The GOP shutdown drama in Washington costs us plenty, even when Congress averts a stoppage

- Share via

Tired of Congress’ repeated partisan standoffs every time a big fiscal deadline approaches, like this week’s? Weary of the breathless cable coverage of looming government shutdowns or debt defaults, knowing the partisans (almost) always come to some 11th-hour compromise, as they did Tuesday?

Or have you tuned out by now?

Opinion Columnist

Jackie Calmes

Jackie Calmes brings a critical eye to the national political scene. She has decades of experience covering the White House and Congress.

Here’s why you should pay attention: These senseless, self-induced crises have cost us taxpayers big bucks in higher interest on U.S debt, even when Congress manages to avert a government stoppage or a default. On top of that, they’ve taken an incalculable toll on the public’s faith in governance.

And know that this irresponsibility is not a both-sides issue. Democrats and Republicans are not equally culpable. Going back more than a quarter century, it has been Republicans who have provoked the showdowns, setting conditions that couldn’t become law on their own both for funding the government and raising the nation’s debt limit, so the Treasury can keep borrowing to pay the bills.

In fact, Republicans have made budget brinkmanship routine — when a Democrat is in the White House, that is. They were quietly complicit as the federal debt grew by nearly $8 trillion during the Trump administration.

This week’s scary 2024 polls only get scarier when you contemplate what the former president and his allies have in mind for a Trump presidency 2.0.

The serial fiscal dramas have real consequences. The latest came Friday, when Moody’s Investors Service announced that it had changed its outlook for U.S. government debt to “negative” from “stable,” partly because of “continued political polarization.”

The firm’s statement did not single out Republicans explicitly; private-sector analysts stick to politically neutral prose, not least to avoid alienating clients. Yet in expanding on the “congressional dysfunction” it sees as an economic as well as political problem, Moody’s gave four examples: “Renewed debt limit brinkmanship, the first ouster of a House Speaker in U.S. history, prolonged inability of Congress to select a new House Speaker, and increased threats of another partial government shutdown.”

Those examples only describe the House Republican majority.

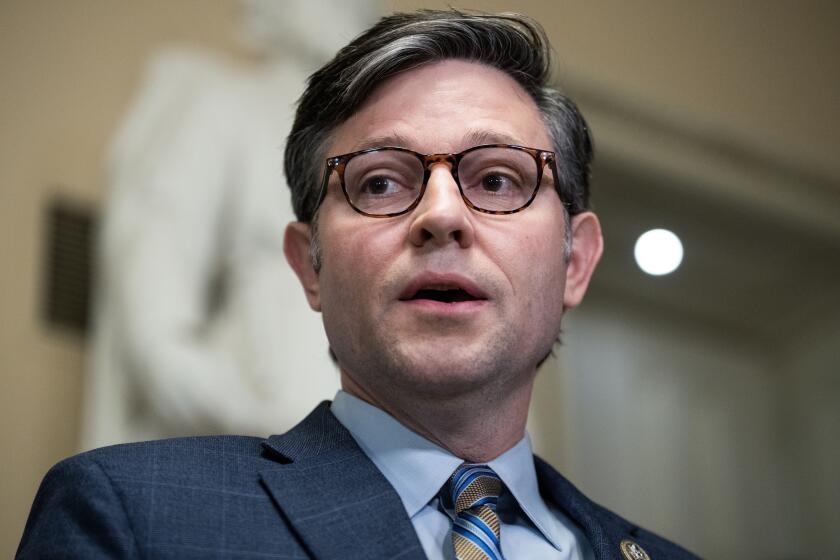

The new House Speaker Mike Johnson is little different from Matt Gaetz and the rest of the ‘Crazy 8s’ who ousted Kevin McCarthy three weeks ago.

On Tuesday the latest shutdown threat was lifted — for now. The House’s novice speaker, Mike Johnson of Louisiana, could not resolve Republicans’ infighting over how much to slash spending and other nonstarter demands, including anti-abortion add-ons. He turned to Democrats for enough votes to pass a stopgap funding bill that simply extends the current spending levels, keeping government open and buying Congress time — to February — to finally reach an agreement for this fiscal year.

So the saga isn’t over yet. Though Moody’s lowered its outlook for U.S. debt, it did maintain the nation’s triple-A credit rating, the highest possible. If Congress makes a hash of the funding process yet again in the new year, Moody’s is poised to knock that down as well.

That, in turn, could provoke the country’s creditors, who buy Treasury bills and notes, to demand that the government pay them higher interest, which only adds to the annual deficit, the tab we taxpayers are ultimately responsible for.

New House Speaker Mike Johnson just relied on Democratic votes to fund the government. Will it come back to haunt him?

Two ratings firms have already downgraded U.S. credit from AAA to AA+. Fitch Ratings did it in August, soon after House Republicans refused to raise the debt limit without unrealistically deep spending cuts. The last-minute debt deal that since-ousted Speaker Kevin McCarthy negotiated with President Biden enraged far-right Republicans and was the beginning of his end.

Fitch’s reasoning previewed Moody’s. Its analysis pointed to a “steady deterioration in standards of governance” over the past two decades. In other words, dysfunction is nothing new, it has just gotten worse in the MAGA era. Again, Fitch didn’t cite “Republicans” specifically, but the timeline makes clear who it faulted.

Fitch had warned months earlier that “debt ceiling brinkmanship” and the continued questioning of the 2020 presidential election were worrisome signs. When it finally lowered the credit rating, Fitch reportedly told Biden administration officials that the Jan. 6, 2021, insurrection was a factor. According to the Associated Press, Fitch had concluded that the government’s stability deteriorated from 2018 to 2021, then increased once Biden succeeded Trump. But then Republicans took over the House this year.

He has devoted his career to demeaning, endangering and imprisoning LGBTQ+ people. That’s the résumé House Republicans were looking for.

Fitch’s downgrade was only the second time in the nation’s history that the U.S. credit rating has been cut. The first was after a 2011 debt-limit crisis, when Standard & Poor’s took the AAA rating down a peg. It has never restored the top rating.

There is a parallel between Congress’ fiscal mayhem in 2011 and 2023: Those years followed Republicans’ winning a House majority in midterm elections, and resolving to shake things up under a Democratic president. In 2011, it was the tea party takeover. Now we have the MAGA House.

Republicans once claimed the descriptor “fiscal conservatives.” But over decades of covering budget policy, I’ve watched them squander that brand. Insisting on excessive spending cuts to reduce deficits while opposing any tax increases, threatening shutdowns and near-defaults — those aren’t the tactics of fiscal conservatives.

By now we’re sick and tired of the brinksmanship. If only Republicans were too.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.