Excuse me, may I borrow your Netflix password?

- Share via

This is the April 19, 2022, edition of the Wide Shot newsletter about the business of entertainment. If this was forwarded to you, sign up here to get it in your inbox.

Hi, there. My name is Ryan, and I would like to borrow your Netflix password.

No, I’m kidding.

Naturally, as an entertainment reporter, I’m already subscribed. And besides, I assume readers of this newsletter either work in the entertainment industry, or they care about its economic sustainability on some level. As such, surely they wouldn’t even give their login info to a close family member, friend or ex-partner, let alone a virtual stranger coming to them in their inbox.

Right?

Well, yeah, not for free, of course.

As my colleague Wendy Lee wrote recently, password sharing has become a problem that is increasingly hard for media companies to ignore. In an evocative example, Lee’s story describes a dodgy online marketplace where people pay for discounted access to others’ login information.

How does 10 days of Netflix in Ultra HD for just $1 sound, compared with the regular $19.99 a month? What about $1.09 a month for ad-free HBO Max, next to the normal $14.99 a month price tag? And 90 cents for Disney+? Now we’re talking!

Look, as someone working in a subscription-based business, I’m not endorsing this practice.

Sharing Netflix passwords outside one’s household is a violation of the company’s terms of service. Selling passwords is illegal and punishable with fines and prison time under the Computer Fraud and Abuse Act, lawyers who spoke to the Times said. Organizations that do content protection work for entertainment and media companies consider these marketplaces to be vectors of piracy, no better than Napster.

The Alliance for Creativity and Entertainment (ACE), an anti-piracy coalition that includes Netflix, Apple and the major Hollywood studios, called such operations “a growing threat to the creative sector, consumers and the economy.” ACE “has been focused on the growing problem of commercial-scale illegal password selling for some time and continues to combat the harmful practice on all fronts,” the organization said in a statement.

But still, it’s easy to understand why password sharing is happening at such a massive scale.

We’ve written multiple items about people feeling oversubscribed and overwhelmed in the increasingly crowded streaming wars. Companies are bombarding people with more services and supposedly must-watch shows than they can make time for. Some of the new offerings seem increasingly marginal. So it makes sense that people want to offset the aggregate cost of their subscriptions.

Streaming service subscriptions are affordable enough, individually. Some, like Peacock and Paramount+, cost about the same as a fancy cappuccino in Los Angeles. Yet the most established players are raising prices to improve revenue and reinvest in content. Netflix’s standard plan went up to $15.49 a month this year. Disney+ raised fees by $1 last year, and will probably do so again at some point. (The Wide Shot is still totally free, by the way. Tell your friends.)

Customers might start thinking, “Do I really need to watch ‘Only Murders in the Building,’ and if so, why am I paying for Hulu by myself? Maybe that deadbeat former roommate who still has access to my account can finally start going halfsies.” Venmo request sent. Also, set up your own profile, dude. You’re messing with my recommendation algorithm.

More than half (55%) of people who have a video service subscription believe there are too many streaming options, while 53% say it’s getting too expensive to pay for all the content they want to watch, according to a recent poll of 1,500 Americans by the Motley Fool, an online financial resource. One way to cope is to simply borrow someone else’s account. I’m surprised the MoviePass people haven’t started a password-sharing co-op, charging, let’s say, $4.20 to $14.20 a month.

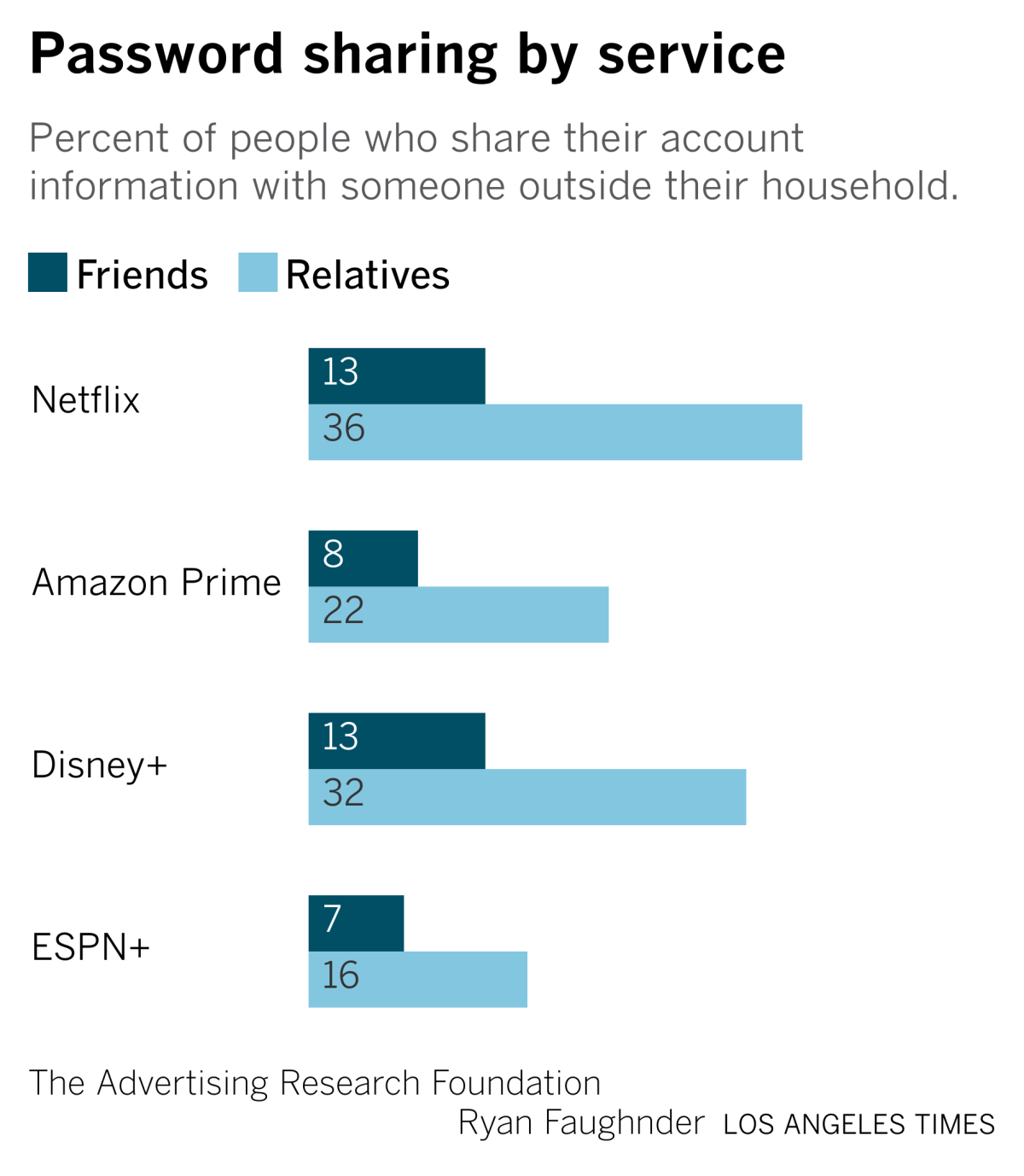

How much is rampant password sharing holding back growth for Netflix? It’s hard to say, but the answer is almost certainly not “zero.” A study by the Advertising Research Foundation said 36% of Netflix subscribers share their password with at least one relative outside of their household, while 13% share their password with a friend outside of their household. And that’s why you know that your mother-in-law watched two thirds of “The Blind Side” sometime in the last week.

Now, after hesitating for a long time, Netflix is starting to crack down in modest ways. The company said last month that it is introducing fees for subscribers in Chile, Costa Rica and Peru to add up to two users outside of their household for an additional $2 or $3 per account.

There’s some outrage online, because that is the way of the internet. Netflix has historically tolerated password sharing, despite estimates that streamers and pay-TV providers, in total, are missing out on billions in annual revenue because of freeloading and account piracy. Streaming services lose roughly $25 billion a year due to password sharing, according to a Citi analyst.

At times, Netflix even seemed to encourage it with a wink and a nod. If they’re stealing our stuff, it must mean they like it, and now even more people will see it! It was good for the brand, or so the logic went.

But Netflix’s growth is slowing, and the company is under pressure from Wall Street to make more money. Netflix reports earnings after the market closes today, and it looks like it won’t be pretty. The company was expected to report adding about 2.5 million in the first quarter, down from nearly 4 million a year earlier, which would be another sign that the post-COVID-19 slowdown, following the early pandemic surge, is real. Those projections don’t reflect the loss of an estimated 1 million subscribers in Russia, where the company has ceased doing business because of Putin’s assault on Ukraine.

Netflix’s revenue is estimated to hit $7.93 billion in the quarter, up about 11% from the same period of time a year ago, which would be the lowest quarterly percentage growth for the company since the end of 2012, wrote Monness Crespi Hardt analyst Brian White in a note to clients last week. The stock is down about 45% so far this year, closing Monday at $337.86.

“Although the content on Netflix has been exceptional over the past couple of years,” White wrote, “nefarious forces appear to be lurking beneath the surface of Netflix’s post-lockdown recovery, either in the form of a slower-than-expected healing process after the pandemic-driven pull forward, a weaker-than-expected global economy, or a platform that has simply hit a near term growth wall.”

There are a number of things Netflix can do to try to spur growth while also minimizing churn. Clamping down on the password free-for-all is one. Raising prices to spend more on content is another. Not all of those moves are going to be popular. But Netflix had to start trying something. And once more restrictive policies become the norm at Netflix, they’re sure to spread.

Stuff we wrote

— What Elon Musk’s bid for Twitter says about social media’s political tightrope. Musk’s proposed takeover highlights the reasons why Twitter has struggled to balance fostering free speech and combating misinformation.

— Another cinematographer tragedy. A 29-year-old student cinematographer was killed Friday when an off-road vehicle carrying a group of young filmmakers rolled over in Imperial Valley, authorities said.

— Happy Easter, Fox News. Shannon Bream’s Bible stories are turning Fox News Books into a publishing force, writes Stephen Battaglio.

— Controversy by the sea. Balboa Boardwalk businesses upset by a closure to make way for filming are seeking edits to Newport Beach’s film policy, reports Sara Cardine.

— Lit City: The Everything Guide to Literary Los Angeles. Check out The Times’ special project on the best bookstores in L.A.

— More news and notes: Facebook is pulling back from its foray into podcasting. Disgraced journalist Charlie Rose is back with a new interview with Warren Buffett. Explaining Hollywood: How to get a job as a music supervisor. “Exploding Kittens” gets show and mobile game at Netflix. Alex Jones’ Infowars files for bankruptcy protection.

Holy Disney war

Walt Disney Co.’s feud with Ron DeSantis over Florida’s Parental Rights in Education legislation — nicknamed the “Don’t Say Gay” bill by LGBTQ activists — recently escalated into a full-blown imbroglio playing out on cable news and social media. To people who know their Disney history, it’s hardly surprising that Burbank and Anaheim have become battlefields in another culture war with religious conservatives.

My latest take on the ongoing Disney saga digs into the parallels with the Southern Baptist Convention boycott of the late 1990s, and the longstanding tensions between Disney and the right, which long saw a kindred spirit in founder and namesake Walt because of his right-leaning politics, family friendly movies and WASP-y persona. To say that things changed over the decades is certainly an understatement.

Religious conservatives have had a wide-ranging list of grievances against Disney during the last 30 years or so. They didn’t like it when Disney extended benefits to the same-sex partners of employees in 1996. They cried foul when Ellen DeGeneres came out on Disney-owned ABC. They balked as Disney released edgier live-action movies through Touchstone and Miramax.

Now partisan cable news and social media are fueling a backlash against not only Disney’s belated political stance, but also the idea of including more LGBTQ themes and moments in movies like “Lightyear.” As our A1 print headline put it, it’s the circle of life.

Number of the week

As expected, “Fantastic Beasts: The Secrets of Dumbledore” posted the worst domestic opening in the history of the Warner Bros. franchise. The J.K. Rowling-penned “Fantastic Beasts” series was supposed to be a five-film cycle, but the studio has not announced a follow-up to “Dumbledore,” the third one to get made so far. Internationally, the new film has grossed $150 million for a global haul of $192 million. That’s not ideal, given the estimated budget of $200 million plus marketing.

You should be reading ...

— Kara Swisher on Elon Musk’s Twitter game. (New York Times)

— The Atlantic’s The Review pod on “Turning Red” and animation’s post-villain era.

— Alissa Wilkinson on the grim satire that explains Ukraine, sort of. (Vox)

— Colin Marshall on what “The Twilight Zone” says about prestige TV. (The New Yorker)

— Savannah Walsh on Warner Bros. wizarding woes. (Vanity Fair)

— Jessica Iredale on the women publicists of the Lede Co. (NYT)

— Jonathan Haidt on social media and a uniquely stupid decade. (The Atlantic)

Finally ... Couchella is on

There are a lot of things to love about Coachella weekend in Los Angeles. Better parking. Less traffic. These days you don’t even have to miss the music, thanks to the festival’s live stream.

Also, this is a good time to be an L.A.-area hip-hop fan. North Long Beach rapper Vince Staples has a new album, “Ramona Park Broke My Heart,” and that’s supplying my writing music this week. Even better, on Monday, Compton’s Kendrick Lamar announced his new album is coming in May.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.