in 2010. They constitute an army of more than 14.7 million workers today, all vulnerable to losing hours or all employment in the crisis.

The second reason is that America’s social safety net — to mix metaphors, the lifeline for low-income households — is not merely tattered, but far less serviceable than those of every other developed country. Resistance to improving it, even in the face of the pain and suffering already being felt by workers cast aside, remains rife among Republicans in Congress.

Let’s look at some pertinent measures. America’s low-income workers earn less in comparison to total average earnings than those in any other developed country. According to statistics from the Organization for Economic Co-Operation and Development, or OECD, the poorest-paid 10% of U.S. workers earn only about 47% of the median wage. That’s a fair pointer to general economic inequality.

Don’t just give airlines bailout money — get something from them in return.

That’s the worst ratio among the 21 countries the OECD surveyed. Low-income workers in Ireland do best, at 72.8% of that country’s median. The ratio is better than 60% in Norway, Australia, Germany, Britain, France and Canada, and better than 65% in Switzerland, Denmark and Belgium.

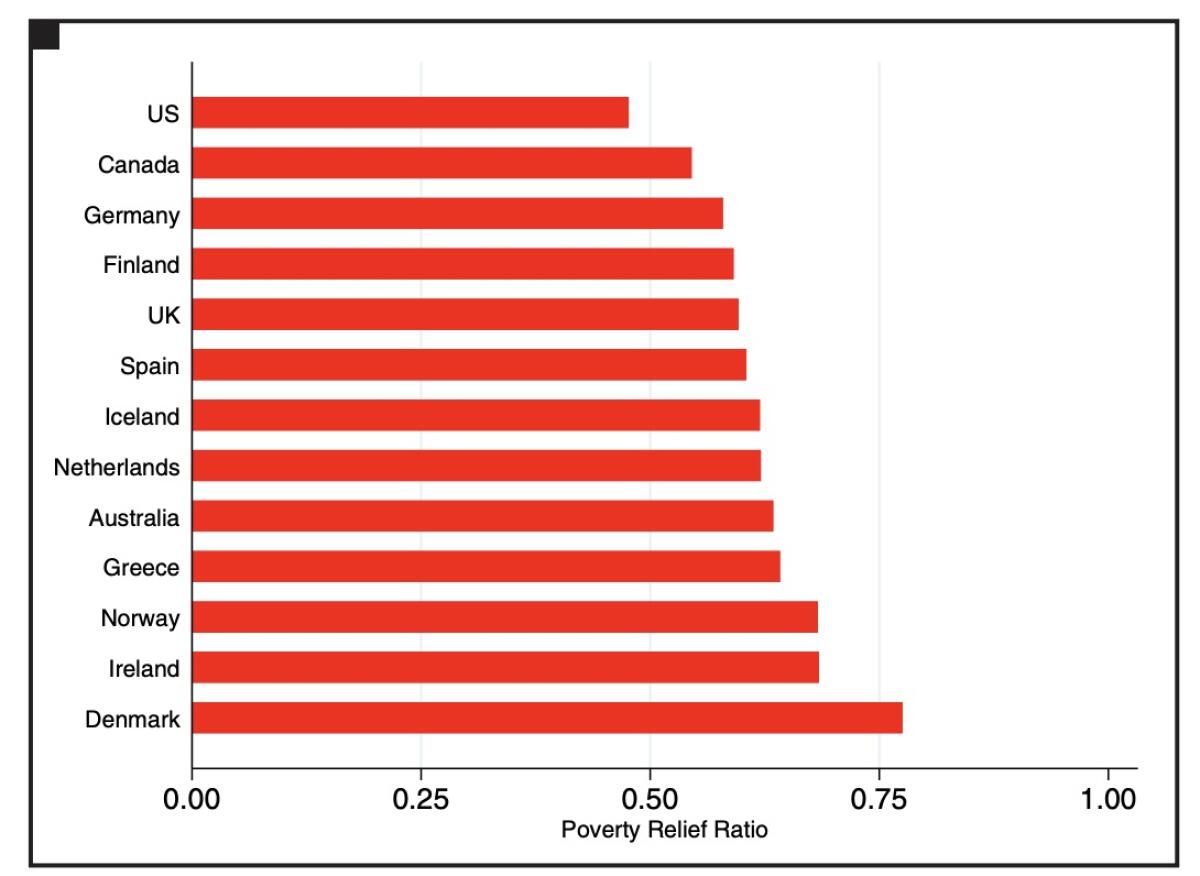

The anti-poverty safety net is threadbare in the U.S., compared with those countries. As Karen Jusko of the Stanford Center on Poverty and Inequality reported in 2016, the U.S. ranked last in terms of its efforts to raise workers out of poverty.

The U.S. provided less than half the assistance needed to raise everyone’s income to 150% of the U.S. poverty level (this year, that would be $39,300 for a family of four). Denmark led the list, providing more than 75% of what’s needed. No country fell below 50%, except the U.S.

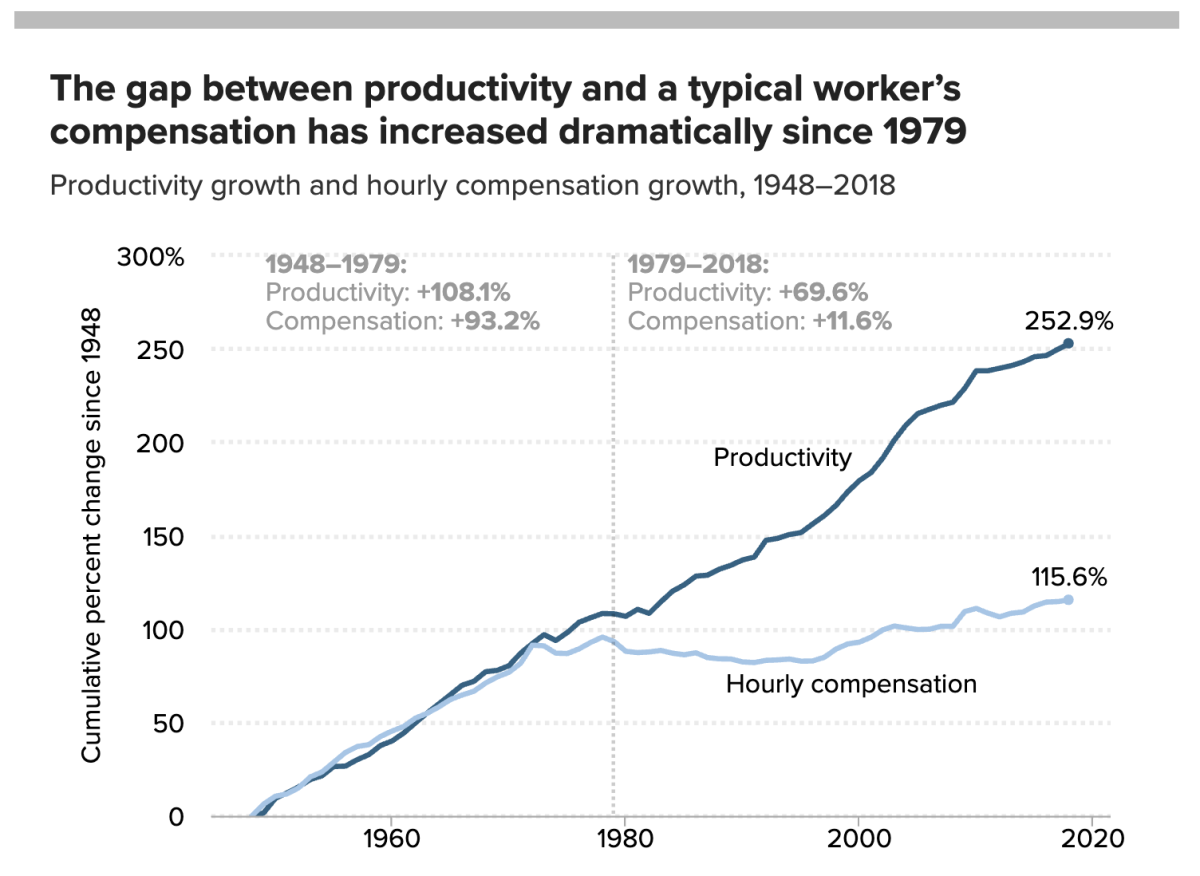

The gap between rank-and-file workers and the rest of the American workforce has been widening since the late 1970s, largely because the productivity gains driving economic growth have been steered upward to the rich.

From 1948 through 1979, according to statistics from the union-backed Economic Policy Institute, productivity — measured as output of goods and services per hour worked — grew by 108%, while wages and benefits for production and nonsupervisory workers grew by 93.2%. From 1979 through 2018, however, productivity grew by nearly 70% but compensation rose by only 11.6%.

According to the Project to Raise America’s Pay, labor’s shrinking share of economic growth has resulted in $30 trillion in lost wages transferred to top executives and corporate profits — that is to say, shareholders — since 1973.

The fragile lifestyles of America’s low-income workers go beyond these raw figures. Working-class Americans have less access to child care, healthcare and digital services such as internet connectivity that middle- and upper-income workers have come to take for granted.

As a result, even if they have jobs that could be performed from home during the American lockdown, they don’t have the resources to get the work done.

They can’t rely on the internet. They can’t afford to bring in someone to keep the children occupied and cared for, a necessity now that the schools are all closed. Filing for unemployment benefits often means a mound of paperwork and a delay before even meager unemployment funds start flowing.

They don’t often have savings to tide them over from paycheck to paycheck, much less from paycheck to no paycheck.

If they need to go to the doctor, a hospital or even an urgent care center, they may have to meet a steep deductible or co-pays if they have insurance, or even greater expense if they don’t. So they may put off needed healthcare, which could mean more dire medical conditions or greater expenses down the line.

Amazingly, President Trump and congressional leaders, especially Republicans, don’t seem to have gotten the message, even now.

A measure proposed by House Democrats that would have provided for permanent paid sick leave and paid family and medical leave benefits was watered down in legislative conference. The final version signed by Trump provides for full-wage replacement for workers who take sick leave for their own care, but only two-thirds of pay for leave taken to care for a sick child or other family member.

Past bear markets bequeathed us a host of investment maxims (but they were often wrong).

“This reduced wage can really make it difficult for workers who only make the minimum wage to afford to take this leave,” says Pronita Gupta of the Center for Law and Social Policy.

The measure, moreover, exempts firms with 500 or more workers, such as big restaurant chains, and allows companies with fewer than 50 employees to seek hardship exemptions, thus cutting out the biggest and the smallest employers of low-income workers.

Congressional negotiators also watered down the bill’s paid family leave provisions. The final version provides for up to 12 weeks of paid leave only for parents of children under 18 whose school or child-care service is closed. But the first 10 days of leave are unpaid, and the remaining 10 weeks are covered only up to two-thirds of pay.

Meanwhile, a next-step stimulus plan developed by Senate Majority Leader Mitch McConnell (R-Ky.) would further shortchange the neediest Americans. McConnell described the plan as providing up to $1,200 for an individual or $2,400 for a couple, plus $500 for every child. (So far, so good.)

But under his plan, the payments, including phaseouts, would be based on 2018 tax returns, or 2019 if they didn’t file for 2018. But one’s 2018 income may not give much of a clue to how needy he or she has become in March 2020: Those whose 2018 earnings exceeded $75,000, where the phaseouts begin, may need much more today.

Some low-wage workers may not have earned enough to file a tax return for 2018, when singles younger than 65 and earning less than $10,400 didn’t have to file (for couples, the threshold was $20,800). The lowest-income workers would receive only $600, while those with less than $2,500 in wage earnings will get nothing.

In other words, for the most vulnerable Americans, even government assistance will increase their unequal standing.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.