The Wide Shot: The pandemic hammered Disney. Will it ever be the same?

- Share via

Imagine the “WandaVision”-style alternate-reality version of the last year for Walt Disney Co.

Executives, filmed in 1950s sitcom black-and-white, shake hands by the pool to celebrate a massive 2020. They toast “Black Widow” grossing $1 billion, full queues for Rise of the Resistance at the theme parks and strong numbers for Disney+.

But wait ... what’s that faint voice crackling through the transistor radio? Is that ... Dr. Anthony Fauci?

Back to the real world.

In many ways, the pandemic hit Disney harder than any other media and entertainment company.

The Burbank, Calif.-based entertainment giant lost $2.8 billion in fiscal 2020, furloughed more than 100,000 workers, laid off thousands, delayed the release of its biggest blockbusters, closed an animation studio (R.I.P. Blue Sky) and decided to shed 60 Disney Stores to focus on e-commerce.

In the middle of all of this, the company — which addresses shareholders Tuesday at its annual meeting — has accelerated its transformation into a “direct-to-consumer first” business. At the center of that transition is Disney+, nearing 100 million subscribers worldwide, thanks to hits like “The Mandalorian,” “Hamilton” and, of course, “WandaVision.”

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

The company spent much of the pandemic in a standoff with California Gov. Gavin Newsom over the continued closure of Disneyland. Finally, under new guidance the state unveiled Friday, California theme parks and sports stadiums will be allowed to welcome back visitors as early as April 1, with strict capacity limits.

Theatrical movies remain in question, despite New York City opening cinemas last week. “Black Widow” is still scheduled for May 7, but there’s no guarantee it will stick after Universal Pictures pushed “F9” back by a month to June 25. And after a year of on-demand viewing, analysts say consumer habits probably have changed forever.

Yet Wall Street has sent Disney shares to record heights because of its streaming numbers and the recent parks news. The shares rose 6% to $201.91 on Monday.

So what questions will shareholders have for Chief Executive Bob Chapek on Tuesday? At last year’s event, a child asked the newly named boss what advice he would give a future Disney CEO. What an innocent time.

People surely will want to know more about the return of the parks, the future of the annual pass program and the status of the film schedule.

Then there’s the bigger question of what Disney’s movie release strategy will look like after the pandemic, during which the company experimented with sending movies like “Soul” directly to Disney+.

Last weekend, Disney Animation’s “Raya and the Last Dragon” debuted in theaters and on Disney+ for a $30 fee through its Premier Access strategy. In North American cinemas, it grossed a soft $8.5 million in box office. The company hasn’t said how many people watched online.

Disney has furloughed much of its staff and cut executive salaries. The impacts on Hollywood’s dominant company could be long-lasting.

This came after Chapek caused some waves at an investor conference.

“I think the consumer is probably more impatient than they’ve ever been before, particularly since now they’ve had the luxury of an entire year of getting titles at home pretty much when they want them,” he said at a Morgan Stanley confab last week. “And so I’m not sure there’s going back. But we certainly don’t want to do anything like cut the legs off a theatrical exhibition run.”

Jason Kilar, CEO of WarnerMedia, echoed Chapek’s remarks later in the conference. But the sentiments coming from the head of Disney, until now the most consistent hitmaker for theatrical exhibition, caused a stir. Chapek was not available for comment.

His remarks highlight Disney’s dilemma. To succeed in streaming, it needs to redirect its massive content machine toward making shows and films for subscribers, with the aim of bringing 100 new titles a year to Disney+.

But Disney also has more to lose from the decline of the theatrical business than any other company, and no one expects it to abandon big-screen releases. Disney had a record number of movies in 2019 that grossed $1 billion in global box office worldwide. Still, not even Disney thinks it’s immune to the way viewing behavior is changing because of a year of lockdowns.

“We like to let the consumer be our guide in almost all situations,” Chapek said.

Right now, the consumer really likes Disney+. Chapek and executive chairman Bob Iger in December laid out an aggressive strategy to grow the company’s streaming empire — Disney+, ESPN+, Hulu and Star — to 350 million subscribers by 2024.

And viewers really like “WandaVision,” the Marvel Studios series about a superhero couple.

Disney hasn’t disclosed viewership numbers, but data company Parrot Analytics said the show was 109 times more in-demand than the average show globally over the last 30 days.

Streaming aggregator Reelgood, which measures online interest among its 2 million users, has consistently placed “WandaVision” at No. 1 on its most-watched list since the show’s premiere.

Reelgood CEO David Sanderson said the show’s success validates Disney’s strategy.

“Before COVID, there was an actual water cooler,” Sanderson said. “But now, people have found a way to do the same thing online.”

Disney’s business has always been about different parts of the business feeding into one another. It hasn’t yet seen what having parks and movies operating at full force can do to boost its streaming business. It’s still unclear when it will be able to find out.

Royal ratings

Viewership was huge for Oprah Winfrey’s bombshell CBS interview with Prince Harry and Meghan, the Duke and Duchess of Sussex.

An average of 17.1 million viewers watched the two-hour telecast, according to Nielsen data, which Times writer Stephen Battaglio described as “impressive by streaming-era standards where viewers have more choices and the knowledge that they can catch clips on the internet after a program airs.”

But why wasn’t the hotly anticipated special available on-demand on Paramount+, the streaming service ViacomCBS just launched last week? As Battaglio explains, it’s about competition.

“Viewers who missed the interview can stream it for free in its entirety on CBS.com, the ad-supported website where the network presents its shows after they air,” he wrote. “It will not be available on parent company ViacomCBS’ new subscription video streaming service Paramount+ as it competes directly with Netflix, where Meghan and Harry have a production deal.”

Stuff we wrote

— More Golden Globes/HFPA fallout: Members voted not to hire a diversity consultant last summer, writes Stacy Perman. “But wait, there’s more!” Perman tweeted. HFPA plans “transformational” reforms after The Times’ probe. Time’s Up is skeptical.

— David Crosby, whose first solo album, “If I Could Only Remember My Name,” was recorded 50 years ago, about dinner with Joni Mitchell and his social media spat (yes, really) with Phoebe Bridgers.

— Mark Olsen interviews Dasha Nekrasova (one half of the “Red Scare” podcast) about why she made a horror movie inspired by the Jeffrey Epstein conspiracy theory.

— Battaglio on the unexpectedly fun dynamic between Fox News’ scrappy White House correspondent, Peter Doocy, and President Biden, who plays along with his grilling.

Number of the week

Since Jay-Z acquired a little-known Norwegian music streaming service for $56 million in 2015, Tidal has straggled behind streaming giants like Spotify and Apple Music.

So when Jack Dorsey’s financial tech company Square announced a deal to buy a “significant majority” stake in Tidal for $297 million, people had questions. Square’s lines of business are twofold: a digital payments service for small businesses and the personal funds-sharing service Cash App. Now it has a third business: Tidal. But why?

“With Cash App, Square has made financial services more relatable and accessible to millions of customers, many of whom have been historically overlooked and underserved,” said Square. “Square sees an opportunity to leverage those learnings to help musicians find new ways to support their work and make better decisions through Tidal.”

How putting New York-based Tidal under the same umbrella as Square of San Francisco will empower artists was not immediately clear.

Music and media attorney Bill Hochberg, of Rosenfeld, Meyer & Susman, sees a major opportunity in music-based NFTs (or non-fungible tokens, often referred to as crypto collectibles), which are popular with digital currency enthusiasts. Square and Tidal could sell rare VIP experiences, sneak peaks or lifetime front-row seats as NFTs.

“This could be good for musicians at all levels of success,” Hochberg said. “Kings of Leon’s NFT price tags aren’t so high, so a whole lot of fans can get in on the action.”

Peter Kafka’s funny explainer for Recode offered: But “[e]ven if you think the idea of Jay-Z selling five-second beatbox videos for millions of dollars and high-fiving Jack Dorsey is pretty awesome, none of this requires a $300 million deal to buy Jay-Z’s company,” Kafka wrote.

Yeah, but then Square wouldn’t get Jay-Z on its board of directors.

Showcasing female filmmakers

There are structural problems that keep women and people of color from ascending at the same rates as white men. But also, as Samantha Bee put it in 2016, companies need to “just hire people.”

In an effort to elevate female directors from around the world, distributor ShortsTV recently debuted a collection of short documentaries called “Five,” each one highlighting a female entrepreneur and directed by a woman. The subjects of the shorts, timed for International Women’s Day, hail from India, Lebanon, Chicago, Brazil and Croatia.

One of the docs, for example, directed by Brazil’s Renata Sette, follows São Paulo-based Carolina Ignarra, who, following a motorcycle accident, had to traverse the city in a wheelchair. Ignarra founded the consulting firm Talento Incluir to work with companies to hire people with disabilities.

Sette, who previously directed shorts including the boxing docudrama “The Fight Continues: A Documentary in 12 Rounds,” explained to me through an interpreter why she found Ignarra’s story inspiring.

“She’s a real fighter,” Sette said. “What really surprised me is that she got stronger after she had her accident. It may sound a little clichéd, but Carolina took what could be a tragedy and turned it into fuel in her fight for herself and the people she decided to work for.”

The five films are available to watch on VOD and through Laemmle’s “virtual cinema.” Though the shorts were commissioned by Mastercard, they are not branded content. While such initiatives won’t change anything overnight, Sette said they can be helpful to women in film.

“There are so many obstacles, even today,” she said. “We need to close this gap and we can do that by opening new opportunities. Unfortunately, we need this kind of thing. We shouldn’t, but we still do. We have to fight for that all the time to see that someday we have the same opportunity men have in this industry.”

TikTok talent company sold

Wide Shot exclusive: Los Angeles-based TalentX Entertainment, a company that manages video creators on TikTok, has been acquired by esports firm ReKTGlobal for an undisclosed sum.

Known for assembling the group of TikTok stars at the Sway House in Bel-Air — which includes creators Josh Richards, Griffin Johnson and Bryce Hall — TalentX features a roster of about 40 social media personalities and 15 to 20 employees. Richards is one of TalentX’s cofounders.

ReKTGlobal CEO Dave Bialek, who is based in New York, said the acquisition will expand his company’s reach beyond the male-dominated world of esports. “Now we’re able to equally reach females through content creators on TikTok,” Bialek said.

The acquisition also establishes an L.A. presence for ReKTGlobal, which has 160 employees, including contractors. The move consolidates a previous joint venture between the two firms.

Times staff writer Wendy Lee contributed to this section.

Hollywood production

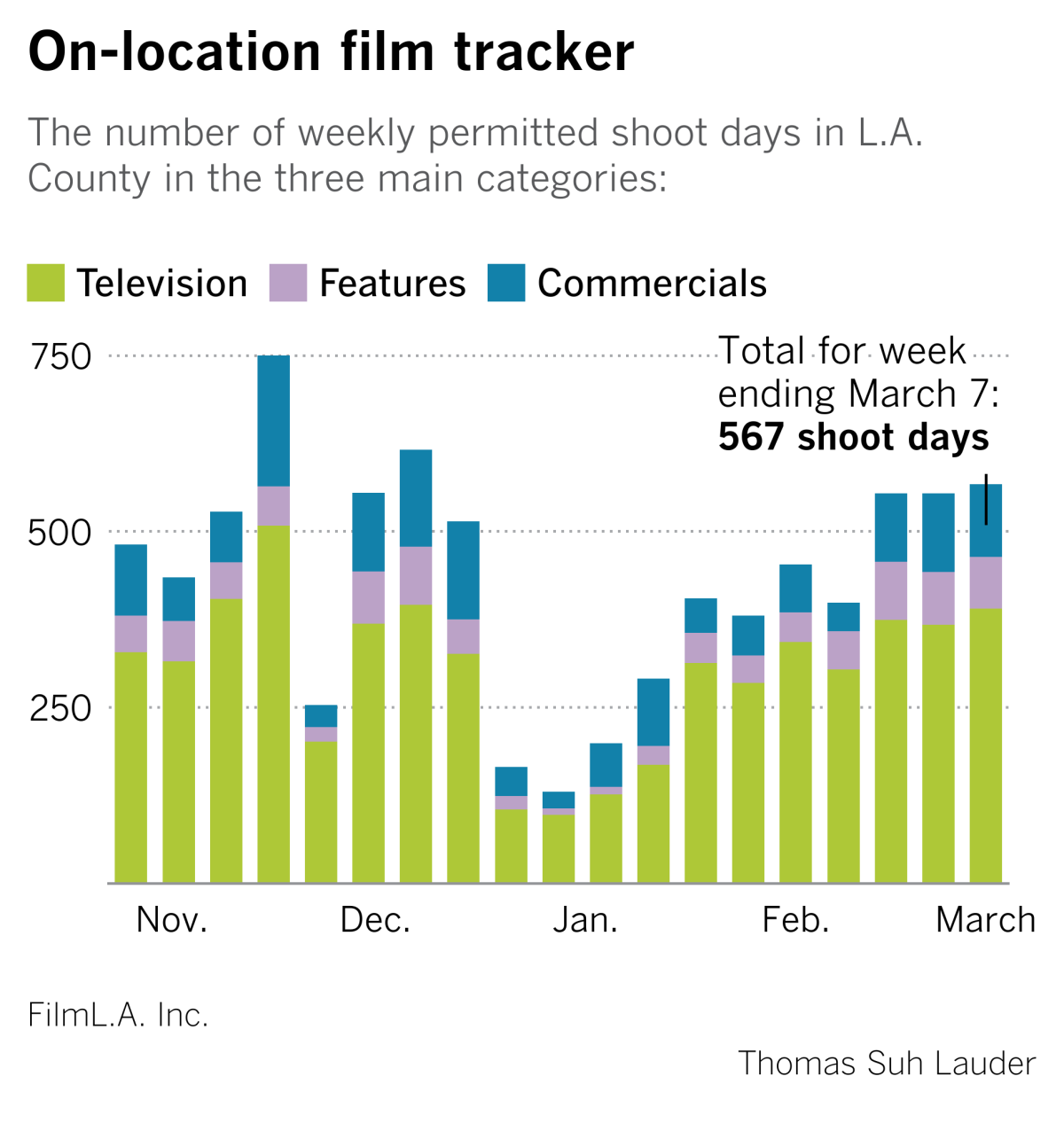

Production in the Los Angeles area saw a slight uptick last week to 567 shoot days, thanks to an increase in television filming. The previous two weeks were steady at 554 days.

More stories from the week

— A fun read about how anyone who’s anyone has a SPAC now from the New York Times’ Style section, which dug into the rise of celebrity SPACs. Everyone, from musician Ciara Wilson to athletes Serena Williams and Colin Kaepernick, is getting in on the trend. But not Kim Kardashian, as money manager Barry Ritholtz pointed out. Maybe she knows something we don’t.

— Former Disney streaming architect and TikTok CEO Kevin Mayer has joined sports streamer DAZN as its new chairman, replacing John Skipper, the former head of ESPN, reported Joe Flint. (WSJ)

— Tuma Basa changed Spotify with a playlist. YouTube’s next. The veteran music exec on trying to make the industry’s gatekeeping obsolete. (Vulture)

— How TikTok made “WandaVision” must-see TV. (CNN)

— Michael Harriot of the Root penned a poignant personal essay about his family’s history with the Seuss canon and why the author’s books were contraband in his childhood home. (The Atlantic)

— How’s this for a New York Times headline to get people talking? The best bagels are in California (sorry, New York). (NYT)

On the calendar

— Grammys air Sunday

— Oscar noms come Monday

— IAB’s annual leadership meeting started Monday and runs through Friday.

Finally ... life after death

“Biggie: I Got a Story to Tell,” the new documentary about the Notorious B.I.G. (real name Christopher Wallace), features revealing interviews with subjects including the Brooklyn rapper’s mother and a sax-player neighbor. The Netflix doc makes much use of personal footage shot by Wallace’s friend, Damion “D-Roc” Butler. Here’s The Times’ review.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.