Q&A: When will you receive a government payment from the coronavirus bailout?

- Share via

WASHINGTON — The economic stimulus bill provides direct payments to many American adults to help them pay their bills as they navigate through the shutdowns caused by the coronavirus outbreak.

Here are answers to common questions about the payments.

Who is eligible?

All U.S. residents are eligible as long as they have a work-eligible Social Security number and meet the income requirements. People whose income is entirely from nontaxable, means-tested programs — such as Supplemental Security Income benefits — are eligible too. If a person is a dependent on someone else’s tax return — such as a young adult — they cannot get a payment.

How much will the payment be?

All Americans with an adjusted gross income below $75,000 (or $150,000 for a married couple) would receive the full amount: $1,200 per adult or $2,400 for a married couple. In addition, they are eligible for an additional $500 per child under 17. People with no income are eligible for the same amount too.

A family of four — two adults and two children — that makes under $150,000 will get $3,400.

Americans who make between $75,000 and $99,000 (or married couples making between $150,000 and $198,000) are eligible for a portion of the payment. The rebate amount is reduced by $5 for each $100 in income over $75,000 (or $150,000 for a married couple.)

For instance, a single person with an adjusted gross income of $85,000 would get a payment of $700. A single person making $90,000 would get $450.

A married couple with an adjusted gross income of $180,000 would get $900. A married couple making $190,000 would get $400.

In each case, every dependent child would result in an additional $500. The amount per child is not adjusted by income, but is only available to parents with income of $99,000 or less and married couples with income of $198,000 or less.

What’s my adjusted gross income?

Adjusted gross income is a line on your federal income tax filing. It is a person’s wages, dividends, capital gains and other income minus 401(k) payments, student loan interest and other deductions.

The figure can be found in Box 7 on a person’s 2018 federal 1040 tax return or Box 8b on 2019 returns.

My income as a single person is over $99,000 (or as a married couple is over $198,000). Am I eligible?

No. Eligibility is capped at $99,000 per adult, or $146,500 for head of household filers with one child, and $198,000 for joint filers with no children.

What do I have to do to get my payment?

Most Americans won’t have to do anything to get the benefit. The Internal Revenue Service will base the payments on a person’s adjusted gross income on his or her 2018 tax return (or their 2019 return if filed). Low-income persons who file a tax return in order to get the refundable Earned Income Tax Credit or Child Tax Credit are included.

How soon will payments go out?

According to new estimates from the Trump administration provided to the House Ways and Means Committee, people who already receive direct payments from the IRS should start getting money the week of April 13. Estimates suggest that the IRS currently has direct deposit information for about 50% of tax filers, or about 60 million people.

The IRS is creating an online portal where people can update their direct deposit information and track the status of their payout. It is also creating a “simple tax return” that contains only a few questions, including name, Social Security number, dependents and deposit information to speed up the process for getting money to people who don’t normally have to file taxes.

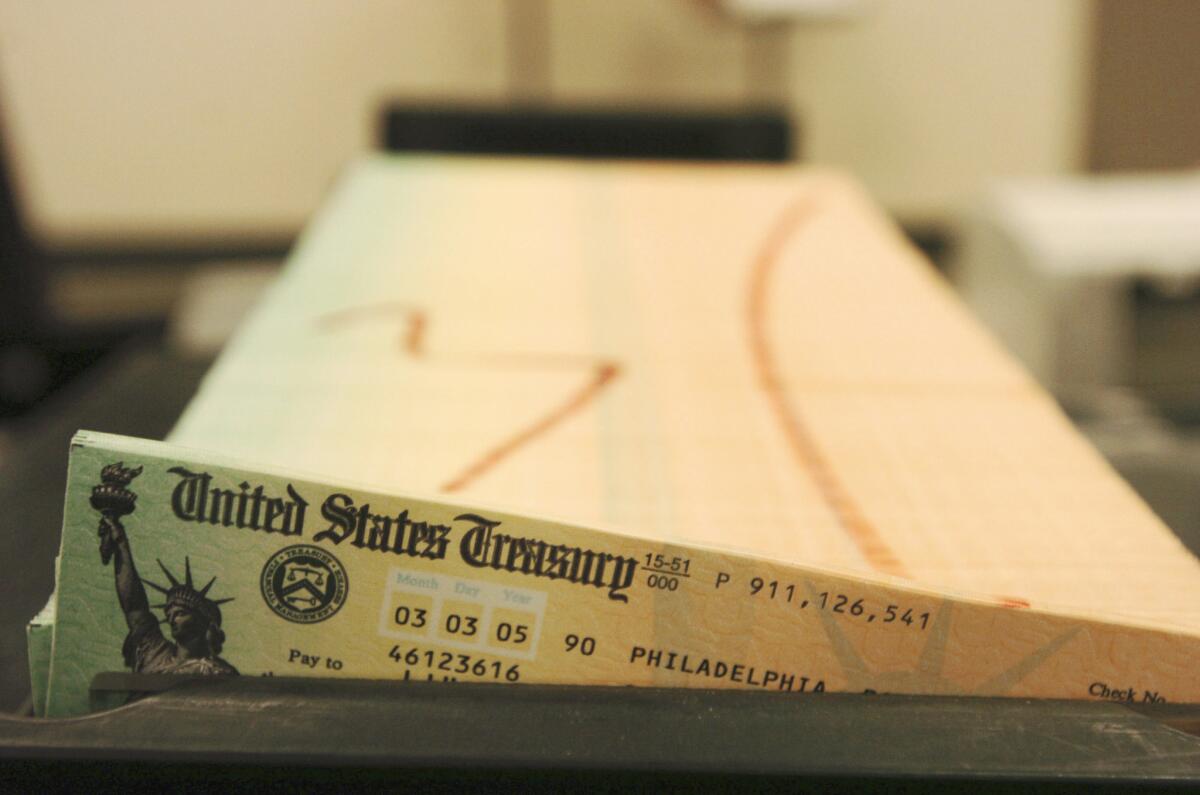

Checks could take longer, and will start being printed the week of May 4. Some may have to wait weeks or even months to see their money because it will take the IRS longer to get the paper checks printed. Prepaid debit cards may be sent out as an alternative, Treasury Secretary Steven T. Mnuchin said.

When the government has done similar direct payments in the past, it has taken two months or more to put the money in people’s hands, and the estimates provided to the House Ways and Means Committee indicate it can take 20 weeks to print all the checks.

But Mnuchin emphasized that checks are the least favorable option.

“This money does people no good if it shows up in four months,” Mnuchin said.

What if $1,200 is not enough to cover my costs?

The payments will be made in a one-time payment. But lawmakers have already opened the door to cutting additional checks in the future.

How many Americans will this help?

About 93% of people who file taxes, or 165 million households, are eligible for some sort of payment, according to an estimate complied by Kyle Pomerleau, a tax expert at the American Enterprise Institute.

Will the payments be taxed?

No, the money is not taxable, according to a Senate Republican aide.

Why are the checks based on my 2018 income? I need help today.

While basing eligibility on a person’s income today would have been more accurate, there was no easy way for the IRS to make that calculation, Pomerleau said. The next best alternative is to use 2018 or 2019 taxes.

But the IRS plans to make adjustments for people who don’t get a payment now, even though they would have qualified for one based on their 2020 income.

If a person’s income dramatically fell since 2018 (or 2019) — for instance, if they made $150,000 in 2018 and $60,000 in 2020 — they would not get a check this spring. But the IRS will credit the amount they should have received based on their 2020 adjusted gross income to the person’s 2020 tax return. Similarly, if a person gets a check but would be entitled to a larger one based on their 2020 income, they’ll get a credit from the IRS on their 2020 return.

Basing the checks on 2018 or 2019 income was the IRS’ only option, even if that meant people who saw a significant decline in their 2020 income wouldn’t get relief for many months.

“There is a significant timing issue — the idea here was to get checks into everyone’s hands as fast as possible,” Pomerleau said. “Being made whole at a later date really doesn’t help you very much if we’ve somewhat recovered or mostly recovered from this when you get the money.”

On the flip side, if a person’s 2018 (or 2019) income makes him or her eligible for a check now, but their 2020 income turns out to be so much higher — for instance, they earned $60,000 in 2018 and $150,000 in 2020 — that they shouldn’t have gotten one, they will not have to repay the IRS.

Similarly, if their payment based on 2018 income is larger than it would have been based on 2020 income, they will not have tor repay the difference.

What if I haven’t filed taxes for 2018 or 2019?

You should file a return. Even though the 2019 tax deadline has been moved to July 15, the rebate can begin to be processed as soon as a 2019 tax return is filed.

Will I get a check if I get Social Security?

Yes. Even if you don’t normally file taxes, you should get the payout through the same method you receive your Social Security payments. The IRS will use information on the Form SSA-1099 or Form RRB-1099 to send senior citizens and Social Security recipients the money.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox twice per week.

You may occasionally receive promotional content from the Los Angeles Times.