Trump’s tax cuts could cost U.S. trillions of dollars, experts say

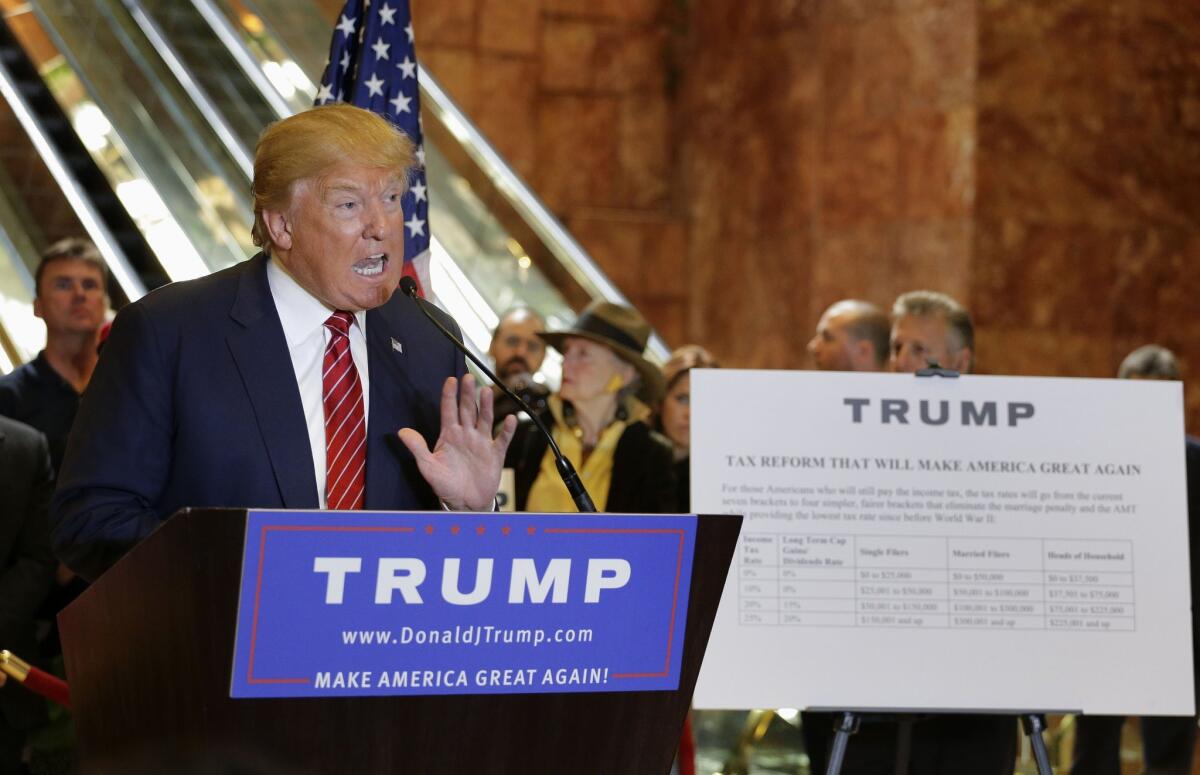

Republican presidential candidate Donald Trump talks about his tax plan in New York.

- Share via

Republican presidential front-runner Donald Trump proposed a major package of tax cuts on Monday, but offered few specifics on how to pay for them – and experts predicted they would cost untold trillions of dollars.

Trump, who has faced pressure to offer a detailed campaign agenda, vowed to simplify the tax system, with four individual income tax brackets: 25%, 20%, 10% and 0%. The highest of the seven current brackets is 39.6%.

Trump would also lower the 35% corporate rate to 15%. But businesses would lose tax breaks on earnings overseas and various unidentified “loopholes that cater to special interests.”

Millions of individuals who earn less than $25,000 a year, or couples who make less than $50,000, would no longer pay income tax, Trump said. They would instead send a one-page form to the Internal Revenue Service stating, in characteristic Trump fashion: “I win.”

Trump, the billionaire real estate developer, acknowledged that tax rates on the wealthy would drop, but said his plan would result in a vastly simpler tax code.

“My returns go up to the ceiling and beyond, which is ridiculous,” he told reporters at a news conference in front of the lobby escalator at Trump Tower in Manhattan.

TRAIL GUIDE: All the latest news on the 2016 presidential campaign >>

Beyond his boast, though, how his plan would accomplish any of his predictions remained murky.

Tax experts said it would cost the government trillions of dollars in lost revenue. How many trillions is unknown, they said, because of Trump’s lack of detail on which tax breaks he would wipe out.

“He’s very specific about the nature of the tax cuts, but very vague about the nature of the tax increases,” said Howard Gleckman, senior fellow at the nonpartisan Urban-Brookings Tax Policy Center. “Politicians of both parties have been playing that game forever, and he’s just doing it too.”

Trump’s tax cuts appear to be substantially larger than those recently proposed by his Republican rivals Jeb Bush and Marco Rubio, experts said. The plan also hews closely to standard Republican fiscal policy despite Trump campaign rhetoric that has hinted he might challenge party orthodoxy on taxes.

It’s clear the cuts would benefit the wealthiest Americans more than anyone else, Gleckman said. Trump’s plan would eliminate the federal inheritance tax, a cut that could produce a windfall for his own children. The tax applies to estates of $5 million or more for individuals, and $10 million or more for couples.

Trump vowed to keep personal income tax deductions for mortgage interest and charitable giving. He also called for abolishing the alternative minimum tax, which was initially aimed at ensuring that the wealthy pay their fair share, but has proved costly to more and more middle-class taxpayers.

At the same time, Trump said he would reduce or eliminate “most deductions and loopholes available to the very rich.” He provided no details.

Elimination of some deductions, like the one for state and local taxes, could adversely affect people in high-tax states such as California, said Edward McCaffery, professor of law, economics and political science at USC.

“The devil is in the unspecified details,” he said.

Get more national political news and the latest from Campaign 2016 >>

Release of Trump’s tax proposal came 12 days after a Republican presidential debate in which Trump was notably less detailed on federal policy than a number of his opponents.

One of the methods Trump proposed to pay for his tax cuts would be to end the deferral of income taxes on corporate profits earned overseas. He would offer a one-time “repatriation” of money held abroad, taxing those earnings at a discounted 10% tax rate. President Obama proposed a similar tax this year, at a 14% rate, and the idea has gotten bipartisan support, though at lower rates than Obama’s plan.

Kyle Pomerleau, an economist at the nonpartisan Tax Foundation in Washington, said it was highly unlikely that the overall plan would cost the government nothing, as Trump asserted.

“Even accounting for additional economic growth from the plan,” he said, “it still wouldn’t be able to claw back the revenue losses.”

For months, Trump hinted that he would break with his party and crack down on tax breaks for Wall Street. His plan does include elimination of the so-called carried interest break that has enabled hedge fund titans and private equity investors like Mitt Romney to pay lower tax rates than the middle class.

But it’s not clear that Trump’s plan would actually raise taxes on the group. Most of their investment income is now taxed at the top 23.8% rate for capital gains. Under Trump’s plan, it would be taxed as ordinary income, at the new top rate of 25%. Whatever investors earned in ordinary income, currently taxed at 39.6%, would be taxed at a maximum of 25%.

Because much of the other earnings of Wall Street’s richest bankers is already taxed as ordinary income, the net result could be a substantial drop in their overall income taxes.

Twitter: @finneganLAT

MORE POLITICS NEWS:

Kevin McCarthy announces bid to become House speaker

Meet the busboy who’s taking on Donald Trump over immigration

Hillary Clinton’s big donors in California have found all sorts of reasons to be nervous

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.