Op-Ed: Sure as the sun rises, one day your California town will be on fire. Get insurance—lots of it

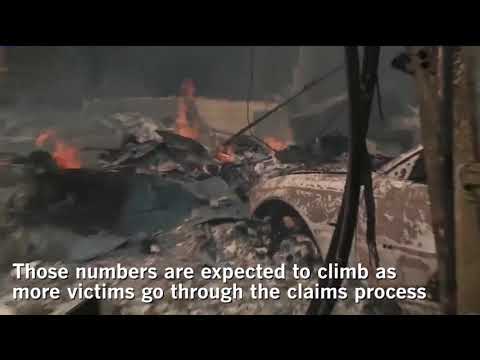

Deadly wildfires in Northern California have caused over $1 billion in losses. (Oct. 20, 2017)

- Share via

Sonoma is on fire. Santa Rosa is on fire. Anaheim is on fire. And as sure as the sun rises tomorrow, one day your California town will be on fire. The best you can hope for is that you’re prepared to rebuild after it happens.

But after the fires are extinguished, thousands of Californians will learn that they are not prepared, because they do not have enough insurance to rebuild their homes. Worse, they may not receive much, if any, assistance from the federal government. FEMA coffers are being depleted from the rising number of annual declared disasters, and federal policy under the current administration seems to change by the day. There are no guarantees.

Insurance industry data reveals that for a score of reasons — inflation of the cost of work and supplies after a mass disaster, the rising cost of home construction, the difference between the cost of construction and the cost of buying an existing home — at least 80% of the homes in the United States have less than 80% of the coverage required to completely rebuild after a fire.

Almost everyone assumes they have enough insurance, but evidently they don’t.

After the fires are extinguished, thousands of Californians will learn that they do not have enough insurance to rebuild their homes.

How can that be? Buried in many California insurance policies is a clause that says the homeowner is the expert on the value of her own home, so if the amount of insurance purchased is not enough, it falls to the homeowner to pick up the difference. Our courts usually enforce that clause.

You may say, “My insurance provides 125% coverage of my home value, so I am comfortable that I have enough insurance.” Don’t take comfort in that policy. The percentage is pegged to the value of the home at the time of purchase, meaning it can sound like a lot more than it is in reality. Real estate values rise — sometimes quickly — and building costs rise after large-scale disasters due to simple supply-and-demand economics.

In the 2003 Cedar fire in San Diego, I had a neighbor who had such a clause and had bought her home and insurance just four months before the fire. Even she didn’t have enough insurance to rebuild, and had to pay a substantial sum out of her own pocket to replace what she lost.

California should change the laws that regulate fire insurance to ensure full replacement of a home lost in a wildfire. For example, California could mandate that every time an insurance company provides a quote for a new or renewed homeowner’s policy, it must also provide an option for uncapped, “guaranteed replacement coverage.” But that process, once started, will take years to move through our political system. Until those laws change, here’s what to do to ensure you have enough insurance.

Before you purchase or renew a home insurance policy, send an email to the insurance broker/agent that says: “I want enough insurance that if my home burns down in a wildfire, I have enough coverage to rebuild my home. Please tell me what amount of coverage I should have, and quote me the rate for that amount of coverage. Please respond by email rather than by telephone or in person. Thank you.”

When the broker/agent responds to that email, purchase the amount quoted immediately. Keep a record of the correspondence somewhere other than in your house — even documents in a fire safe are not “safe” in a fire. Repeat this exercise every single time that you renew your homeowner’s insurance.

Stay safe. Do what you can for our friends in Anaheim and Northern California — send them money, not your old clothes. One day you may need their help in return.

Kenneth S. Klein is a professor of law at California Western School of Law. He lost his own home to wildfire and has received awards for counseling hundreds of fire survivors.

Follow the Opinion section on Twitter @latimesopinion or Facebook

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.