Wall Street buckles under higher bond yields as Dow wipes out gain for the year

- Share via

Wall Street fell sharply Tuesday as it focused on the downside of a surprisingly strong job market.

The Standard & Poor’s 500 index dropped 1.4% to its lowest point in four months. The Dow Jones industrial average tumbled 1.3% and wiped out the last of its gains made for the year so far. Some of the heaviest losses came from large tech stocks, which sent the Nasdaq composite to a market-leading loss of 1.9%.

Stocks fell as the pressure on them cranked even higher from rising Treasury yields in the bond market.

The 10-year Treasury yield climbed again Tuesday, up to 4.79% from 4.69% late Monday and from just 0.50% early in the pandemic. It touched its highest level since 2007 and rose after a report showed U.S. employers have many more job openings than expected.

When bonds are paying so much more in interest, they pull investment dollars away from stocks and other investments prone to bigger swings in price than bonds. High yields also make borrowing more expensive for companies and households across the economy, which can hurt corporate profits.

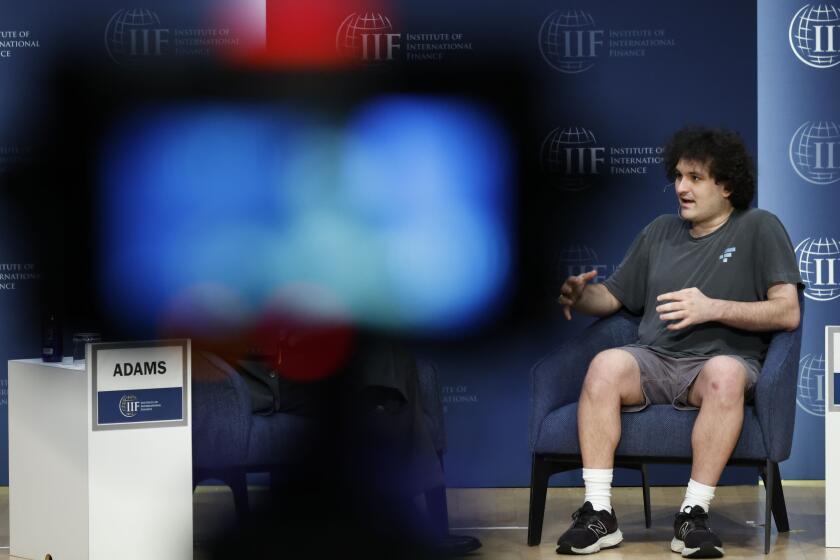

The trial of Bankman-Fried, the founder of the failed cryptocurrency brokerage FTX, will begin Tuesday with jury selection.

Yields have been on the march because investors are increasingly taking the Federal Reserve at its word that it will keep its main interest rate high for a long time in order to drive down inflation. The Fed has already yanked its federal funds rate to the highest level since 2001, and it indicated last month that it may keep the rate higher in 2024 than it earlier expected.

Fed Gov. Michelle Bowman said in a speech Monday that she expects it to probably be appropriate “to raise rates further and hold them at a restrictive level for some time.” Restrictive is what Fed officials call high-enough rates to slow the overall economy.

Tuesday’s report on the U.S. job market could give the Fed more reason to keep rates high. It showed employers were advertising 9.6 million job openings at the end of August, much higher than the 8.9 million that economists expected.

Such hunger for workers could keep upward pressure on wages to attract employees. Although that would be welcomed by workers trying to keep up with inflation, the Fed’s fear is that could give inflation more fuel.

“It’s a classic good news is bad news because the potential impact of higher interest rates on both the economy and markets is becoming concerning as the yield on the 10-year Treasury note continues to march higher,” said Yung-Yu Ma, chief investment officer at BMO Wealth Management.

Big tech stocks were some of the heaviest weights on the market. They and other high-growth stocks are typically seen as some of the biggest victims of high interest rates. Amazon fell 3.7%, Microsoft dropped 2.6% and Nvidia lost 2.8%.

Several other challenges also are tugging at Wall Street, besides higher yields. The resumption of student loan repayments could drag on spending by U.S. households, which has been strong enough to help keep the economy out of a recession despite high interest rates. Higher oil prices are threatening to worsen inflation, and economies around the world look shaky.

A weaker recovery than expected in China’s economy was one of the main reasons McCormick, a maker of cooking spices, reported slightly weaker revenue for its latest quarter than analysts expected. Its profit matched expectations, but its stock fell 8.5%.

The world’s second-largest economy is also facing a crisis within its property development industry, and Hong Kong’s Hang Seng index tumbled 2.7% as investors unloaded stocks of developers.

The ridiculous story of Sam Bankman-Fried, FTX and cryptocurrency generally is aired in two new books, but only one is worth reading and it’s not by bestselling author Michael Lewis.

However, China Evergrande jumped 28% after resuming trading Tuesday. Its shares were suspended last week as the troubled real estate developer announced that its chairman was under investigation.

Markets in mainland China and South Korea remained closed for holidays, while Japan’s Nikkei 225 index fell 1.6%. Stocks were also lower across much of Europe.

On Wall Street, Point Biopharma, which develops cancer-fighting treatments, soared 84.9% after Eli Lilly said it was buying the company for about $1.4 billion in cash. Eli Lilly fell 2.4%.

All told, the S&P 500 fell 58.94 points to 4,229.45. The Nasdaq sank 248.31 points to 13,059.47, and the Dow dropped 430.97 points to 33,002.38.

The Dow is down 0.4% for the year, after being up nearly 8% at the start of August. The S&P 500, which is the index more 401(k) investments are benchmarked against, has sliced its gain for the year so far to 10.2%.

Oil prices were ticking higher a day after slumping sharply to trim their big gains since the summer.

A barrel of benchmark U.S. crude rose 41 cents to settle at $89.23 after charging mostly higher from $70 during the summer. Brent crude, the international standard, rose 21 cents to $90.92 per barrel.

AP writers Matt Ott and Elaine Kurtenbach contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.