California tries to cap oil company profits. Figuring out how is a challenge

- Share via

SACRAMENTO — Nearly five months after Gavin Newsom initially called for a penalty on excessive oil company profits, the governor and lawmakers in Sacramento appear no closer to deciding how to prevent the kind of gasoline price spikes that Californians experienced last year.

At the first legislative hearing on the governor’s proposal at the state Capitol on Wednesday, lawmakers shared concerns about potential unintended consequences of his desire to cap the industry’s earnings.

Some oil market experts said Newsom’s idea to limit oil refinery profits wouldn’t solve the problem — and one called it a “tax gimmick.” Other economists agreed with the Newsom administration about demanding more transparency from oil refiners on pricing, maintenance, supply contracts and inventory.

“I know that legislators do not want the answer, ‘We need more investigation,’ but the fact is shooting first and then finding out if it’s the right solution is going to likely be just as detrimental as helpful,” Severin Borenstein, director of the Energy Institute at UC Berkeley’s Haas School of Business, told lawmakers.

Lawmakers and many experts who testified Wednesday agreed with Newsom that something should be done to prevent oil companies from charging Californians more than drivers in other states, a differential that peaked in October when in-state prices were $2.60 above the national average, while the corporations reap billions in profits. Polls conducted by advocates for Newsom’s policy found that 6 in 10 Californians support a price-gouging penalty on oil refiners when gas prices reach abnormally high levels.

But the hearing underscored the challenge Newsom has faced since he began publicly talking about penalizing the industry before he had a detailed plan to execute it: Solving the problem is even more complicated than it seems.

At Gov. Gavin Newsom’s urging, California lawmakers are expected to begin a special session Monday to consider a penalty on oil profits in response to high gas prices.

Newsom’s push for a cap on oil industry profits comes as the governor engages in a high-profile battle with the industry, which he has accused of intentionally price gouging Californians as retribution for the state’s effort to curb the use of fossil fuels. The petroleum industry argues the consequences of those policies and the state’s dependence on a small number of oil refineries drives up gasoline costs.

Catherine Reheis-Boyd, president and chief executive of the Western States Petroleum Assn., described the governor’s plan as a misguided policy that “focuses on profits, rather than the root cause of price spikes, which is a lack of supply.”

“These supply constraints, coupled with demand driven by the world’s fourth-largest economy and 35 million internal combustion engine vehicles even as we adopt more [electric vehicles], are the primary drivers of fuel costs in the state,” Reheis-Boyd said.

Newsom called for swift passage of a penalty on oil company profits to alleviate financial pressures on working families when he announced the special session in October. At the time, prices topped $6 per gallon. Now, prices have declined to $4.74 per gallon, while steep increases in home heating bills are a growing concern, showing the difficulties the Legislature faces in quickly addressing top-of-mind issues for Californians.

The governor did not attend the informational hearing Wednesday and instead traveled to Palo Alto, where he joined Elon Musk as the Tesla CEO announced that his company would open a new global engineering headquarters in California. Newsom made no mention of the hearing, special session or his proposal for a penalty on oil companies in a video of the event Musk shared on social media.

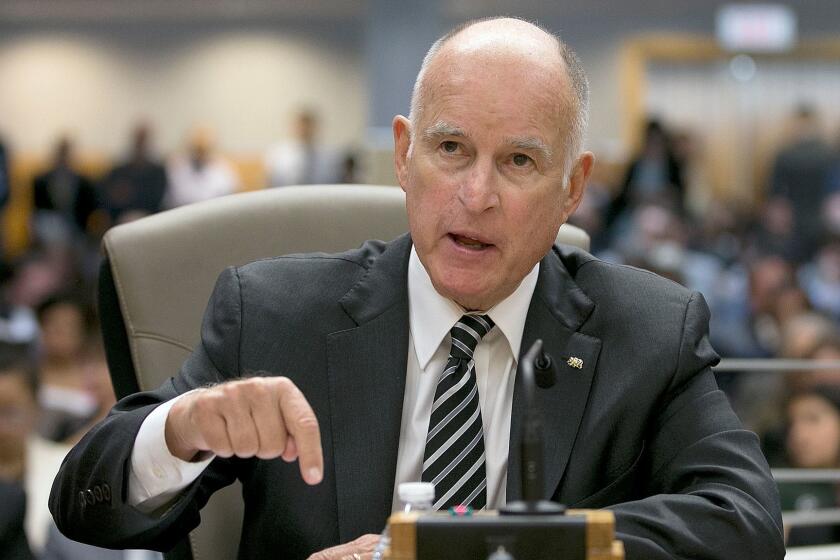

Newsom’s predecessor, Gov. Jerry Brown, on rare occasion testified before the Legislature in support of proposals he championed, such as pension reform in 2011, and the gas tax and the extension of the cap-and-trade program in 2017. Often described as a policy wonk, Newsom has not participated in a legislative hearing since taking office in 2019.

When asked last week, Newsom said imposing a limit on the profits of oil refiners is challenging, in part, because it’s largely uncharted territory in California and the rest of the nation.

“No other state in history has done it,” Newsom said.

The Democratic governor also highlighted the lack of transparency from oil refiners. The state’s largest oil refining companies declined to participate in a prior hearing on gas prices held by the California Energy Commission. Newsom said the state would “fight like hell to see to it that information is provided so they can’t game the system.”

“And once we figure that out, and we’re in the process of doing that, we’re going to be able to fill in those blanks on what apparently everybody wants to see,” Newsom said.

Officials from his administration shared the same concerns to lawmakers Wednesday.

“We’re at a point where I think we need to move beyond sort of the voluntary sharing of information and start using the state’s authority to get the information that you all need to make informed policy decisions,” Nicolas Maduros, director of the California Department of Tax and Fee Administration, said at the hearing.

Newsom calls special legislative session to consider taxing oil company profits reaped by high gas prices.

State Sen. Dave Min (D-Costa Mesa) said he has concerns about the governor’s proposal and didn’t see any “smoking guns” at the hearing. But he also said the state’s petroleum market is broken if the industry is able to earn record profits while Californians pay “ridiculously high” gas prices.

“We have to fix it and I do think we need answers and accountability here because I don’t know where the blame lies,” Min said.

Jamie Court, president of Consumer Watchdog, agreed that more investigation should be done to detail unexplained surcharges, largely at the retail end of the supply chain, but argued that lawmakers should not pass up the opportunity to also cap the profits of oil refiners.

“This is the first time the Legislature has ever focused on why Californians are paying so much more money for our gas and what tangibility can be done about it with a penalty for doing it,” Court said in an interview. “Any legislation that doesn’t have a penalty and a windfall profits cap would be a failure.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.