El Salvador explores bitcoin mining powered by volcanoes

- Share via

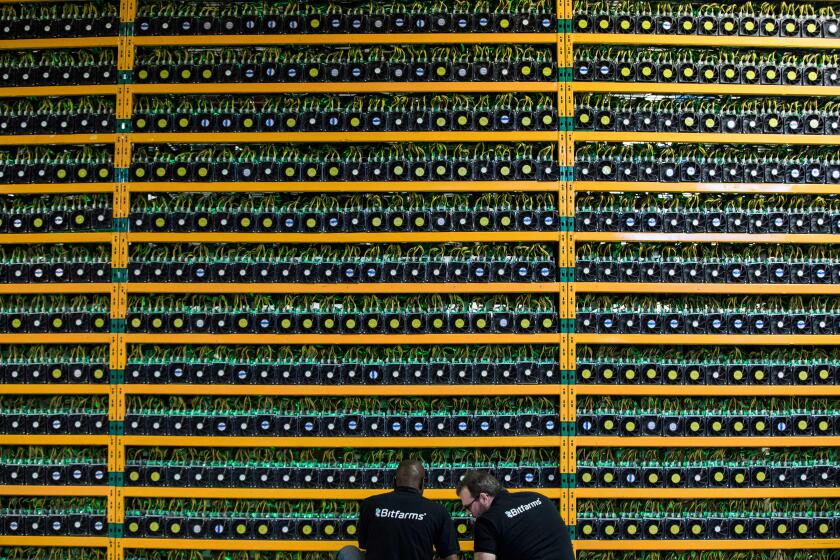

BERLIN, El Salvador — At a geothermal power plant near El Salvador’s Tecapa volcano, 300 computers whir inside a trailer as they make complex mathematical calculations day and night verifying transactions for the cryptocurrency bitcoin.

The pilot project has inspired a rash of volcano emojis from President Nayib Bukele, who made bitcoin legal tender in September, and promises of cheap, renewable energy for so-called bitcoin “mining.” Such operations, including ones industrial in scale, have been harshly criticized elsewhere in the world for the massive amounts of electricity they use and the resulting carbon footprint.

Bukele and others say El Salvador’s geothermal resources — generating electricity from high-pressure steam produced by the volcano’s subterranean heat — could be a solution. But the picture in the tiny Central American country is more complicated.

“We don’t spend resources that contaminate the environment, we don’t depend on oil, we don’t depend on natural gas, on any resource that isn’t renewable,” Daniel Álvarez, president of the Rio Lempa Hydroelectric Executive Commission, which oversees the plant, said during a tour Friday.

Cheap power and a supportive government are the two critical factors for attracting bitcoin mining operations, said Brandon Arvanaghi, a bitcoin mining consultant.

Two years ago, China provided about three-quarters of all the electricity used for crypto mining, with operations flocking to take advantage of its cheap hydroelectric power. But the government began restricting mining and in September declared all transactions involving bitcoin and other cryptocurrencies illegal.

That has led to a scramble to set up mining operations in other countries.

Chinese officials have taken steps for months to crack down on cryptocurrencies, with mixed effects. On Friday, they tried to erase any doubts about their intentions.

It would appear to be fortuitous for Bukele, who shocked the nation and many around the world with his announcement last summer that bitcoin would become legal tender beside the U.S. dollar in El Salvador. The president sold the plan in part as a way for Salvadorans living overseas — mostly in the U.S. — to send money home to their families more cheaply. It also made him a darling of the bitcoin world.

But the launch has been rocky. The digital wallet Salvadorans were expected to use to perform basic transactions had a glitchy rollout. Some users said they just wanted the $30 the government offered as an incentive. There continue to be concerns that the digital currency, which touts being controlled by no government, will invite criminal activity.

So far, the United States has been a big winner in attracting more bitcoin mining operations, especially the state of Texas, which has bountiful renewable energy and a deregulated market.

Bitcoin mining in El Salvador would appear to have a supportive government in Bukele, but cheap electricity is so far just a promise.

El Salvador imports about one-fifth to one-quarter of its electricity. The rest of production is divided among hydroelectric, geothermal and plants fired by fossil fuels.

Geothermal accounts for about a quarter of the country’s energy. El Salvador has 23 volcanoes.

“When you add these renewable sources like these vast abundant areas, a ton of renewable sources and a friendly regime it can be very attractive, and El Salvador may very well fit that model,” Arvanaghi said.

Right now, El Salvador’s electricity is not considered particularly cheap.

The website GlobalPetrolPrices.com, which publishes retail energy prices around the world, puts electric costs to households and businesses in El Salvador well above the global average.

Arvanaghi said that bitcoin mining incentivizes the expansion of renewable energy production by providing high demand for cheap power and that miners have shown themselves to be willing to pause a portion of their machines at times when there is less power available from the grid.

Bukele’s promise of cheap power for bitcoin mining then would have to involve a subsidy, at least until renewable capacity expanded and rates declined.

Luis González, public policy director at the nongovernmental organization Salvadoran Ecological Unit, said if El Salvador can manage to provide cheaper, renewable power it should go to the country’s families, not cryptocurrency mining operations.

“The ideal would be that the cheapest, cleanest, most national energy would be for the people,” González said.

He also warned that advertising geothermal as clean has caveats. It is cleaner than burning fossil fuels, he said, but comes with its own impacts. The sites where wells are dug to tap into the subterranean heat impact the local habitat. He also expressed concerns that aquifers could become contaminated at geothermal sites.

“We’re the country with the least access to water in Central America,” he said, noting that was the main reason El Salvador banned metals mining four years ago.

Many bitcoin mining operations have concentrated in cooler climates too, because beyond the electricity to power the machines, more is needed to keep them cool, González said. El Salvador has a tropical climate.

At the Berlin Geothermal plant, two hours drive east of the capital, Gustavo Cuellar, special projects advisor for the Rio Lempa Hydroelectric Executive Commission, is overseeing the mining operation. He said the specialized mining machines on the site are using 1.5 megawatts of the 102 megawatts the plant produces. El Salvador’s other geothermal plant in Ahuachapan produces another 95 megawatts.

Together the plants provide power to 1.5 million of El Salvador’s 6.5 million citizens.

Álvarez said that the project will grow over time “because we have the renewable energy resource, we have a lot of potential to continue producing energy to mine.”

Sherman reported from Mexico City.

It would be the token of all tokens: a $1-trillion coin that backers say could solve the political impasse over suspending the U.S. debt limit.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.