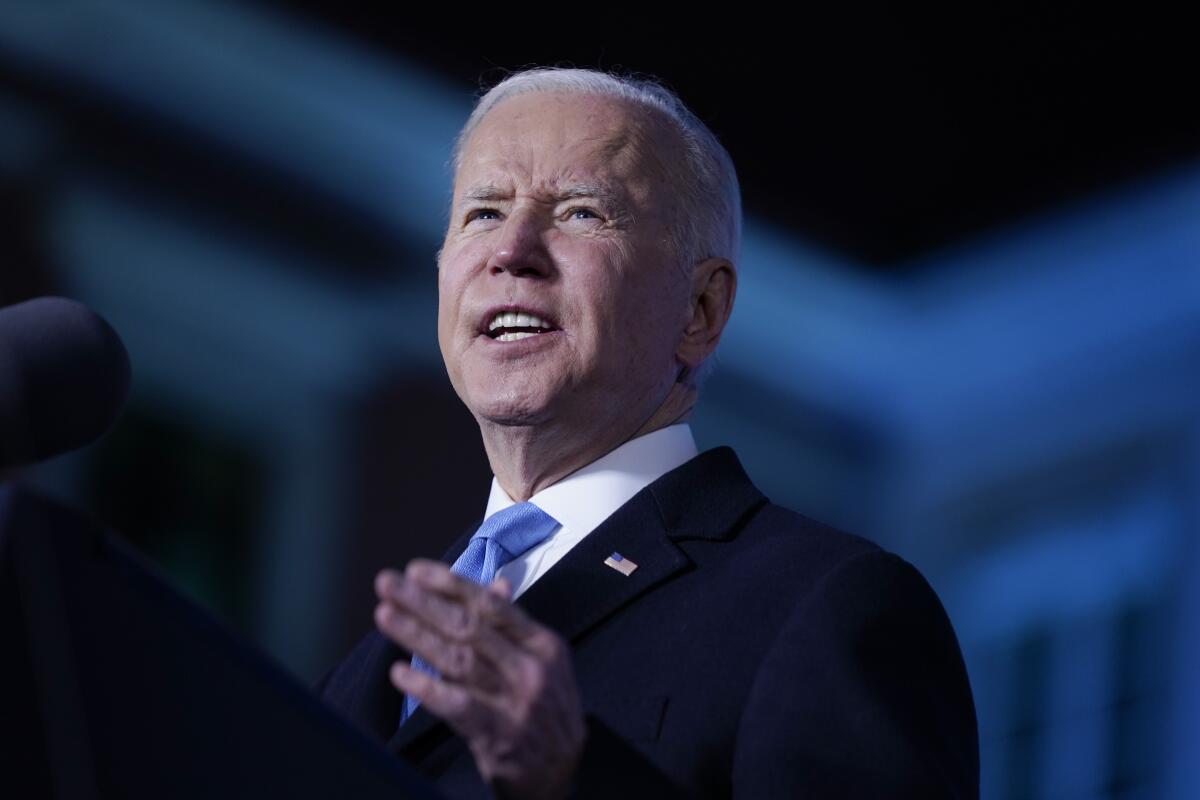

Biden budget seeks minimum tax on households worth over $100 million

- Share via

WASHINGTON — President Biden intends to propose a minimum tax of 20% on households worth more than $100 million and to cut projected budget deficits by more than $1 trillion over the next decade, according to a fact sheet released Saturday by the White House budget office. He is expected to announce the proposal Monday.

The introduction of the minimum tax on the wealthiest Americans would represent a significant reorienting of the tax code. It would apply to the top 0.01% of households, with half of the expected revenue coming from those worth $1 billion or more.

The minimum tax would effectively prevent the wealthiest sliver of America from paying lower rates than families in the middle class, while helping to generate revenue to fuel Biden’s domestic ambitions and keep the deficit in check relative to the U.S. economy.

The plan to lower budget deficits reflects the economy’s resurgence as the United States emerges from the pandemic. It’s a sign that the federal government’s balance sheet will improve after a historic burst of spending to combat the coronavirus.

President Biden, in Poland as the war in neighboring Ukraine appears to be at a critical juncture, says Putin cannot be allowed to retain his power.

The economy’s growth and the fading of the pandemic have enabled the deficit to fall from $3.1 trillion in fiscal 2020 to $2.8 trillion last year and a projected $1.4 trillion this year. That deficit spending paid off in the form of the economy expanding last year at a rate of 5.7%, the strongest growth since 1984.

But those robust gains were accompanied by inflation reaching a 40-year high, and rising prices have weighed on Biden’s popularity.

For the Biden administration, the proposal for the budget year that begins Oct. 1 shows that the burst of spending helped to fuel growth and, as a result, put government finances on more stable ground for years to come. One White House official, insisting on anonymity because the budget has not been released, said the proposal shows that Democrats can deliver on what Republicans have promised before without much success: faster growth and falling deficits.

The Biden budget would pledge to do so through a wealth tax that many Republicans say would hurt the economy by diminishing private investment in companies that create jobs, and by prompting the wealthy to put their fortunes to work abroad.

Republican lawmakers have said the Biden administration’s spending over the past year has led to economic pain in the form of higher prices. The inflation that came with reopening the U.S. economy as pandemic closures began to end has been amplified by supply-chain issues, low interest rates and disruptions in the oil and natural gas markets due to of Russia’s invasion of Ukraine.

Senate Republican leader Mitch McConnell of Kentucky pinned the blame on Biden’s coronavirus relief and push to move away from fossil fuels.

“Washington Democrats’ response to these hardships has been as misguided as the war on American energy and runaway spending that helped create them,” McConnell said Tuesday. “The Biden administration seems to be willing to try anything but walking back their own disastrous economic policies.”

Biden inherited from the Trump administration a budget deficit that was equal in size to 14.9% of the U.S. economy. But the deficit starting in the upcoming budget year will be the equivalent of less than 5% of the economy, putting the country on a more sustainable path, according to people familiar with the budget proposal who insisted on anonymity while discussing forthcoming details.

The lower deficit totals will also be easier to manage, even if interest rates rise.

The expected deficit decrease for fiscal 2022 reflects the solid recovery in hiring that occurred in large part because of Biden’s $1.9-trillion coronavirus relief package. The jobs mean additional tax revenue, with the government likely collecting $300 billion more than it did in fiscal 2021, a 10% increase.

Still, the country faces uncertainties that could reshape Biden’s proposed budget. It will not include the spending omnibus recently signed into law. And Biden and U.S. allies are providing aid to Ukrainians fighting Russian forces in a war that could reshape spending priorities and the broader economic outlook.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.