Storage start-up Clutter lands investment from Sequoia, and more L.A. tech news

- Share via

A business that stashes clothes, bikes and furniture for people tight on space doesn't sound like much of a tech company.

But that hasn't stopped one of Silicon Valley's top venture capital firms from investing in a Los Angeles storage start-up.

Clutter Inc. has movers pack people's belongings and then haul them to a storage facility until they're needed. It doesn't bring in a huge number of customers, but the ones who do sign up pay a couple of hundred dollars a month and remain customers for a long time, said Omar Hamoui, a partner at Sequoia Capital.

That helps explain why Hamoui's firm recently invested $20 million in Clutter, just six months after leading a $9-million infusion for the company.

“This is more of a high-value subscription business than a one-off purchase," Hamoui said. "The revenue is fairly regular and recurring."

Venture capitalists generally hold in high regard software firms that charge their customers a monthly service fee and don't see much turnover because the combination makes it easy to determine an operation's potential value.

Having a similar business model has been an advantage for Clutter. Other labor-intensive start-ups that deliver goods and services at the push of a button have been struggling to raise funds at desired prices. In part, that's because those companies aren't seen as subscription businesses: People hail a car or order takeout only so often.

That could change. Last month, Postmates, which delivers items as diverse as burritos, clothing and toiletries, launched a $9.99 monthly subscription plan.

At Clutter, it isn’t just the business model that is exciting investors though. Hamoui said another factor in a quick, second investment was that Clutter’s sales have grown significantly since fall. Clutter and rival start-ups that use warehouses on the outskirts of cities also represent a threat to the traditional self-storage industry, which relies on more pricey, urban real estate.

Outsiders may be skeptical about a storage business attracting venture capital. But Hamoui said backing Clutter was like when Sequoia funded an advertising technology company he founded long before the industry took off.

"We’re comfortable with stuff we haven’t seen before," he said of himself and his partners.

Clutter, available in parts of California and New York City, plans to launch in more cities with the new cash. But the 175-employee company will be careful with spending, recognizing that the venture capital market may continue to cool.

Hamoui noted that Clutter likely would have tried to raise significantly more cash two years ago when investors were eager to purchase shares of high-growth companies at any cost.

But the fact that Clutter has to be more conservative now doesn't concern Hamoui, who said a push to start generating profits always has to happen at some point. When exactly it happens doesn't matter to Sequoia as long as the company remains on the right track.

The new investment comes from Sequoia’s Growth Fund, while the previous deal involved the firm’s Venture Fund. The last company to get an investment from both funds was WhatsApp, a Clutter spokeswoman said. Facebook later bought WhatsApp for about $22 billion.

A new way to invest.

Crowdfunder, a Los Angeles company that enables start-ups to sell shares online, has launched a new investment vehicle for wealthy individuals.

People who can cut at least a $100,000 check may invest that big sum into the VC Index Fund, which will hold shares in hundreds of start-ups that have also been backed by top venture capital firms including Andreessen Horowitz and Union Square Ventures.

By investing in a large number of companies through a single fund, Crowdfunder aims to provide more opportunity to strike gold while reducing the chance that the investors will lose their initial outlay.

Silicon Valley venture capitalist Tim Draper is an advisor to the new fund.

Dating app hires in L.A.

Happn, a dating app out of Paris that links users who were simultaneously in the same location earlier in the day, has hired a chief marketing officer for the U.S. who will be based in Los Angeles. Serge Gojkovich previously held a similar role at Grindr, a dating app aimed at gay men.

Two-year-old Happn says it has 14 million users worldwide but wants to quickly grow its U.S. user base of nearly 2 million.

Elsewhere on the Web.

AirMap, a Santa Monica company developing maps of the sky to help drone operators know where they can fly, has raised $15 million in venture capital, according to TechCrunch.

Tradesy, an online marketplace for clothing, is partnering with Los Angeles start-up Happy Returns, which operates a “Return Bar” in Santa Monica. Customers can drop returns off there to get refunds faster, according to Re/Code.

Beauty and home products maker Honest Co. may decide to sell itself if the chances of landing a windfall in an initial public offering continue to look bleak because of stock market wariness, according to Women’s Wear Daily, which cited anonymous sources.

Atom Tickets, a Santa Monica company that brings movie theater concessions to an app, says its early customers have seen double-digit increases in sales of popcorn, candy and other fare, according to the Globe and Mail.

In case you missed it.

Why are the biggest investors in technology backing firms whose tech prowess amounts to little more than a nifty website and a social media team? Silicon Valley, despite its reputation for world-changing ideas, can also quietly embrace the mundane.

Electric car start-up Faraday Future Inc. and mobile app maker Snapchat Inc. are poised to receive millions of dollars in state tax breaks over the next five years if they can hit hiring and investment goals.

To St. Joseph Center, Safe Place for Youth, Grand View Boulevard Elementary and other groups that have benefited from Snapchat's largesse, the nearly 5-year-old company is a model for how Venice's new tech residents can help preserve its character.

Uber agreed to a $25-million settlement in a lawsuit alleging the ride-hailing company misled and overcharged customers in Los Angeles and San Francisco.

Verizon has agreed to buy a 24.5% stake in AwesomenessTV and plans to form a premium mobile video brand.

Coming up.

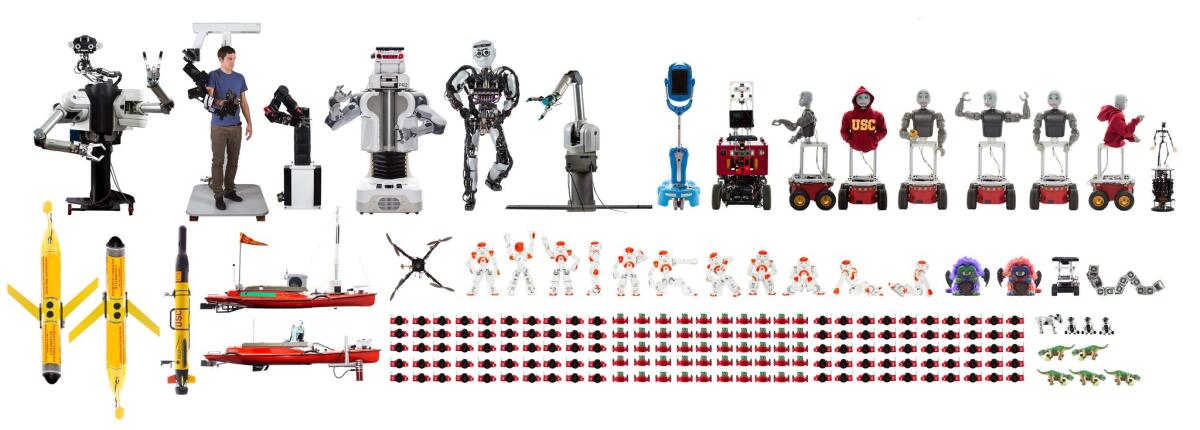

The USC Viterbi School of Engineering hosts its annual Robotics Open House on Thursday, which will let the public interact with about 60 robots that are being used in faculty research. Robots on hand include ones that help in medical settings, education and environmental research.

Twitter: @peard33