Center Theatre Group headed for fifth straight budget deficit

- Share via

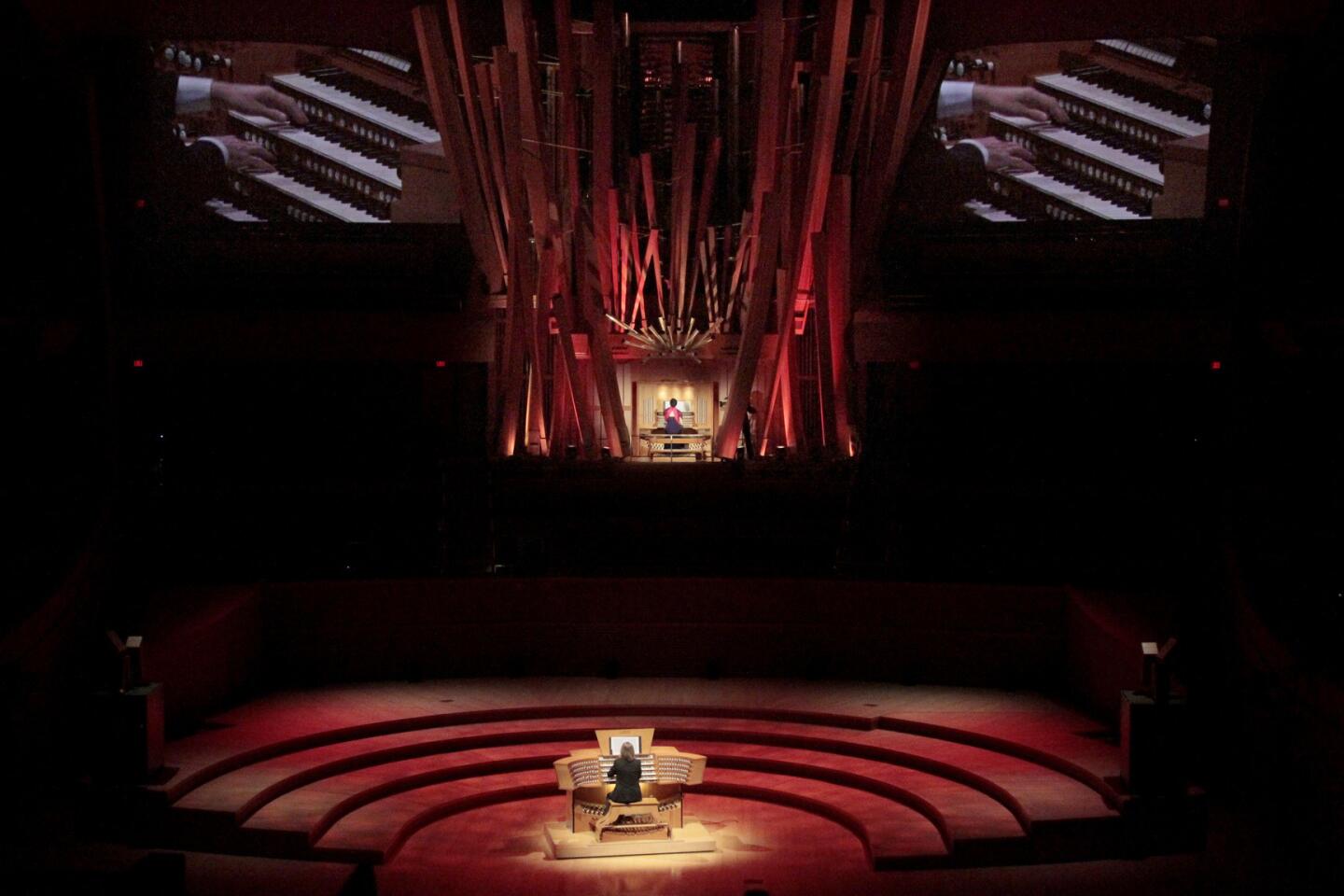

By some measures, L.A.’s Center Theatre Group is the busiest nonprofit stage company in the nation — and it’s the biggest by far outside Manhattan. But now this theatrical giant is in serious need of more than a little help from its friends.

The 2012-13 fiscal year that ends June 30 is expected to yield the fifth consecutive splash of red ink since mid-2008 for the company that runs the Ahmanson Theatre, Mark Taper Forum and Kirk Douglas Theatre.

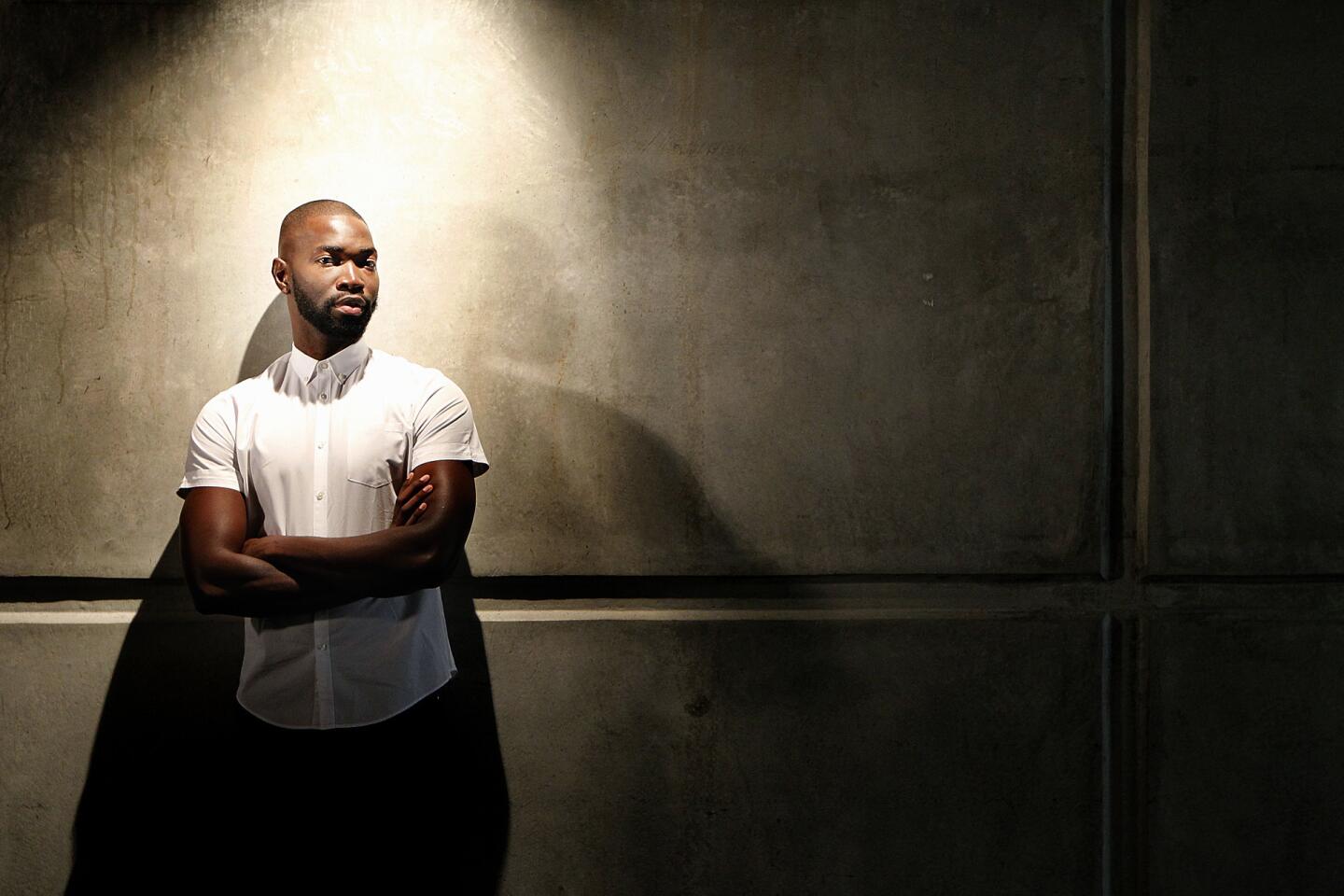

Artistic director Michael Ritchie and managing director Edward Rada said in a recent interview that they expect a $500,000 loss — after four years in which deficits totaled $15 million, or $3.76 million a year.

FOR THE RECORD:

Center Theatre Group: In the June 13 Calendar section, an article about Center Theatre Group’s finances gave two different figures for the post-recession drop in average performances per season at the Mark Taper Forum. The correct figure is 21%, not 27%.

Ritchie and Rada said their strategy in recent years has been to tap a once-substantial nest egg to avoid deeply compromising the quality and quantity of what CTG’s audiences see on stage. But Ritchie acknowledged the approach can’t continue much longer, and a major fundraising push is needed to rebuild the company’s reserves.

FULL COVERAGE: 2013 Spring arts preview

Using its stages to mount about 15 to 17 plays per season, CTG has remained busy, selling more than 500,000 tickets a year since 2008-09, when the recession hit. Even so, the company has struggled.

Investment losses and spending to fill budget gaps had winnowed its reserves by a third since mid-2008, leaving little wiggle room. As of mid-2012, all but $4.2 million of CTG’s remaining investments were in a $38.4-million endowment its board had resolved not to touch.

Despite those difficulties, “overall we’re sound financially,” Ritchie said. Thanks to the nest egg, “we were able to weather for a time the financial downturn” and its repercussions for ticket sales and donations. “We’ll be able to come out of it and to grow.”

He said the company will try to make its 50th anniversary in 2017 a fundraising landmark as well as a chronological one.

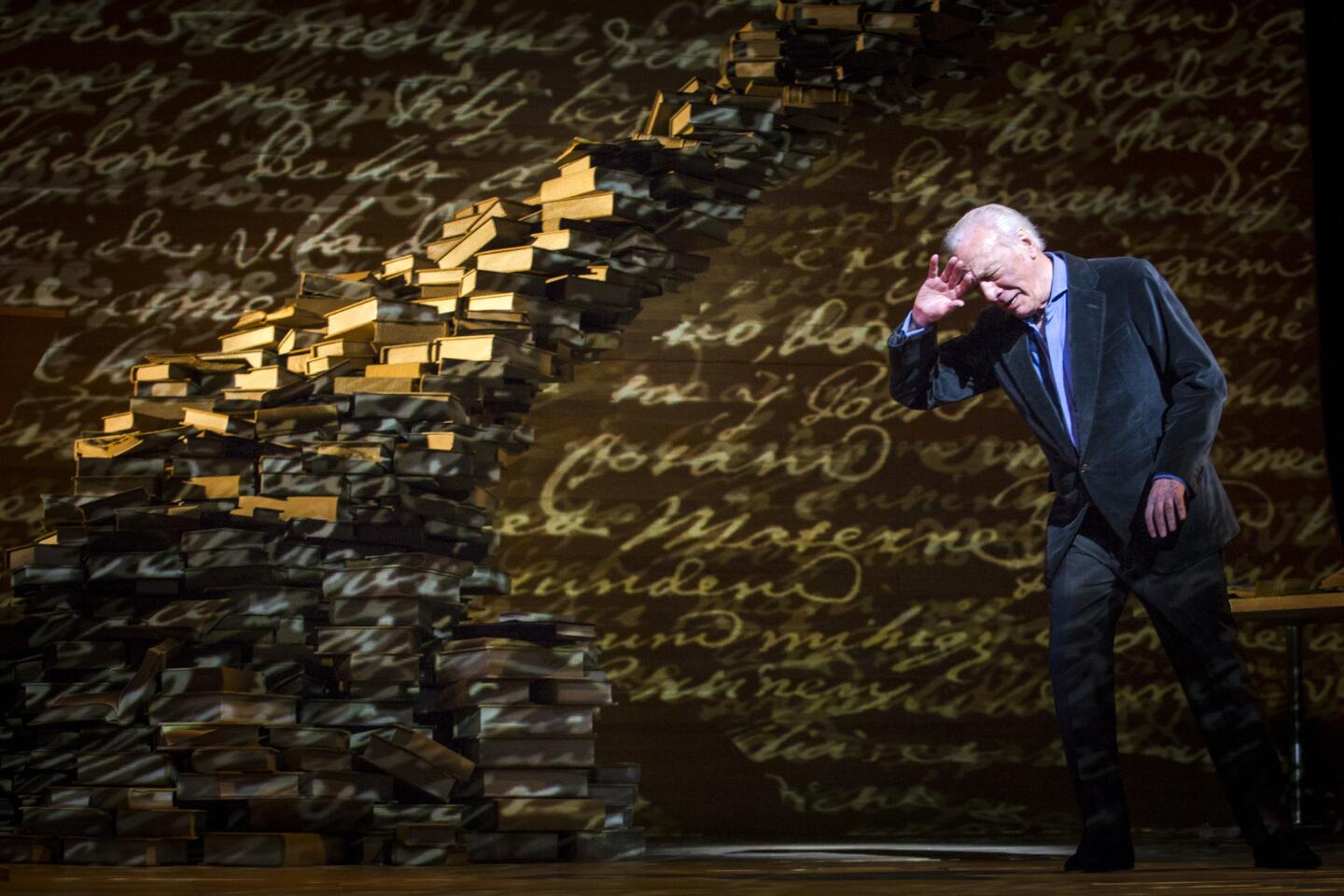

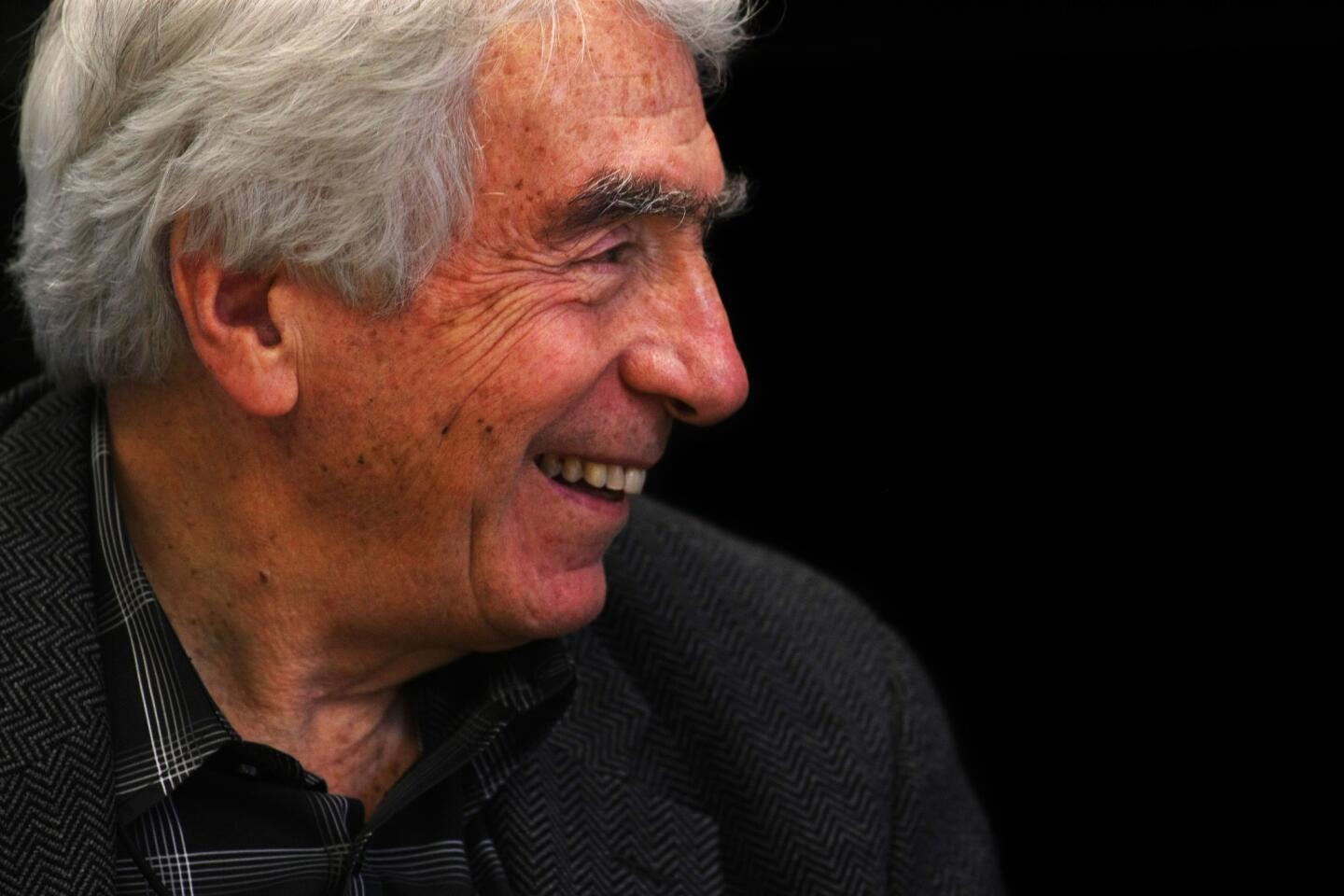

“I think the board, and the rest of our donor base, will see that as an important moment,” said the artistic director, who has led the company since taking the reins from founding artistic director Gordon Davidson in the summer of 2005. “We’ll be announcing the campaign at an appropriate time, and it will be successful.”

A number of CTG’s productions continue to do well at the box office, especially at the 2,064-seat Ahmanson, which mainly features touring Broadway shows. The chronic deficits don’t appear to reflect an operation that’s tanking, but one for which a series of moderate reversals have added up.

PHOTOS: Arts and culture in pictures by The Times

In the four years starting in mid-2008, CTG’s average annual performance revenues — box office plus “ancillary” earnings from its shows, such as concession-stand sales — were 6.8% below the four pre-recession years, adjusting for inflation. Meanwhile, average expenses rose 4.8%. Inflation-adjusted contributions were 1.1% smaller, on average, than in the three years preceding the recession.

The chronic financial problem child of the L.A. arts scene is the Museum of Contemporary Art, which damned the torpedoes during the go-go mid-2000s and allowed spending to run full speed ahead despite a skein of budget deficits. The California attorney general later found that MOCA “did not meet [the] standard” for preserving nonprofit endowments that’s set out in state law.

CTG’s financial reports tell a different story. Between mid-2008 and mid-2012, it cut annual spending from $56.8 million to $48.9 million, adjusted for inflation — a 14% drop that Rada said included layoffs and a two-year wage freeze.

CTG suffered its worst deficit, $5.5 million, during 2011-12. Ritchie said the board had anticipated a $2.5-million deficit at the start of that fiscal year, but it ballooned, largely because a planned revival of the musical “Funny Girl” at the Ahmanson collapsed when CTG’s producing partners backed out.

Stephen Eich, a veteran theater manager who’s now an independent consultant after years of overseeing business operations for the Pasadena Playhouse, Geffen Playhouse and Chicago’s Steppenwolf Theatre, said that running nonprofit theaters has become a much more difficult game, financially, since the late-2000s downturn, which continues to hit middle-class and low-income ticket-buyers much harder than the well-to-do.

PHOTOS: Hollywood stars on stage

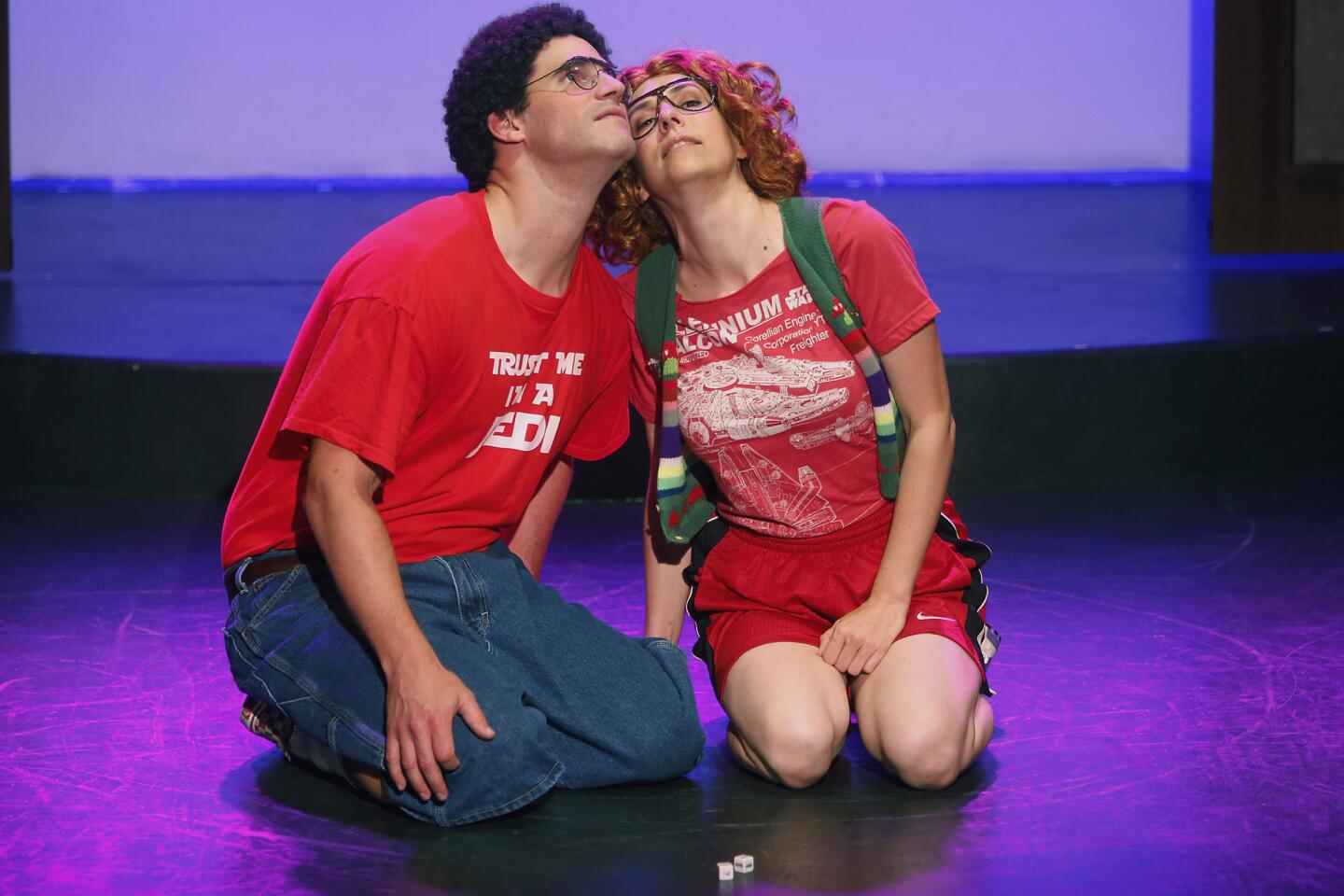

For theater managers, he said, “it’s an ongoing challenge to find a way to keep your head above water financially, and at the same time have some risk, so you don’t lull people to sleep” with safe and predictable play selections.

Center Theatre Group’s streak of deficits isn’t necessarily cause for intense worry, or even entirely surprising, given the economy, Eich said. “I think CTG and Michael and Ed are going to do fine, because they have a strong board that’s respected in the arts community here, and has traditionally understood its responsibilities. They’re obviously there to solve the problem rather than just to close it up.”

New York City’s Lincoln Center Theater and Roundabout Theatre Company are the two nonprofit companies most comparable to Center Theatre Group in size and approach — although there are significant differences.

Roundabout has had its budget struggles, running deficits in three of the four years between mid-2008 and mid-2012. It accumulated $5.2 million in red ink over that span, about a third as much as CTG.

Lincoln Center Theater limits its business risks somewhat by rolling out one show at a time instead of committing in advance to a full subscription season. It generates more than $1 million a year by selling memberships that confer ticket discounts and first choice of seats.

The theater at Lincoln Center ran surpluses in eight of the nine fiscal years from 2003-04 to 2011-12, covering its operating expenses while building a $42-million, 112-seat third stage that opened last year on the roof of its flagship, 1,100-seat Vivian Beaumont Theater.

It also has been a stronger fundraiser than CTG — $18.8 million in average annual contributions (including membership dues), compared with the L.A. company’s $13 million, adjusting for inflation.

CHEAT SHEET: Spring Arts Preview

The 739-seat Taper, whose seasons are weighted more toward plays than musicals, is the CTG stage that has been most affected by the post-recession climate. Average attendance was 606 per performance during five seasons before the recession, according to figures reported in the company’s public tax returns. In four seasons since mid-2008, the average slipped to 575 — down 5%.

The Taper also grew less busy, averaging 234 performances per season since mid-2008, down 21% from the three comparable pre-recession years in which CTG operated on three stages.

The house also became much less busy, shifting to a five-play subscription season instead of six since the recession began, which has meant a 27% drop in the average number of performances per season.

At the Ahmanson and the 315-seat Douglas, average crowds were up from pre-recession days, on a per-performance basis, but neither house remained as busy. The average number of annual performances was down 10.8% at the Ahmanson and 22% at the Douglas from pre-recession norms.

“Spring Awakening,” “Mary Poppins,” “South Pacific,” “God of Carnage,” “American Idiot” and “Les Misérables” all pulled at least 1,579 ticket holders per show at the Ahmanson, pushing the house average to 1,509 for the four years beginning in mid-2008. In the six years before the recession, the average had been 1,394.

With the economy warming somewhat, Ritchie says there are signs of a hopeful trend. Among people who enjoy theater but aren’t keen on subscribing, he said, “someone who in 2007 would see four shows a year went down to one. Now they’re up again to two or three. We’re seeing a return of the casual ticket buyer.”

For a company whose margin for error has grown thin, that’s no casual matter.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.