Texas forces companies to be neutral on guns or lose business

- Share via

To keep doing business with Texas, companies will in effect have to take a vow of neutrality if the latest school-shooting massacre sets off another nationwide furor over gun control.

That’s because in June 2021, flanked by Republican lawmakers and officials from the National Rifle Assn., Gov. Greg Abbott signed a state law that gives firearm makers, retailers and industry groups a special protection, one that relies on language usually reserved to shield people from racism, sexism, ageism or other forms of prejudice.

As a result, companies signing contracts with government agencies there — including school districts, cities and Texas itself — must verify they don’t “discriminate” against the industry, seeking to force them to ignore any calls to cut their business ties.

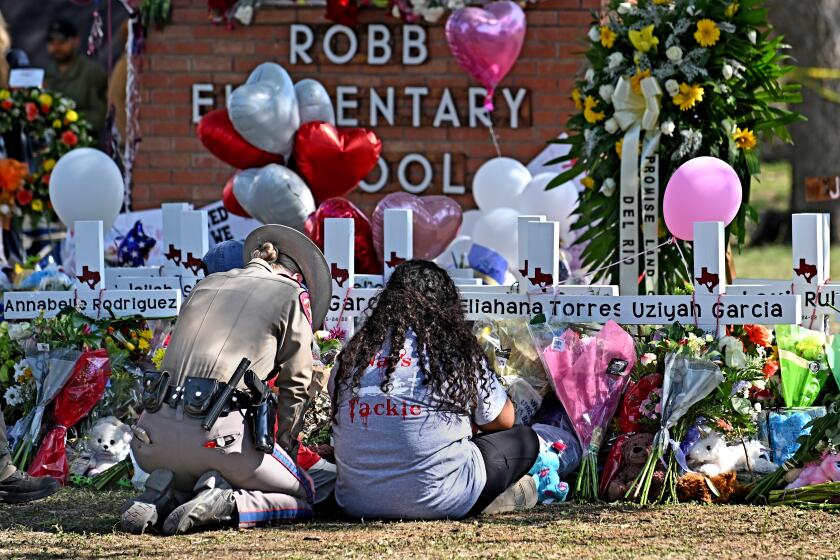

The unusual provision, which has since inspired legislation in other Republican-led states, shows how much power the gun lobby has wielded in the nation’s statehouses to fend off any efforts to curtail access to firearms in the wake of mass shootings. The latest occurred Tuesday at an elementary school in Uvalde, Texas, where a gunman killed 19 students and two teachers in the deadliest school shooting since the massacre at Sandy Hook Elementary School in Connecticut a decade ago.

A gunman killed 19 children and two adults at an elementary school in Uvalde, Texas, about 80 miles west of San Antonio, on May 24, 2022.

The Texas shooting, which came after a racist attack at a grocery store in Buffalo, N.Y., has reignited the debate over gun control, with President Biden saying it’s time to ask when the nation is “going to stand up to the gun lobby.”

But such calls have been met with little success before. In fact, as legislative efforts failed in Washington, the gun industry has been successful in state capitols at fending off new regulations — or, in the case of Texas, finding ways to even increase its might.

“Texas has pro-gun legislation which clearly makes a statement at ensuring that the firearms industry is well protected,” said Janice Iwama, a professor at American University who studies the effect of gun legislation.

The National Shooting Sports Foundation, a trade group based in Newtown, Conn., has been encouraging other states to enact legislation like that in Texas, contending that companies in the industry are being denied services by banks. Lawmakers in Oklahoma and Louisiana have advanced similar bills, and additional measures have been introduced elsewhere.

In recent weeks, amid deadly rampages in Gilroy, El Paso and Dayton, a shopper on EBay could buy a variety of products designed to make the types of weapons used in those attacks as deadly as possible.

The foundation declined to comment Wednesday, citing respect for the victims of Tuesday’s shooting. Spokespeople for Gov. Abbott didn’t immediately respond to requests for comment.

The Texas law has already cast ripples across Wall Street, where Bank of America Corp., JPMorgan Chase & Co., and Goldman Sachs Group Inc. had been curtailing some ties to gun companies, including by not lending to those that make military-style weapons for civilian use. Citigroup Inc. had also put in place restrictions for retailers that it works with.

The Texas bill requires any public contract valued at or more than $100,000 to include a provision that states the company does not and will not discriminate against a firearm entity or trade association.

For months, lawyers and bankers in Texas have complained in private about the vague nature of the law and the difficulty, if not impossibility, of defining how a bank could be discriminating against a firearms entity.

That led Bank of America, JPMorgan, and Goldman to stop underwriting most municipal-bond deals in Texas as they evaluated it, though Citigroup returned to the market last year. JPMorgan cited the law’s ambiguity when it previously announced that it wouldn’t bid on most public contracts. The bank this month, however, took a first step to reenter the market, with its law firm sending a letter to state officials defending the policy. In the meantime, major banks lost business to regional firms that weren’t drawn into political debates, as the industry’s behemoths have been.

The law is also likely to touch the school district where Tuesday’s slaying unfolded. Officials at the Uvalde Consolidated Independent School District recently considered adding a multimillion-dollar bond referendum to the November ballot for school improvement projects, according to local news reporting. To float that debt issue, any underwriter would have to promise not to curtail its gun-industry ties.

Bloomberg writers Hannah Levitt and Jenny Surane contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.